Form Ar4ec (Tx) - Texarkana Employee'S Withholding Exemption Certificate - Arkansas

ADVERTISEMENT

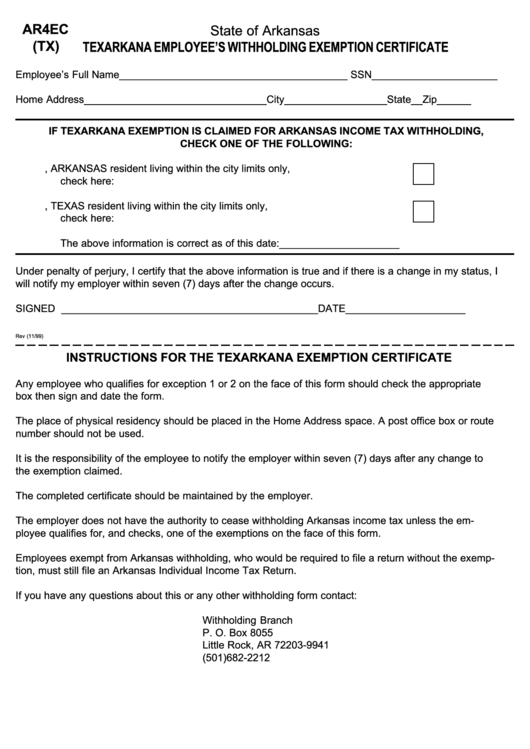

AR4EC

State of Arkansas

(TX)

TEXARKANA EMPLOYEE’S WITHHOLDING EXEMPTION CERTIFICATE

Employee’s Full Name ________________________________________ SSN ______________________

Home Address ________________________________ City __________________ State __ Zip ______

IF TEXARKANA EXEMPTION IS CLAIMED FOR ARKANSAS INCOME TAX WITHHOLDING,

CHECK ONE OF THE FOLLOWING:

1. Texarkana, ARKANSAS resident living within the city limits only,

check here: .....................................................................................................

2. Texarkana, TEXAS resident living within the city limits only,

check here: .....................................................................................................

The above information is correct as of this date: _____________________

Under penalty of perjury, I certify that the above information is true and if there is a change in my status, I

will notify my employer within seven (7) days after the change occurs.

SIGNED _____________________________________________ DATE_____________________

Rev (11/99)

INSTRUCTIONS FOR THE TEXARKANA EXEMPTION CERTIFICATE

Any employee who qualifies for exception 1 or 2 on the face of this form should check the appropriate

box then sign and date the form.

The place of physical residency should be placed in the Home Address space. A post office box or route

number should not be used.

It is the responsibility of the employee to notify the employer within seven (7) days after any change to

the exemption claimed.

The completed certificate should be maintained by the employer.

The employer does not have the authority to cease withholding Arkansas income tax unless the em-

ployee qualifies for, and checks, one of the exemptions on the face of this form.

Employees exempt from Arkansas withholding, who would be required to file a return without the exemp-

tion, must still file an Arkansas Individual Income Tax Return.

If you have any questions about this or any other withholding form contact:

Withholding Branch

P. O. Box 8055

Little Rock, AR 72203-9941

(501)682-2212

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1