Form Tt-100 - Wisconsin Distributor'S Tobacco Products Tax Return - 2010

ADVERTISEMENT

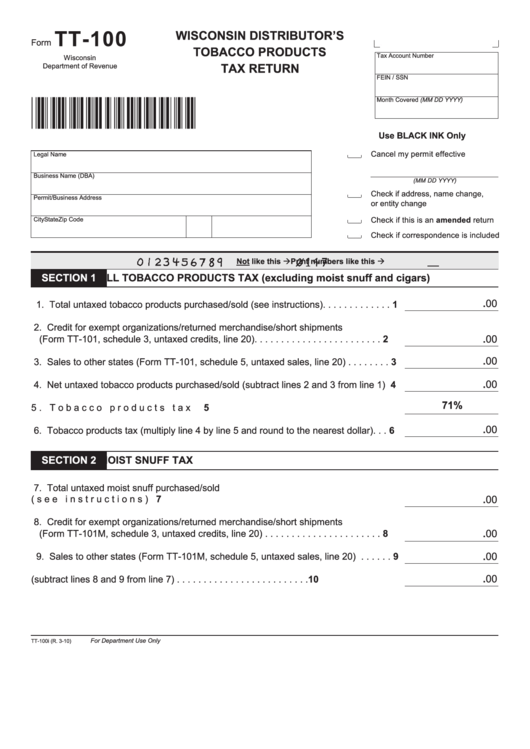

TT-100

WISCONSIN DISTRIBUTOR’S

Form

TOBACCO PRODUCTS

Tax Account Number

Wisconsin

TAX RETURN

Department of Revenue

FEIN / SSN

Month Covered (MM DD YYYY)

Use BLACK INK Only

Cancel my permit effective

Legal Name

Business Name (DBA)

(MM DD YYYY)

Check if address, name change,

Permit/Business Address

or entity change

Check if this is an amended return

City

State

Zip Code

Check if correspondence is included

Print numbers like this

Not like this

NO COMMAS

SECTION 1

ALL TOBACCO PRODUCTS TAX (excluding moist snuff and cigars)

.00

1. Total untaxed tobacco products purchased/sold (see instructions) . . . . . . . . . . . . . 1

2. Credit for exempt organizations/returned merchandise/short shipments

.00

(Form TT-101, schedule 3, untaxed credits, line 20) . . . . . . . . . . . . . . . . . . . . . . . . 2

.00

3. Sales to other states (Form TT-101, schedule 5, untaxed sales, line 20) . . . . . . . . 3

.00

4. Net untaxed tobacco products purchased/sold (subtract lines 2 and 3 from line 1) 4

71%

5. Tobacco products tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.00

6. Tobacco products tax (multiply line 4 by line 5 and round to the nearest dollar) . . . 6

SECTION 2

MOIST SNUFF TAX

7. Total untaxed moist snuff purchased/sold

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

.00

8. Credit for exempt organizations/returned merchandise/short shipments

.00

(Form TT-101M, schedule 3, untaxed credits, line 20) . . . . . . . . . . . . . . . . . . . . . . 8

.00

9. Sales to other states (Form TT-101M, schedule 5, untaxed sales, line 20) . . . . . . 9

.00

10. Moist snuff tax (subtract lines 8 and 9 from line 7) . . . . . . . . . . . . . . . . . . . . . . . . . 10

For Department Use Only

TT-100i (R. 3-10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2