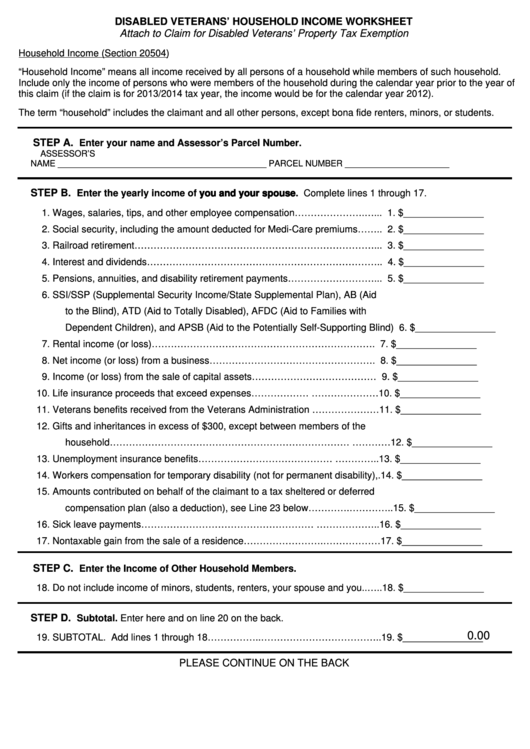

DISABLED VETERANS’ HOUSEHOLD INCOME WORKSHEET

Attach to Claim for Disabled Veterans’ Property Tax Exemption

Household Income (Section 20504)

“Household Income” means all income received by all persons of a household while members of such household.

Include only the income of persons who were members of the household during the calendar year prior to the year of

this claim (if the claim is for 2013/2014 tax year, the income would be for the calendar year 2012).

The term “household” includes the claimant and all other persons, except bona fide renters, minors, or students.

STEP A.

Enter your name and Assessor’s Parcel Number.

ASSESSOR’S

NAME ____________________________________________

PARCEL NUMBER ______________________

STEP B.

Enter the yearly income of you and your spouse. Complete lines 1 through 17.

1.

Wages, salaries, tips, and other employee compensation………………….…... 1. $_______________

2.

Social security, including the amount deducted for Medi-Care premiums…….. 2. $_______________

3.

Railroad retirement…………………………………………………………………... 3. $_______________

4.

Interest and dividends……………………………………………………………….. 4. $_______________

5.

Pensions, annuities, and disability retirement payments………………………... 5. $_______________

6.

SSI/SSP (Supplemental Security Income/State Supplemental Plan), AB (Aid

to the Blind), ATD (Aid to Totally Disabled), AFDC (Aid to Families with

Dependent Children), and APSB (Aid to the Potentially Self-Supporting Blind) 6. $_______________

7.

Rental income (or loss)…………………………………………………………….

7. $_______________

8.

Net income (or loss) from a business…………………………………………….

8. $_______________

9.

Income (or loss) from the sale of capital assets………………………………… 9. $_______________

10.

Life insurance proceeds that exceed expenses……………… …………………10. $_______________

11.

Veterans benefits received from the Veterans Administration …………………11. $_______________

12.

Gifts and inheritances in excess of $300, except between members of the

household………………………………………………………………… …………12. $_______________

13.

Unemployment insurance benefits…………………………………… …………..13. $_______________

14.

Workers compensation for temporary disability (not for permanent disability),.14. $_______________

15.

Amounts contributed on behalf of the claimant to a tax sheltered or deferred

compensation plan (also a deduction), see Line 23 below………….…………..15. $_______________

16.

Sick leave payments……………………………………………… ………………..16. $_______________

17.

Nontaxable gain from the sale of a residence…………………….………………17. $_______________

STEP C.

Enter the Income of Other Household Members.

18.

Do not include income of minors, students, renters, your spouse and you..…..18. $_______________

STEP D.

Subtotal. Enter here and on line 20 on the back.

19.

SUBTOTAL. Add lines 1 through 18……………..………………………………..19. $_______________

0.00

PLEASE CONTINUE ON THE BACK

1

1 2

2