Form 7505 - Foreign Fire Insurance Tax - City Of Chicago

ADVERTISEMENT

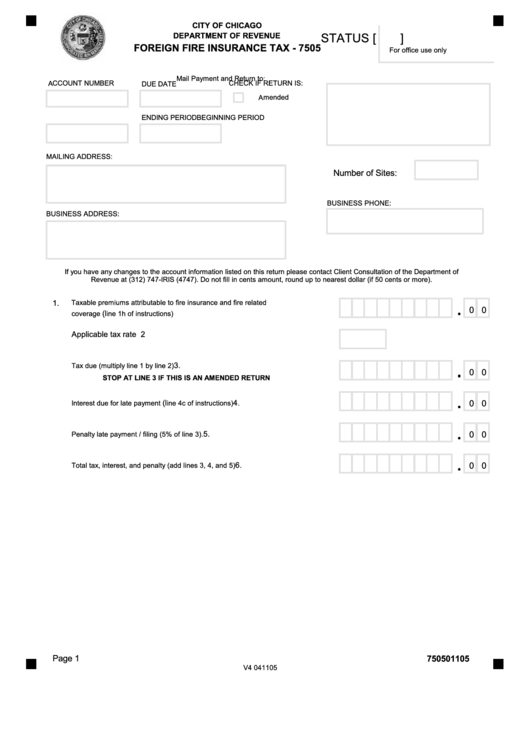

CITY OF CHICAGO

STATUS [

]

DEPARTMENT OF REVENUE

FOREIGN FIRE INSURANCE TAX - 7505

For office use only

Mail Payment and Return to:

ACCOUNT NUMBER

CHECK IF RETURN IS:

DUE DATE

Amended

BEGINNING PERIOD

ENDING PERIOD

MAILING ADDRESS:

Number of Sites:

BUSINESS PHONE:

BUSINESS ADDRESS:

If you have any changes to the account information listed on this return please contact Client Consultation of the Department of

Revenue at (312) 747-IRIS (4747). Do not fill in cents amount, round up to nearest dollar (if 50 cents or more).

1.

Taxable premiums attributable to fire insurance and fire related

0 0

(l

.............................................................

coverage

ine 1h of instructions)

2

Applicable tax rate ...............................................................................

3.

...............................................................

Tax due (multiply line 1 by line 2)

0 0

STOP AT LINE 3 IF THIS IS AN AMENDED RETURN

4.

(l

...................................

0 0

Interest due for late payment

ine 4c of instructions)

5.

..................................................

0 0

Penalty late payment / filing (5% of line 3).

6.

....................................

0 0

Total tax, interest, and penalty (add lines 3, 4, and 5)

Page 1

750501105

V4 041105

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3