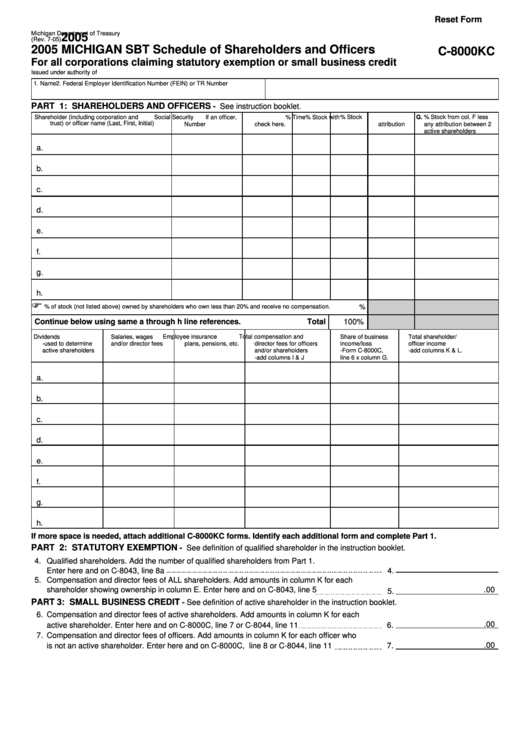

Reset Form

Michigan Department of Treasury

2005

(Rev. 7-05)

2005 MICHIGAN SBT Schedule of Shareholders and Officers

C-8000KC

For all corporations claiming statutory exemption or small business credit

Issued under authority of P.A. 228 of 1975. See instruction booklet for filing guidelines.

1. Name

2. Federal Employer Identification Number (FEIN) or TR Number

PART 1: SHAREHOLDERS AND OFFICERS

- See instruction booklet.

3A.

Shareholder (including corporation and

B.

Social Security

C.

If an officer,

D.

% Time

E.

% Stock

F.

% Stock with

G.

% Stock from col. F less

trust) or officer name (Last, First, Initial)

Number

check here.

attribution

any attribution between 2

active shareholders

a.

b.

c.

d.

e.

f.

g.

h.

% of stock (not listed above) owned by shareholders who own less than 20% and receive no compensation.

%

Continue below using same a through h line references.

Total

100%

H.

Dividends

I.

Salaries, wages

J.

Employee insurance

K.

Total compensation and

L.

Share of business

M.

Total shareholder/

-used to determine

and/or director fees

plans, pensions, etc.

director fees for officers

income/loss

officer income

active shareholders

and/or shareholders

-Form C-8000C,

-add columns K & L.

-add columns I & J

line 6 x column G.

a.

b.

c.

d.

e.

f.

g.

h.

If more space is needed, attach additional C-8000KC forms. Identify each additional form and complete Part 1.

PART 2: STATUTORY EXEMPTION

- See definition of qualified shareholder in the instruction booklet.

4.

Qualified shareholders. Add the number of qualified shareholders from Part 1.

Enter here and on C-8043, line 8a

4.

5.

Compensation and director fees of ALL shareholders. Add amounts in column K for each

shareholder showing ownership in column E. Enter here and on C-8043, line 5

.00

5.

PART 3: SMALL BUSINESS CREDIT

- See definition of active shareholder in the instruction booklet.

6.

Compensation and director fees of active shareholders. Add amounts in column K for each

.00

active shareholder. Enter here and on C-8000C, line 7 or C-8044, line 11

6.

7.

Compensation and director fees of officers. Add amounts in column K for each officer who

.00

is not an active shareholder. Enter here and on C-8000C, line 8 or C-8044, line 11

7.

1

1