New Business Application Form - Hamilton County Clerk Page 2

ADVERTISEMENT

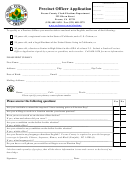

APPLICATION FOR BUSINESS TAX LICENSE

INSTRUCTIONS

1.

Select the classification under which your dominant business activity falls. “Dominant business activity” means the business

activity that is the major and principal source of taxable gross sales of the business. If you need assistance in determining the

appropriate business tax classification, please ask your county clerk or the designated city business tax official. You may also wish

to refer to the document “Determining Your Business Tax Classification,” which is available at tn.gov/revenue.

2

Select the reason for which the application is being filed - new business, additional location, or the purchase of an existing business.

.

Enter the date on which the applicant began or will begin conducting business activities at the location for which registration is

3

.

being made.

4.

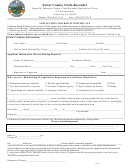

Enter the name and exact location address of the business being registered. Include the business name, street address, city, state,

and zip code.

5.

Enter the mailing address of the business being registered. Enter the legal name (if different from location name), street address

or post office box number, city, state, and zip code. If the legal name and mailing address are identical to the information

in Item 4, leave Item 5 blank.

6.

Enter the name of the county in which the business is located. Indicate whether the business is located within the limits of a city in

the county. If the business is located within the limits of a city, enter the name of the city. Note: A business located within the

limits of a city may have a business tax obligation for both the county and the city. If so, the business must obtain a

business license from both the county and the city.

7.

Enter the telephone number and, if applicable, the fax number of the business being registered.

8.

Enter the name of a contact person for the business being registered. Enter the contact person’s email address.

Enter the Federal Employer’s Identification Number (FEIN) of the business being registered. If the business has applied for but

9.

not received an FEIN, so indicate. If no FEIN is required, so indicate.

10.

If the business being registered currently has a sales and use tax account with the Tennessee Department of Revenue, enter the

sales and use tax account number. If the business has applied for but not received a sales and use tax account number, so indicate.

If no sales or use tax account number is required, so indicate.

11.

Select the legal structure type of the business being registered.

12.

Enter the Tennessee Secretary of State identification number of the business being registered, if applicable.

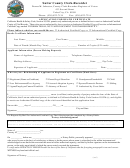

13.

Enter a description of the business activities being performed by the business at the location being registered. Indicate the main

products and services sold at this business location. Please be as detailed as possible.

14.

Enter the names, home addresses, and home telephone numbers of two owners, officers, or partners in the business being

registered. If the owner is an individual, enter the owner’s social security number and check the appropriate box. If the owner is

a business entity, enter the owner’s FEIN and check the appropriate box. Finally, check the box to indicate whether the person is

an individual or business entity owner, partner, officer, or member. This information is critical. It will allow us to identify persons

with whom we may discuss the business tax account when needed.

15.

The application must be signed by an individual owner, partner, or officer of the business being registered. The person who signs

the application must be listed in Item 14 on the application form. Indicate the title of the person signing the application (i.e., owner,

partner, officer) and the date on which the application is signed.

INTERNET (10-09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2