Form W-3ss - Transmittal Of Wage And Tax Statements - 2006

ADVERTISEMENT

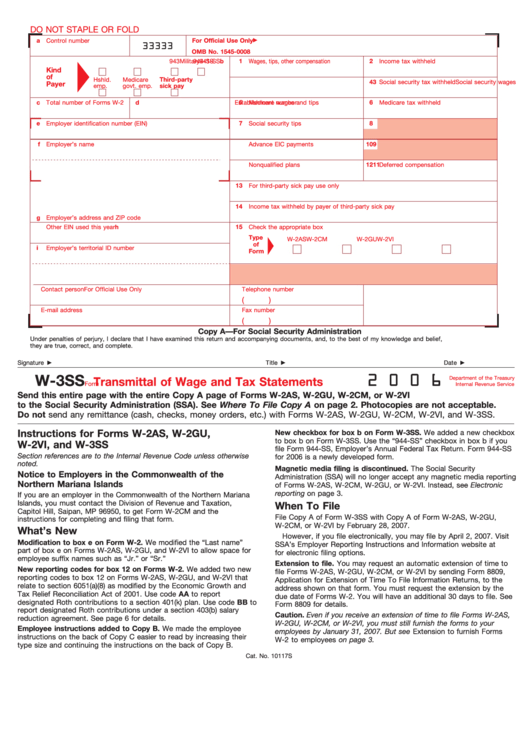

DO NOT STAPLE OR FOLD

a

Control number

For Official Use Only

33333

OMB No. 1545-0008

b

941-SS

Military

943

944-SS

1

Wages, tips, other compensation

2

Income tax withheld

Kind

of

Hshld.

Medicare

Third-party

3

Social security wages

4

Social security tax withheld

Payer

emp.

govt. emp.

sick pay

c

Total number of Forms W-2

d Establishment number

5

Medicare wages and tips

6

Medicare tax withheld

e

Employer identification number (EIN)

7

Social security tips

8

f

Employer’s name

9

Advance EIC payments

10

11

Nonqualified plans

12

Deferred compensation

13

For third-party sick pay use only

14

Income tax withheld by payer of third-party sick pay

g

Employer’s address and ZIP code

h

Other EIN used this year

15

Check the appropriate box

Type

W-2AS

W-2CM

W-2GU

W-2VI

of

i

Employer’s territorial ID number

Form

Contact person

Telephone number

For Official Use Only

(

)

E-mail address

Fax number

(

)

Copy A—For Social Security Administration

Under penalties of perjury, I declare that I have examined this return and accompanying documents, and, to the best of my knowledge and belief,

they are true, correct, and complete.

Signature

Title

Date

2 0

0 6

W-3SS

Department of the Treasury

Transmittal of Wage and Tax Statements

Form

Internal Revenue Service

Send this entire page with the entire Copy A page of Forms W-2AS, W-2GU, W-2CM, or W-2VI

to the Social Security Administration (SSA). See Where To File Copy A on page 2. Photocopies are not acceptable.

Do not send any remittance (cash, checks, money orders, etc.) with Forms W-2AS, W-2GU, W-2CM, W-2VI, and W-3SS.

Instructions for Forms W-2AS, W-2GU,

New checkbox for box b on Form W-3SS. We added a new checkbox

to box b on Form W-3SS. Use the “944-SS” checkbox in box b if you

W-2VI, and W-3SS

file Form 944-SS, Employer’s Annual Federal Tax Return. Form 944-SS

Section references are to the Internal Revenue Code unless otherwise

for 2006 is a newly developed form.

noted.

Magnetic media filing is discontinued. The Social Security

Notice to Employers in the Commonwealth of the

Administration (SSA) will no longer accept any magnetic media reporting

Northern Mariana Islands

of Forms W-2AS, W-2CM, W-2GU, or W-2VI. Instead, see Electronic

reporting on page 3.

If you are an employer in the Commonwealth of the Northern Mariana

Islands, you must contact the Division of Revenue and Taxation,

When To File

Capitol Hill, Saipan, MP 96950, to get Form W-2CM and the

File Copy A of Form W-3SS with Copy A of Form W-2AS, W-2GU,

instructions for completing and filing that form.

W-2CM, or W-2VI by February 28, 2007.

What’s New

However, if you file electronically, you may file by April 2, 2007. Visit

Modification to box e on Form W-2. We modified the “Last name”

SSA’s Employer Reporting Instructions and Information website at

part of box e on Forms W-2AS, W-2GU, and W-2VI to allow space for

for electronic filing options.

employee suffix names such as “Jr.” or “Sr.”

Extension to file. You may request an automatic extension of time to

New reporting codes for box 12 on Forms W-2. We added two new

file Forms W-2AS, W-2GU, W-2CM, or W-2VI by sending Form 8809,

reporting codes to box 12 on Forms W-2AS, W-2GU, and W-2VI that

Application for Extension of Time To File Information Returns, to the

relate to section 6051(a)(8) as modified by the Economic Growth and

address shown on that form. You must request the extension by the

Tax Relief Reconciliation Act of 2001. Use code AA to report

due date of Forms W-2. You will have an additional 30 days to file. See

designated Roth contributions to a section 401(k) plan. Use code BB to

Form 8809 for details.

report designated Roth contributions under a section 403(b) salary

Caution. Even if you receive an extension of time to file Forms W-2AS,

reduction agreement. See page 6 for details.

W-2GU, W-2CM, or W-2VI, you must still furnish the forms to your

Employee instructions added to Copy B. We made the employee

employees by January 31, 2007. But see Extension to furnish Forms

instructions on the back of Copy C easier to read by increasing their

W-2 to employees on page 3.

type size and continuing the instructions on the back of Copy B.

Cat. No. 10117S

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7