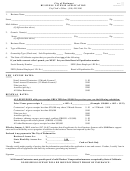

Tax Rate Schedule (Gross Receipts)

The following tax rates shall be applicable to every business declared to be subject to a tax based upon gross receipts, and such taxes shall

be subject to annual review and adjustment by council action.

TAX RATE SCHEDULE A

TAX RATE SCHEDULE D

If Gross Receipts Are:

The Tax Is:

The Tax Is:

If Gross Receipts Are:

Under $50,000.00

$50.00

Under $50,000.00

$100.00

Over $50,000.00

$50.00 plus

Over $50,000.00

$100.00 plus

$0.25 for each thousand dollars

$1.00 for each thousand dollars

or fraction thereof over $50,000

or fraction thereof over $50,000

TAX RATE SCHEDULE B

TAX RATE SCHEDULE E

If Gross Receipts Are:

The Tax Is:

The Tax Is:

If Gross Receipts Are:

Under $25,000.00

$25.00

Under $25,000.00

$50.00

Over $25,000.00

$25.00 plus

Over $25,000.00

$50.00 plus

$0.30 for each thousand dollars

$1.00 for each thousand dollars

or fraction thereof over $25,000

or fraction thereof over $25,000

TAX RATE SCHEDULE C

TAX RATE SCHEDULE F

The Tax Is:

If Gross Receipts Are:

The Tax Is:

If Gross Receipts Are:

Under $100,000.00

$75.00

Under $25,000.00

$25.00

Over $100,000.00

$75.00 plus

$25.00 plus

Over $25,000.00

$0.75 for each thousand dollars

$1.00 for each thousand dollars

or fraction thereof over $100,000

or fraction thereof over $25,000

CONTRACTORS LICENSE DECLARATION

Section 1. Section 7033. Every city or city and county which requires the issuance of a business license as condition precedent

to engaging within the city or city and county, in a business which is subject to regulation under this chapter, shall require that

each licensee and applicant for issuance or renewal of such license shall file, or have on file, with such city or city and county,

a signed statement that such licensee or applicant is licensed under the provisions of this chapter, and stating that the license

is in full force and effect, or if such licensee or applicant is exempt from the provisions of this chapter, he shall furnish proof of

the facts which entitle him to such exemption.

q q

This is to certify that the undersigned is licensed under the Business and Professions Code of California

as a contractor and that such license is in full force and effect.

Date

Signature

Title

q q

This is to ceritify that the undersigned claims exemption from the provisions of Section 7000 ET.SEQ. of

the Business and Professions Code, in that I propose not to furnish labor and/or materials on any

project, the value of which (aggregate labor and materials) is over $299.99.

Date

Signature

Title

WORKERS’ COMPENSATION DECLARATION

I HEREBY AFFIRM, UNDER PENALTY OF PERJURY, ONE OF THE FOLLOWING DECLARATIONS:

q q

I have and will maintain a certificate of consent to self-insure for workers compensation, as provided by

Section 3700, for the duration of any business activities conducted for which this license is issued.

q q

I have and will maintain workers’ compensation insurance, as required by Section 3700, for the duration

of any business activities for which this license is issued. My workers’ compensation insurance carrier

and policy number are:

Carrier

Policy Number

q q

I certify that in the performance of any business activities for which this license is issued I shall not

employ any person in any manner so as to become subject to the workers’ compensation laws of

California, and agree that if I should become subject to the workers’ compensation provisions of Section

3700 of the Labor Code, I shall forthwith comply with the provisions of Section 3700.

Date

Applicant

WARNING: FAILURE TO SECURE WORKERS’ COMPENSATION COVERAGE IS UNLAWFUL, AND SHALL

SUBJECT AN EMPLOYER TO CRIMINAL PENALTIES AND CIVIL FINES UP TO $100,000, IN ADDITION TO

THE COST OF COMPENSATION DAMAGES AS PROVIDED FOR IN SECTION 3706 OF THE LABOR CODE,

INTEREST AND ATTORNEYS FEES.

Reset Form

1

1 2

2