Form 1040me - Worksheet A Residency Information Worksheet For Nonresidents/part-Year Residents, Worksheet B - Income Allocation Worksheet For Nonresidents/part-Year Residents, Worksheet C - Employee Apportionment Worksheet Page 2

ADVERTISEMENT

Your Social Security Number

Name(s) as shown on Form 1040ME

-

-

Attachment

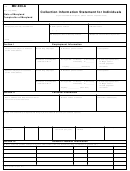

WORKSHEET B

9

Sequence No.

Income Allocation Worksheet for Nonresidents/Part-Year Residents

(See instructions on pages 12 and 13) - Enclose with your Form 1040ME

Nonresidents and Part-year residents must complete this worksheet before completing Schedule NR or Schedule NRH

Maine Resident Period

Nonresident Period

Federal Income

(Part-year Residents only)

(Nonresidents & Part-year Residents)

(NOTE: Married persons fi ling separate

Maine income tax returns must complete

Column A

Column B

Column C*

Column D

Column E

separate worksheets for each spouse)

Income from

Income from Column Income from Column B Income from Column Income from Column D

federal return

A for this period

earned outside of Maine

A for this period

from Maine sources

1. Wages, salaries, tips,

other compensation** ..........................

1

2. Taxable interest ....................................

2

3. Ordinary dividends ...............................

3

4. Alimony received .................................

4

5. Business income/loss ..........................

5

6. Capital gain/loss ..................................

6

7. Other gains/losses ...............................

7

8. Taxable amount of IRA distributions ....

8

9. Taxable amount of pensions

and annuities .......................................

9

10. Rental real estate, royalties,

partnerships, S corporations, and

trusts, etc ............................................. 10

11. Farm income/loss ................................ 11

12. Unemployment Compensation ............ 12

13. Taxable amount of social

security benefi ts ................................... 13

14. Other income (Including lump-sum

distributions, but excluding state

income tax refunds) ............................. 14

15. Add lines 1 through 14 ......................... 15

*

Part-year residents must make an entry in Column C if income was earned in another jurisdiction during the

period of Maine residency. Enter below the name of each other jurisdiction and the dates the income was earned in

those jurisdictions. Use a separate sheet if additional space is needed.

Name of other jurisdiction _____________________________

Period (mm/yy) From _____________ To _____________

Name of other jurisdiction _____________________________

Period (mm/yy) From _____________ To _____________

Name of other jurisdiction _____________________________

Period (mm/yy) From _____________ To _____________

You must attach a copy of the income tax return(s) fi led with the other jurisdiction

**

If necessary, use Worksheet C (Employee Apportionment Worksheet) for Nonresidents/Part-Year Residents to

calculate the amount for line 1, Column E. For a copy of Worksheet C, go to Maine Revenue Services web site at: www.

maine.gov/revenue/forms or call

(207) 624-7894 (to order).

NOTE: See instructions on pages 12 and 13 on how to use Worksheet B, line 15 entries to complete line 1 of Schedule

NR or Schedule NRH.

26

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3