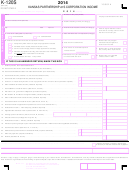

Form K-120s - Kansas Partnership Or S Corporation Income Tax - 2008 Page 2

ADVERTISEMENT

PART I - APPORTIONMENT SCHEDULE

This schedule is to be used only by partnerships and S Corporations that derive income from sources inside and outside of Kansas.

PERCENT

1. Allocation fraction - Enclose Schedule of Computation:

WITHIN KANSAS

TOTAL COMPANY

WITHIN KANSAS

a. Average cost of real and tangible personal property owned at beginning and end of

year plus 8 times the net annual rent. (Exclude property not connected with the

1a

%

business and construction in progress.) Enter % on line 15, block A, page 1. . . . . . . . . .

b. Payroll. Enter % on line 15, block B, page 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1b

%

c. Gross sales or revenue. Enter % on line 15, block C, page 1. . . . . . . . . . . . . . . . . . . . . .

1c

%

%

2. a. Total percent (Add lines 1a, 1b, and 1c if utilizing three factors) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2a

2b

%

b. Total percent (Add lines 1a and 1c if qualified and utilizing the elective two-factor formula) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Average percent of either 2a or 2b, whichever is applicable (To line 15, page 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

%

PART II - PARTNER'S OR SHAREHOLDER'S DISTRIBUTION OF INCOME

This schedule is to be completed for all partners or shareholders. If you have nonresident partners or shareholders, complete Form KW-7S. If there are more than 14

partners or shareholders, you must complete a schedule similar to the schedule below and submit it with your return. Individual partners or shareholders complete columns

1 through 8. All other partners and shareholders complete columns 1 through 5.

(2)

(1)

(3)

(4)

Check box if

Name and address

Social Security Number

Partner's or

Partner's profit

nonresident

OR

of partner or shareholder

shareholder's percent

percent or

Employer Identification

of ownership

shareholder's

Number (EIN)

applicable percentage

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

(k)

(l)

(m)

(n)

Continuation of PART II

(See instructions for Nonresident Partner's or Shareholder's Computation of Columns 6, 7 and 8.)

(5)

(6)

(7)

(8)

Income from Kansas sources.

Partner's or shareholder's

Partner's or shareholder's

Partner's or shareholder's

portion of federal ordinary

Kansas resident individuals: Multiply

portion of total Kansas income.

modification. See instructions.

and other income (losses) and

column 4 by line 12, page 1.

Multiply the percentage in

Enter on Part A of Schedule S,

Nonresident individuals: If income is

deductions. Multiply the

column 4 by line 12, page 1.

Form K-40.

earned only from Kansas sources

percentage in column 4 by

multiply column 4 by line 12, page 1.

line 3, page 1.

If income is earned from inside and

outside of Kansas, multiply column 4

by line 18, page 1.

All other partners or shareholders:

Multiply column 4 by line 18.

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

(k)

(l)

(m)

(n)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2