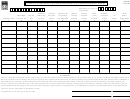

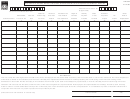

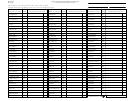

Form Dr-95a - Schedule Of Florida Sales Or Use Tax Credits Claimed On Tangible Personal Property Repossessed Page 2

ADVERTISEMENT

Rule 12A-1.012(2)(a), Florida Statutes, states: A dealer who has paid sales tax in full on the selling price of

tangible personal property sold under a retain title, conditional sale or similar contract may, upon repossession of

the property (with or without judicial process), take credit on a subsequent return or obtain a refund of that portion

of the tax that is applicable to the unpaid balance of the contract. The credit or refund shall be based on the ratio

that the total tax bears to the unpaid balance of the sales price, excluding finance or other nontaxable charges as

reflected in the sales contract. Refund or credit must be claimed within 12 months following the nontaxable month

in which the property was repossessed.

Column 1 -

Customer's Name - Name of customer from whom property repossessed.

Column 2 -

Property Description (Describe Repossessed Property.)

Column 3 -

Date Sales or Use Tax Paid to Florida Department of Revenue.

Column 4 -

Sales Tax Paid on Original Purchase - Include discretionary sales surtax, if applicable.

Column 5 -

Purchase Price Less Trade-In - Price of unit less trade-in, if any. Actual amount of original purchase price should not include nontaxable charges,

such as interest, penalty charges, carrying charges, license fees, notary fees, etc.

Column 6 -

Purchase Price Less Trade-In Less Cash Down - Price of unit less trade-in and any cash down payment.

Note: Complete Column 5 or Column 6, but not both.

Column 7 -

Length of Contract in Months - Total number of months for which contract was written.

Column 8 -

Monthly Payment Prorated - Divide column 5 or 6 by column 7.

Column 9 -

Enter Sales or Use Tax Rate, including surtax, if applicable (.06, .065, or .07). - Multiply column 8 by column 9.

Column 10 - Number of Payments Unpaid - Total of unpaid payments on contract.

Column 11 - Tax Credit - Show credit taken on attached tax report.

Column 12 - Actual Date of Repossession - Indicate the specific date (month, day, and year) the tangible personal property was repossessed.

Note: Copy of invoice must be attached supporting each repossession.

Method of Determining Tax Credit - Divide column 5 or 6 by column 7, equals column 8.

Multiply column 8 by column 9.

The results multiplied by column 10 equals column 11 or tax credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2