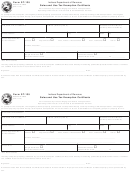

Indiana Department of Revenue

Form ST-135

State Form 47838

Sales and Use Tax Exemption Certifi cate

(R2 / 11-10)

For Purchases by Persons Engaged in Public Transportation*

Operating Under Leases or Contracts to Certifi ed Motor Carriers.

To qualify for the exemption, the tangible personal property purchased must be predominately used in providing public transportation. The tangible

personal property is predominately used in public transportation if more than 50% of its use is attributable to transporting people or property for hire.

Print Name of Purchaser:

FID, SSN, TID, or USDOT #

FHWA # (formerly ICC #)

Intrastate Carriers IMCA #

(formerly PSCI or IURC #)

Street Address

City

State

Zip

□

□

□

□

□

Check Applicable Box

Vehicle

Repair Parts

Tires, Tubes or Accessories

Fuel, Lubricants

Other

for Purchase of:

If Other, Describe: _______________________________________________________________________

______________________________________________________________________________________

□

□

Check One:

Single Purchase

Blanket Purchases

Enter Purchase Price $ _____________________

Effective Date: From _____________ To _____________

*See Reverse Side

I hereby certify the property purchased by use of this exemption certifi cate will be used directly in rendering public transportation under lease or contract

to a certifi ed motor carrier in accordance with IC 6-2.5-5-27.

Signature: _______________________________________________________________________ Date: _______________________________

Purchases made with this certifi cate are limited to the above mentioned items. Improper use of this certifi cate constitutes perjury and is punishable by

law.

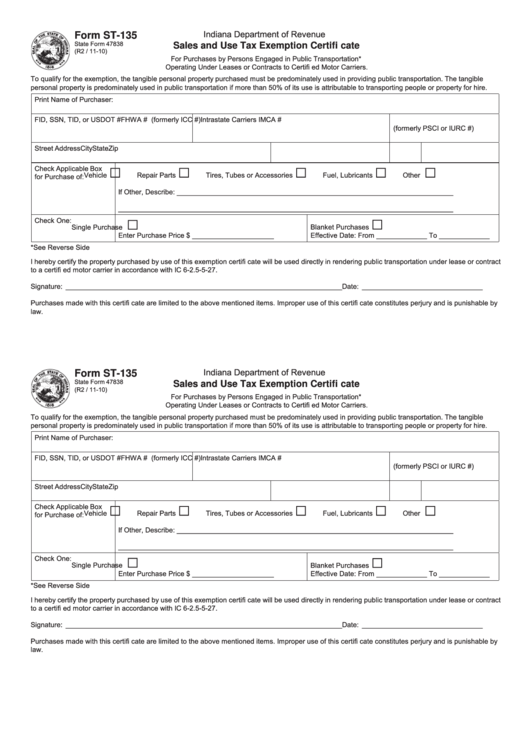

Indiana Department of Revenue

Form ST-135

State Form 47838

Sales and Use Tax Exemption Certifi cate

(R2 / 11-10)

For Purchases by Persons Engaged in Public Transportation*

Operating Under Leases or Contracts to Certifi ed Motor Carriers.

To qualify for the exemption, the tangible personal property purchased must be predominately used in providing public transportation. The tangible

personal property is predominately used in public transportation if more than 50% of its use is attributable to transporting people or property for hire.

Print Name of Purchaser:

FID, SSN, TID, or USDOT #

FHWA # (formerly ICC #)

Intrastate Carriers IMCA #

(formerly PSCI or IURC #)

Street Address

City

State

Zip

□

□

□

□

□

Check Applicable Box

Vehicle

Repair Parts

Tires, Tubes or Accessories

Fuel, Lubricants

Other

for Purchase of:

If Other, Describe: _______________________________________________________________________

______________________________________________________________________________________

□

□

Check One:

Single Purchase

Blanket Purchases

Enter Purchase Price $ _____________________

Effective Date: From _____________ To _____________

*See Reverse Side

I hereby certify the property purchased by use of this exemption certifi cate will be used directly in rendering public transportation under lease or contract

to a certifi ed motor carrier in accordance with IC 6-2.5-5-27.

Signature: _______________________________________________________________________ Date: _______________________________

Purchases made with this certifi cate are limited to the above mentioned items. Improper use of this certifi cate constitutes perjury and is punishable by

law.

1

1