Aerospace Credit Affidavit For Preproduction Spending - Washington Department Of Revenue

ADVERTISEMENT

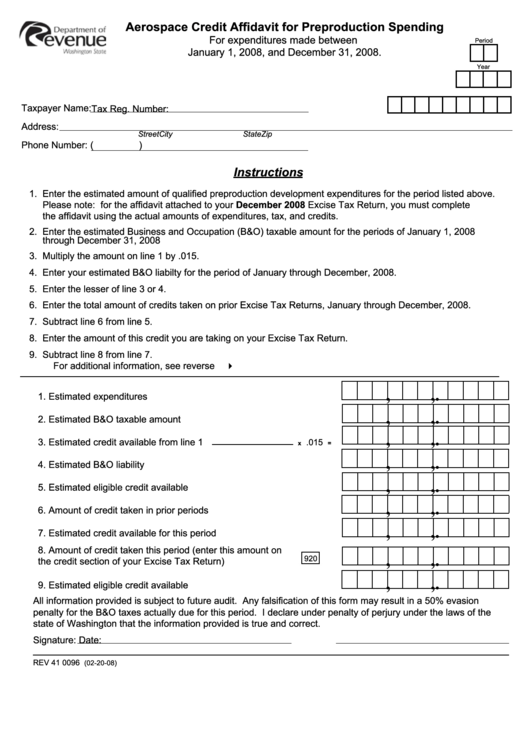

Aerospace Credit Affidavit for Preproduction Spending

For expenditures made between

Period

January 1, 2008, and December 31, 2008.

Year

Taxpayer Name:

Tax Reg. Number:

Address:

Street

City

State

Zip

Phone Number: (

)

Instructions

1. Enter the estimated amount of qualified preproduction development expenditures for the period listed above.

Please note: for the affidavit attached to your December 2008 Excise Tax Return, you must complete

the affidavit using the actual amounts of expenditures, tax, and credits.

2. Enter the estimated Business and Occupation (B&O) taxable amount for the periods of January 1, 2008

through December 31, 2008

3. Multiply the amount on line 1 by .015.

4. Enter your estimated B&O liabilty for the period of January through December, 2008.

5. Enter the lesser of line 3 or 4.

6. Enter the total amount of credits taken on prior Excise Tax Returns, January through December, 2008.

7. Subtract line 6 from line 5.

8. Enter the amount of this credit you are taking on your Excise Tax Return.

9. Subtract line 8 from line 7.

For additional information, see reverse

4

,

,

.

1. Estimated expenditures ....................................................................

,

,

.

2. Estimated B&O taxable amount .......................................................

,

,

.

3. Estimated credit available from line 1

.015

x

=

,

,

.

4. Estimated B&O liability ....................................................................

,

,

.

5. Estimated eligible credit available ...................................................

,

,

.

6. Amount of credit taken in prior periods ............................................

,

,

.

7. Estimated credit available for this period .........................................

8. Amount of credit taken this period (enter this amount on

,

,

.

920

the credit section of your Excise Tax Return) ...................................

,

,

.

9. Estimated eligible credit available ...................................................

All information provided is subject to future audit. Any falsification of this form may result in a 50% evasion

penalty for the B&O taxes actually due for this period. I declare under penalty of perjury under the laws of the

state of Washington that the information provided is true and correct.

Signature:

Date:

REV 41 0096

(02-20-08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2