Annual Return Of Broad Based Health Care Related Taxes Page 4

ADVERTISEMENT

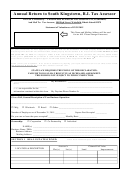

ANNUAL RETURN OF BROAD BASED HEALTH CARE RELATED TAXES

WV/HCP-3A

rtL080 v.10-Web

SCHEDULE A

Report revenue for the full taxable year.

Accrual Basis taxpayers may reduce their Column 1 Total Gross Proceeds by Column 2 Bad Debt and Column 3 Contractual.

Allowance deductions to the extent that they were included in gross receipts upon which the tax imposed was paid.

(Note: Nursing Facility/Nursing Home Service providers may not reduce their Gross Proceeds by Contractual Allowances).

Cash Basis taxpayers may not claim Column 2 Bad Debt and Column 3 Contractual Allowance deductions.

SCHEDULE B

Report revenue from the beginning of your taxable year to June 30.

Accrual Basis taxpayers may reduce their Column 1 Total Gross Proceeds by Column 2 Bad Debt and Column 3 Contractual.

Allowance deductions to the extent that they were included in gross receipts upon which the tax imposed was paid.

Cash Basis taxpayers may not claim Column 2 Bad Debt and Column 3 Contractual Allowance deductions.

SCHEDULE C

Report revenue from July 1 to the end of your taxable year for Line Code 8.

Accrual Basis taxpayers may reduce their Column 1 Total Gross Proceeds by Column 2 Bad Debt deductions only to the

extent that they were included in gross receipts upon which the tax imposed was paid. Deductions for Contractual

Allowances may not be claimed.

Cash Basis taxpayers may not claim Column 2 Bad Debt and Column 3 Contractual Allowance deductions.

PAGE 4 OF 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4