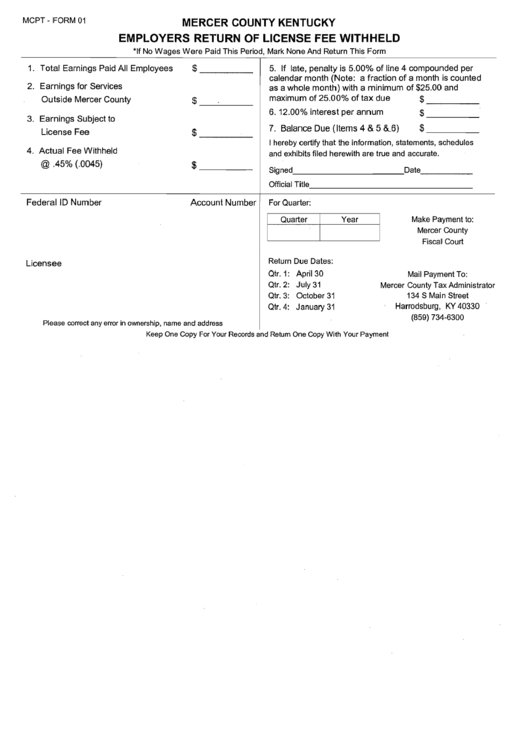

Form 01 - Employers Return Of License Fee Withheld - State Of Kentucky

ADVERTISEMENT

MCPT

-

FORM

01

MERCER COUNTY KENTUCKY

Federal ID Number

Account Number

EMPLOYERS RETURN OF LICENSE FEE WITHHELD

*If No Wages Were Paid This Period, Mark None And Return This Form

Licensee

1. Total Earnings Paid All Employees

$

2. Earnings for Services

Outside Mercer County

$

.

3. Earnings Subject to

License Fee

$

4. Actual Fee Withheld

@ .45% (.0045)

$

Please correct any error in ownership, name and address

5. If late, penalty is 5.00% of line 4 compounded per

calendar month (Note: a fraction of a month is counted

as a whole month) with a minimum of $25.00 and

maximum of 25.00% of tax due

$

6. 12.00% interest per annum

$

7. Balance Due (Items 4 & 5 &6)

$

I hereby certify that the information, statements, schedules

and exhibits filed herewith are true and accurate.

Signed

Date

Official Title

For Quarter:

Quarter

Y

Make Payment to:

Mercer County

Fiscal Court

Return Due Dates:

Qtr.

I :

April

30

Mail Payment To:

Qtr.

2:

July

31

Mercer County Tax Administrator

Qtr.

3:

October 31

134

S Main Street

Qtr.

4:

January

31

Harrodsburg,

KY 40330

(859) 734-6300

Keep One Copy For Your Records and Retum One Copy With Your Payment

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1