Form 2630 -2015 - Bill Of Costs - United States Bankruptcy Court Page 2

ADVERTISEMENT

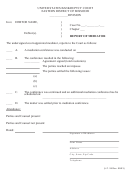

B2630 (Form 2630)(12/15)

page 2

Witness Fees (computation, cf. 28 U .S.C. § 1 821 for statutory fees)

Name and Residence

Attendance

Subsistence

Total Cost

Each

Witness

Days

Total Cost

Days

Total Cost

Miles

Total Cost

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

$

$

$

______

______

______

____________

______________________________________________________

______

______

________

$

____________

TOTAL

NOTICE

Section 1924, Title 28, U.S. Code provides:

“Before any bill of costs is taxed, the party claiming any item of cost or disbursement shall attach thereto an affidavit, made by himself or by his

duly authorized attorney or agent having knowledge of the facts, that such item is correct and has been necessarily incurred in the case and that the

services for which fees have been charged were actually and necessarily performed.”

Section 1920 of Title 28 reads in part as follows:

“A bill of costs shall be filed in the case and, upon allowance, included in the judgment or decree.”

The Federal Rules of Bankruptcy Procedure contain the following provisions:

Rule 7054(b)(1)

“(1) Costs Other Than Attorney’s Fees.

The court may allow costs to the prevailing party except when a statute of the United States or these

rules otherwise provides. Costs against the United States, its officers and agencies shall be imposed only to the extent permitted by law. Costs may be

taxed by the clerk on 14 days’ notice; on motion served within seven days thereafter, the action of the clerk may be reviewed by the

court.”

Rule 9006(f)

“ADDITIONAL TIME AFTER SERVICE BY MAIL OR UNDER RULE 5(b)(2)(D), (E), OR (F) F.R.Civ.P. When there is a right or requirement to

act or undertake some proceedings within a prescribed period after service and that service is by mail or under Rule 5(b)(2)(D), (E), or (F) F.R.Civ.P.,

three days are added after the prescribed period would otherwise expire under Rule 9006(a).”

Rule 7058

This rule incorporates Rule 58 F.R.Civ.P. Rule 58(e) provides, in part,

“Ordinarily, the entry of judgment may not be delayed, nor the time for

appeal extended, in order to tax costs or award fees.”

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2