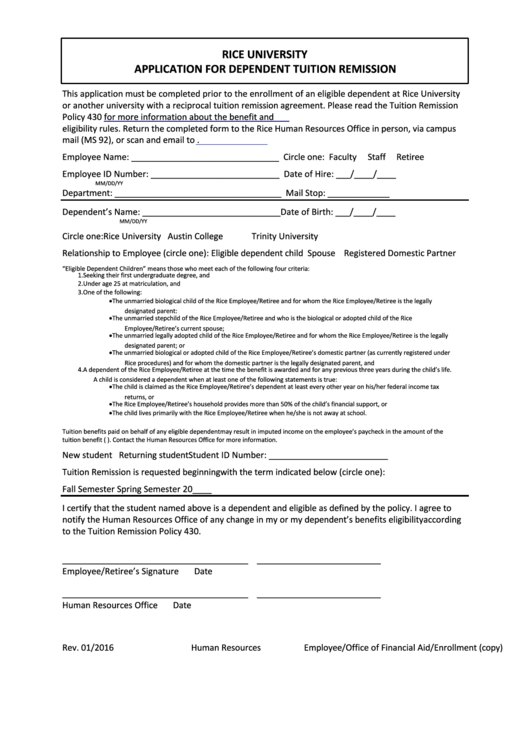

RICE UNIVERSITY

APPLICATION FOR DEPENDENT TUITION REMISSION

This application must be completed prior to the enrollment of an eligible dependent at Rice University

or another university with a reciprocal tuition remission agreement. Please read the Tuition Remission

Policy 430

for more information about the benefit and

eligibility rules. Return the completed form to the Rice Human Resources Office in person, via campus

mail (MS 92), or scan and email to benefits@rice.edu.

Employee Name: _______________________________

Circle one: Faculty

Staff

Retiree

Employee ID Number: ___________________________

Date of Hire: ___/____/____

MM/DD/YY

Department: ___________________________________

Mail Stop: _____________

Dependent’s Name: _____________________________

Date of Birth: ___/____/____

MM/DD/YY

Circle one:

Rice University

Austin College

Trinity University

Relationship to Employee (circle one): Eligible dependent child

Spouse Registered Domestic Partner

“Eligible Dependent Children” means those who meet each of the following four criteria:

1.

Seeking their first undergraduate degree, and

2.

Under age 25 at matriculation, and

3.

One of the following:

•

The unmarried biological child of the Rice Employee/Retiree and for whom the Rice Employee/Retiree is the legally

designated parent:

•

The unmarried stepchild of the Rice Employee/Retiree and who is the biological or adopted child of the Rice

Employee/Retiree’s current spouse;

•

The unmarried legally adopted child of the Rice Employee/Retiree and for whom the Rice Employee/Retiree is the legally

designated parent; or

•

The unmarried biological or adopted child of the Rice Employee/Retiree’s domestic partner (as currently registered under

Rice procedures) and for whom the domestic partner is the legally designated parent, and

4.

A dependent of the Rice Employee/Retiree at the time the benefit is awarded and for any previous three years during the child’s life.

A child is considered a dependent when at least one of the following statements is true:

•

The child is claimed as the Rice Employee/Retiree’s dependent at least every other year on his/her federal income tax

returns, or

•

The Rice Employee/Retiree’s household provides more than 50% of the child’s financial support, or

•

The child lives primarily with the Rice Employee/Retiree when he/she is not away at school.

Tuition benefits paid on behalf of any eligible dependent may result in imputed income on the employee’s paycheck in the amount of the

tuition benefit (i.e. you will owe withholding taxes on the tuition benefit). Contact the Human Resources Office for more information.

New student

Returning student

Student ID Number: _________________________

Tuition Remission is requested beginning with the term indicated below (circle one):

Fall Semester

Spring Semester

20____

I certify that the student named above is a dependent and eligible as defined by the policy. I agree to

notify the Human Resources Office of any change in my or my dependent’s benefits eligibility according

to the Tuition Remission Policy 430.

_______________________________________

__________________________

Employee/Retiree’s Signature

Date

_______________________________________

__________________________

Human Resources Office

Date

Rev. 01/2016

Human Resources

Employee/Office of Financial Aid/Enrollment (copy)

1

1