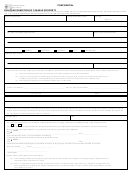

P r o p e r t y T a x

W a t e r c r a f t R e n d i t i o n o f T a x a b l e P r o p e r t y

Form 50-158

If you checked “Under $20,000,” you may complete Business Personal Property rendition of Taxable Property Form 50-144 with Schedule A or this form, whichever you choose.

1. GENERAL INFORMATION:

State Certificate Number:

________________________________________________________________________________________________________________________________________________________

Where is boat and motor kept or docked when not in use?

_____________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________________________________________________________

2. BOAT INFORMATION:

_____________________________________________________________________

__________________

________________________________

____________________________________________________

Make

Year model

Length (in feet)

Hull material

3. MOTOR INFORMATION:

inboard

outboard

_____________________________________________________________________

__________________

________________________________

Make

Year model

Horsepower

4. TRAILER INFORMATION:

Purchased:

new

used

_____________________________________________________________________

__________________

__________________

Make

Year model

Year purchased

Property owner’s total estimate of value:

__________________________________________________________________________

Are you the property owner, an employee of the property owner, or an employee of a property owner on behalf of an affiliated entity of the property owner?

Yes

No

This form must be signed and dated. By signing this document, you attest that the information contained on it is true and correct to the best of your knowledge and belief.

If you checked “Yes” above, sign and date on the first signature line below. No notarization is required.

_____________________________________________________________________________________________________

_________________________________

Signature

Date

If you checked “No” above, you must complete the following:

I swear that the information provided on this form is true and correct to the best of my knowledge and belief.

_____________________________________________________________________________________________________

_________________________________

Signature

Date

Subscribed and sworn before me this

_________________

day of _____________________________, 20 _________.

_____________________________________________________________________________________________________

Notary Public, State of Texas

Section 22.26 of the Tax Code states:

(a) Each rendition statement or property report required or authorized by this chapter must be signed by an individual who is required to file the statement or report.

(b) When a corporation is required to file a statement or report, an officer of the corporation or an employee or agent who has been designated in writing by the board of

directors or by an authorized officer to sign in behalf of the corporation must sign the statement or report.

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Section 37.10, Penal Code.

If you fail to timely file a rendition or property report required by Texas law, the chief appraiser must impose a penalty in an amount equal to 10

percent of the total taxes due on the property for the current year. If the court determines that you filed a false rendition or report with the intent

to commit fraud or to evade the tax or you alter, destroy, or conceal any record, document, or thing or present to the chief appraiser any altered

or fraudulent record, document, or thing, or otherwise engage in fraudulent conduct for the purpose of affecting the outcome of an inspection,

investigation determination, or other proceeding before the appraisal district, the chief appraiser must impose an additional penalty equal to 50

percent of the total taxes due on the property for the current year.

For more information, visit our Web site:

50-158 • 2-10/6 • Page 2

1

1 2

2