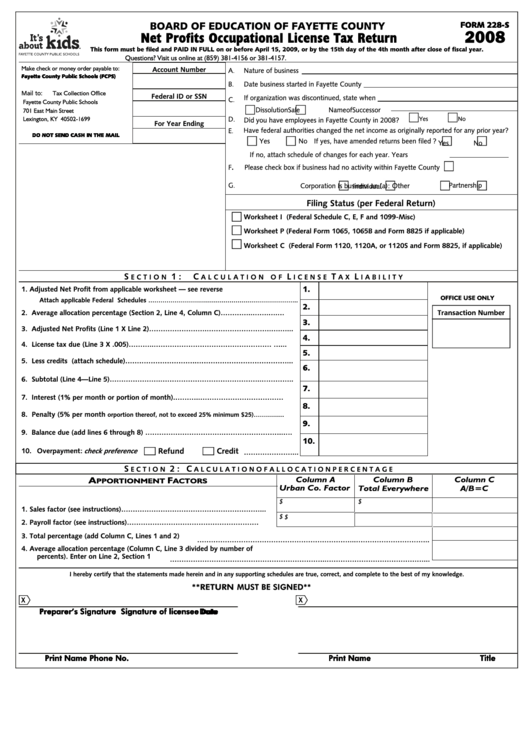

BOARD OF EDUCATION OF FAYETTE COUNTY

FORM 228-S

2008

Net Profits Occupational License Tax Return

This form must be filed and PAID IN FULL on or before April 15, 2009, or by the 15th day of the 4th month after close of fiscal year.

Questions? Visit us online at or contact us by phone at (859) 381-4156 or 381-4157.

Make check or money order payable to:

Account Number

A

Nature of business

.

Fayette County Public Schools (FCPS)

B

Date business started in Fayette County

.

Mail to:

Tax Collection Office

Federal ID or SSN

If organization was discontinued, state when

C

.

Fayette County Public Schools

Dissolution

Sale

Name of Successor

701 East Main Street

D

Lexington, KY 40502-1699

Yes

No

.

Did you have employees in Fayette County in 2008?

For Year Ending

Have federal authorities changed the net income as originally reported for any prior year?

E

.

DO NOT SEND CASH IN THE MAIL

Yes

No

If yes, have amended returns been filed ?

Yes

No

If no, attach schedule of changes for each year.

Years

F

Please check box if business had no activity within Fayette County

.

G

Partnership

.

Is business an (a):

Corporation

Individual

Other

Filing Status (per Federal Return)

Worksheet I (Federal Schedule C, E, F and 1099-Misc)

Worksheet P (Federal Form 1065, 1065B and Form 8825 if applicable)

Worksheet C (Federal Form 1120, 1120A, or 1120S and Form 8825, if applicable)

S

1 :

C

L

T

L

E C T I O N

A L C U L A T I O N O F

I C E N S E

A X

I A B I L I T Y

1.

Adjusted Net Profit from applicable worksheet — see reverse

1.

OFFICE USE ONLY

Attach applicable Federal Schedules

………………………………………………………………..

2.

2.

Average allocation percentage (Section 2, Line 4, Column C)…………..…….….…....

Transaction Number

3.

3.

Adjusted Net Profits (Line 1 X Line 2)…………………….……………………….….…...

4.

4.

License tax due (Line 3 X .005)………..……………………………………………....…...

5.

5.

Less credits (attach schedule)………………………….…………………………………...

6.

6.

Subtotal (Line 4—Line 5)………………….……………………………………..…………..

7.

7.

Interest (1% per month or portion of month).………..……………………………….....

8.

8.

Penalty (5% per month

or portion thereof, not to exceed 25% minimum $25)…………….....

9.

9.

Balance due (add lines 6 through 8) …………………………….……………………..….

10.

check preference

Refund

Credit

10. Overpayment:

…………………...

S

2 : C

E C T I O N

A L C U L A T I O N O F A L L O C A T I O N P E R C E N T A G E

Column B

Column C

A

F

Column A

PPORTIONMENT

ACTORS

Urban Co. Factor

Total Everywhere

A/B=C

$

$

1.

Sales factor (see instructions)……………………………………………………...

$

$

2.

Payroll factor (see instructions)…………………………………………………....

3.

Total percentage (add Column C, Lines 1 and 2)

…………………………………………………………...…………………………..

4.

Average allocation percentage (Column C, Line 3 divided by number of

percents). Enter on Line 2, Section 1

…………………………………………………………..……………………………………...

I hereby certify that the statements made herein and in any supporting schedules are true, correct, and complete to the best of my knowledge.

**RETURN MUST BE SIGNED**

X

X

Preparer’s Signature

Date

Signature of licensee

ate

D

Print Name

Phone No.

Print Name

Title

1

1 2

2