Revenue Collections Operations

Licensing Office

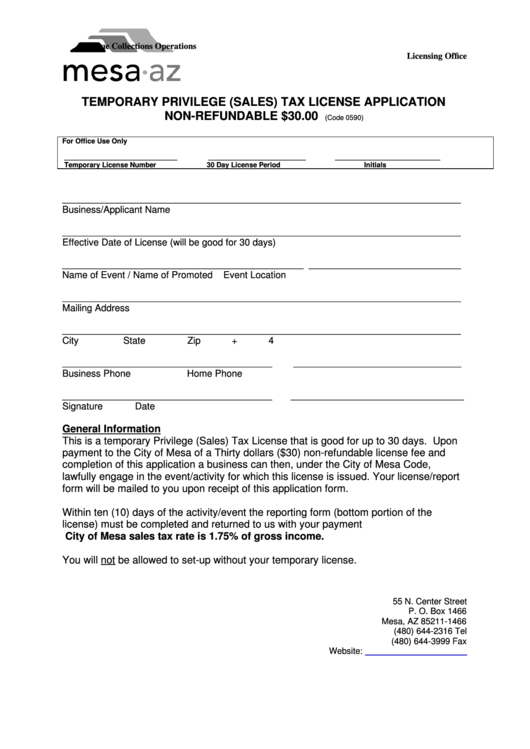

TEMPORARY PRIVILEGE (SALES) TAX LICENSE APPLICATION

NON-REFUNDABLE $30.00

(Code 0590)

For Office Use Only

_____________________________

_________________________

___________________________

Temporary License Number

30 Day License Period

Initials

____________________________________________________________________________

Business/Applicant Name

____________________________________________________________________________

Effective Date of License (will be good for 30 days)

______________________________________________ _____________________________

Name of Event / Name of Promoted

Event Location

____________________________________________________________________________

Mailing Address

____________________________________________________________________________

City

State

Zip + 4

________________________________________

________________________________

Business Phone

Home Phone

________________________________________

_________________________________

Signature

Date

General Information

This is a temporary Privilege (Sales) Tax License that is good for up to 30 days. Upon

payment to the City of Mesa of a Thirty dollars ($30) non-refundable license fee and

completion of this application a business can then, under the City of Mesa Code,

lawfully engage in the event/activity for which this license is issued. Your license/report

form will be mailed to you upon receipt of this application form.

Within ten (10) days of the activity/event the reporting form (bottom portion of the

license) must be completed and returned to us with your payment

City of Mesa sales tax rate is 1.75% of gross income.

You will not be allowed to set-up without your temporary license.

55 N. Center Street

P. O. Box 1466

Mesa, AZ 85211-1466

(480) 644-2316 Tel

(480) 644-3999 Fax

Website:

1

1