Form Il-990-T-V - Payment Voucher For Exempt Organization Income And Replacement Tax - 2000

ADVERTISEMENT

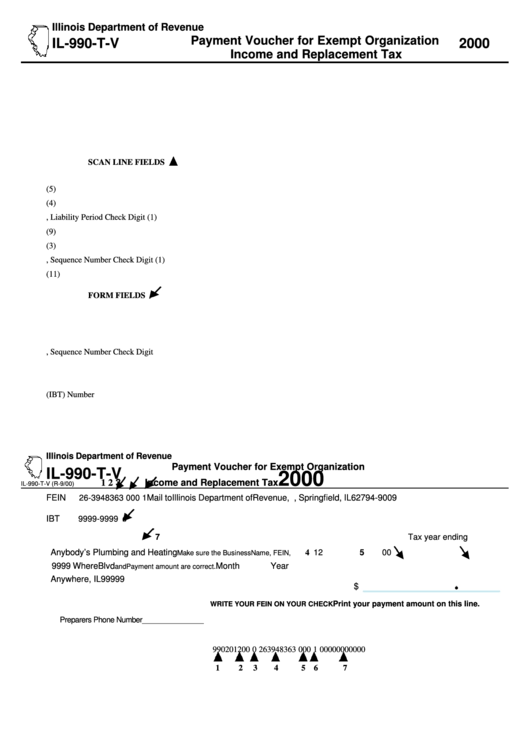

Illinois Department of Revenue

Payment Voucher for Exempt Organization

IL-990-T-V

2000

Income and Replacement Tax

SCAN LINE FIELDS

1.

Form Code - Always 99020 (5)

2.

Liability Period - mmyy (4)

3.

Form Code, Liability Period Check Digit (1)

4.

Federal Employer Identification Number (9)

5.

Sequence Number - Normally 000 (3)

6.

FEIN, Sequence Number Check Digit (1)

7.

Payment Amount - includes cents(11)

FORM FIELDS

1.

Federal Employer Identification Number

2.

Sequence Number - Normally 000

3.

FEIN, Sequence Number Check Digit

4.

Tax Year Ending Month

5.

Tax Year Ending Year

6.

Illinois Business Tax (IBT) Number

7.

Business Name and Address

Illinois Department of Revenue

Payment Voucher for Exempt Organization

IL-990-T-V

2000

3

Income and Replacement Tax

1

2

IL-990-T-V (R-9/00)

FEIN

Mail to Illinois Department of Revenue, P .O. Box 19009, Springfield, IL 62794-9009

26-3948363 000 1

IBT

9999-9999

6

7

Tax year ending

Anybody’s Plumbing and Heating

4

12

5

00

Make sure the BusinessName, FEIN,

9999 Where Blvd

Month

Year

and Payment amount are correct.

Anywhere, IL 99999

$

Print your payment amount on this line.

WRITE YOUR FEIN ON YOUR CHECK

Preparers Phone Number_______________

990201200 0 263948363 000 1 00000000000

1

2

3

4

5 6

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1