Form Bt-5 - Schedule A - Receipt Of Tax Free Purchases And Tax Free Returns - 2001

ADVERTISEMENT

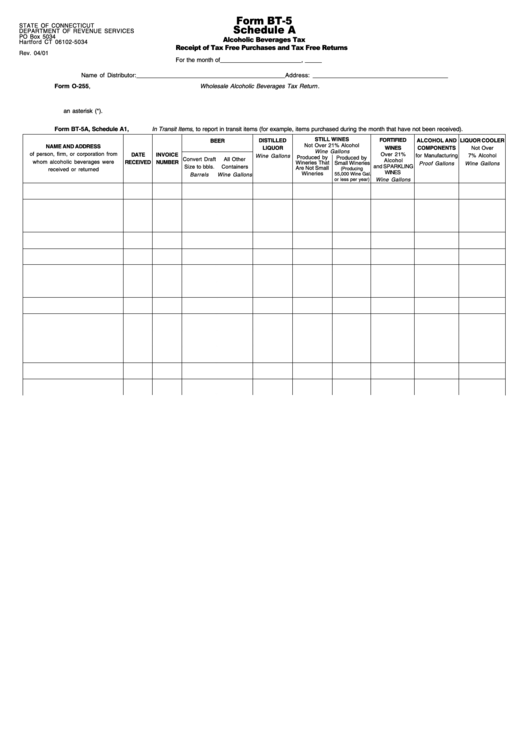

Form BT-5

STATE OF CONNECTICUT

Schedule A

DEPARTMENT OF REVENUE SERVICES

PO Box 5034

Alcoholic Beverages Tax

Hartford CT 06102-5034

Receipt of Tax Free Purchases and Tax Free Returns

Rev. 04/01

For the month of ________________________ , _____

Name of Distributor: ____________________________________________

Address: ________________________________________

1. Use this schedule when completing Form O-255, Wholesale Alcoholic Beverages Tax Return .

2. Use this schedule to report all purchases made during the month listed above on which alcoholic beverages tax was not paid.

3. Use this schedule to report those alcoholic beverages that were returned to you for credit and on which alcoholic beverages tax was not paid. Mark all such items with

an asterisk (*).

4. Use this schedule to report the total withdrawals from bonded warehouses for the month listed above. Please list the total for each warehouse separately.

5. Use Form BT-5A, Schedule A1, In Transit Items , to report in transit items (for example, items purchased during the month that have not been received).

STILL WINES

DISTILLED

FORTIFIED

ALCOHOL AND

LIQUOR COOLER

BEER

Not Over 21% Alcohol

NAME AND ADDRESS

LIQUOR

WINES

COMPONENTS

Not Over

Wine Gallons

of person, firm, or corporation from

DATE

INVOICE

Over 21%

Wine Gallons

for Manufacturing

7% Alcohol

Produced by

Produced by

Convert Draft

All Other

Alcohol

whom alcoholic beverages were

RECEIVED

NUMBER

Wineries That

Small Wineries

Proof Gallons

Wine Gallons

and SPARKLING

Size to bbls.

Containers

Are Not Small

(Producing

received or returned

WINES

Wineries

55,000 Wine Gal.

Barrels

Wine Gallons

or less per year)

Wine Gallons

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2