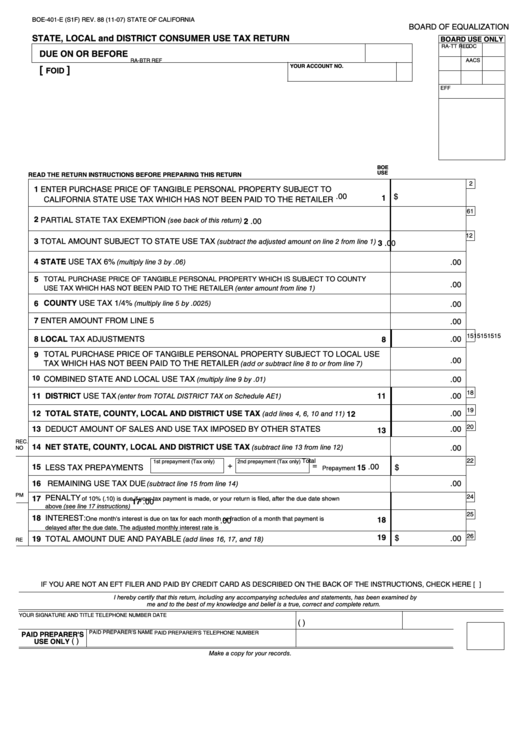

BOE-401-E (S1F) REV. 88 (11-07)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

STATE, LOCAL and DISTRICT CONSUMER USE TAX RETURN

BOARD USE ONLY

LOC

RA-TT

REG

DUE ON OR BEFORE

RA-BTR

AACS

REF

YOUR ACCOUNT NO.

[

]

FOID

EFF

BOE

USE

READ THE RETURN INSTRUCTIONS BEFORE PREPARING THIS RETURN

2

1 ENTER PURCHASE PRICE OF TANGIBLE PERSONAL PROPERTY SUBJECT TO

$

.00

1

CALIFORNIA STATE USE TAX WHICH HAS NOT BEEN PAID TO THE RETAILER

61

2 PARTIAL STATE TAX EXEMPTION

(see back of this return)

2

.00

12

3 TOTAL AMOUNT SUBJECT TO STATE USE TAX

(subtract the adjusted amount on line 2 from line 1)

3

.00

4 STATE USE TAX 6%

(multiply line 3 by .06)

.00

5

TOTAL PURCHASE PRICE OF TANGIBLE PERSONAL PROPERTY WHICH IS SUBJECT TO COUNTY

.00

USE TAX WHICH HAS NOT BEEN PAID TO THE RETAILER (enter amount from line 1)

COUNTY USE TAX 1/4%

6

(multiply line 5 by .0025)

.00

7 ENTER AMOUNT FROM LINE 5

.00

15

15

15

15

15

8 LOCAL TAX ADJUSTMENTS

8

.00

9

TOTAL PURCHASE PRICE OF TANGIBLE PERSONAL PROPERTY SUBJECT TO LOCAL USE

.00

TAX WHICH HAS NOT BEEN PAID TO THE RETAILER

(add or subtract line 8 to or from line 7)

10

COMBINED STATE AND LOCAL USE TAX

.00

(multiply line 9 by .01)

18

11 DISTRICT USE TAX

11

.00

(enter from TOTAL DISTRICT TAX on Schedule AE1)

19

12 TOTAL STATE, COUNTY, LOCAL AND DISTRICT USE TAX

.00

12

(add lines 4, 6, 10 and 11)

20

13 DEDUCT AMOUNT OF SALES AND USE TAX IMPOSED BY OTHER STATES

.00

13

REC.

14 NET STATE, COUNTY, LOCAL AND DISTRICT USE TAX

(subtract line 13 from line 12)

.00

NO

Total

22

1st prepayment (Tax only)

2nd prepayment (Tax only)

=

+

15 LESS TAX PREPAYMENTS

.00

15

$

Prepayment

16 REMAINING USE TAX DUE

.00

(subtract line 15 from line 14)

PM

17 PENALTY

24

of 10% (.10) is due if your tax payment is made, or your return is filed, after the due date shown

17

.00

above (see line 17 instructions)

25

18 INTEREST:

One month's interest is due on tax for each month or fraction of a month that payment is

18

.00

delayed after the due date. The adjusted monthly interest rate is

19

26

$

.00

19 TOTAL AMOUNT DUE AND PAYABLE

(add lines 16, 17, and 18)

RE

IF YOU ARE NOT AN EFT FILER AND PAID BY CREDIT CARD AS DESCRIBED ON THE BACK OF THE INSTRUCTIONS, CHECK HERE [ ]

I hereby certify that this return, including any accompanying schedules and statements, has been examined by

me and to the best of my knowledge and belief is a true, correct and complete return.

YOUR SIGNATURE AND TITLE

TELEPHONE NUMBER

DATE

(

)

PAID PREPARER'S NAME

PAID PREPARER'S

PAID PREPARER'S TELEPHONE NUMBER

(

)

USE ONLY

Make a copy for your records.

1

1 2

2