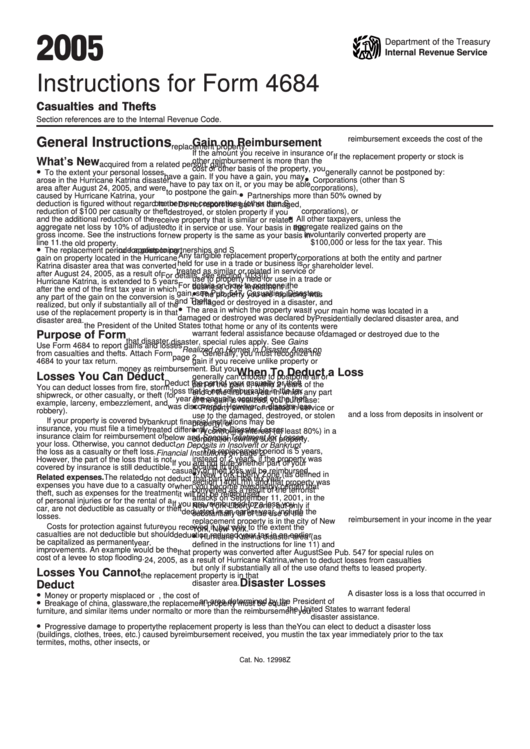

Instructions For Form 4684 - Casualties And Thefts - 2005

ADVERTISEMENT

05

2 0

Department of the Treasury

Internal Revenue Service

Instructions for Form 4684

Casualties and Thefts

Section references are to the Internal Revenue Code.

reimbursement exceeds the cost of the

General Instructions

Gain on Reimbursement

replacement property.

If the amount you receive in insurance or

If the replacement property or stock is

What’s New

other reimbursement is more than the

acquired from a related person, gain

•

cost or other basis of the property, you

To the extent your personal losses

generally cannot be postponed by:

•

have a gain. If you have a gain, you may

arose in the Hurricane Katrina disaster

Corporations (other than S

have to pay tax on it, or you may be able

area after August 24, 2005, and were

corporations),

•

to postpone the gain.

caused by Hurricane Katrina, your

Partnerships more than 50% owned by

one or more corporations (other than S

deduction is figured without regard to the

Do not report the gain on damaged,

corporations), or

reduction of $100 per casualty or theft

destroyed, or stolen property if you

•

and the additional reduction of the

All other taxpayers, unless the

receive property that is similar or related

aggregate net loss by 10% of adjusted

aggregate realized gains on the

to it in service or use. Your basis in the

gross income. See the instructions for

involuntarily converted property are

new property is the same as your basis in

line 11.

$100,000 or less for the tax year. This

the old property.

•

The replacement period for postponing

rule applies to partnerships and S

Any tangible replacement property

corporations at both the entity and partner

gain on property located in the Hurricane

held for use in a trade or business is

or shareholder level.

Katrina disaster area that was converted

treated as similar or related in service or

after August 24, 2005, as a result of

For details, see section 1033(i).

use to property held for use in a trade or

Hurricane Katrina, is extended to 5 years

For details on how to postpone the

business or for investment if:

after the end of the first tax year in which

•

gain, see Pub. 547, Casualties, Disasters,

The property you are replacing was

any part of the gain on the conversion is

and Thefts.

damaged or destroyed in a disaster, and

realized, but only if substantially all of the

•

The area in which the property was

If your main home was located in a

use of the replacement property is in that

damaged or destroyed was declared by

Presidentially declared disaster area, and

disaster area.

the President of the United States to

that home or any of its contents were

Purpose of Form

warrant federal assistance because of

damaged or destroyed due to the

that disaster.

disaster, special rules apply. See Gains

Use Form 4684 to report gains and losses

Realized on Homes in Disaster Areas on

from casualties and thefts. Attach Form

Generally, you must recognize the

page 2.

4684 to your tax return.

gain if you receive unlike property or

money as reimbursement. But you

When To Deduct a Loss

Losses You Can Deduct

generally can choose to postpone all or

Deduct the part of your casualty or theft

part of the gain if, within 2 years of the

You can deduct losses from fire, storm,

loss that is not reimbursable in the tax

end of the first tax year in which any part

shipwreck, or other casualty, or theft (for

year the casualty occurred or the theft

of the gain is realized, you purchase:

example, larceny, embezzlement, and

•

was discovered. However, a disaster loss

Property similar or related in service or

robbery).

and a loss from deposits in insolvent or

use to the damaged, destroyed, or stolen

If your property is covered by

bankrupt financial institutions may be

property, or

•

insurance, you must file a timely

treated differently. See Disaster Losses

A controlling interest (at least 80%) in a

insurance claim for reimbursement of

below and Special Treatment for Losses

corporation owning such property.

your loss. Otherwise, you cannot deduct

on Deposits in Insolvent or Bankrupt

The replacement period is 5 years,

the loss as a casualty or theft loss.

Financial Institutions on page 2.

instead of 2 years, if the property was

However, the part of the loss that is not

If you are not sure whether part of your

located in the:

covered by insurance is still deductible.

•

casualty or theft loss will be reimbursed,

New York Liberty Zone (as defined in

Related expenses. The related

do not deduct that part until the tax year

section 1400L(h)) and that property was

expenses you have due to a casualty or

when you become reasonably certain that

converted as a result of the terrorist

theft, such as expenses for the treatment

it will not be reimbursed.

attacks on September 11, 2001, in the

of personal injuries or for the rental of a

If you are reimbursed for a loss you

New York Liberty Zone, but only if

car, are not deductible as casualty or theft

deducted in an earlier year, include the

substantially all of the use of the

losses.

reimbursement in your income in the year

replacement property is in the city of New

Costs for protection against future

you received it, but only to the extent the

York, New York.

•

casualties are not deductible but should

deduction reduced your tax in an earlier

Hurricane Katrina disaster area (as

be capitalized as permanent

year.

defined in the instructions for line 11) and

improvements. An example would be the

that property was converted after August

See Pub. 547 for special rules on

cost of a levee to stop flooding.

24, 2005, as a result of Hurricane Katrina,

when to deduct losses from casualties

but only if substantially all of the use of

and thefts to leased property.

Losses You Cannot

the replacement property is in that

Disaster Losses

Deduct

disaster area.

•

A disaster loss is a loss that occurred in

Money or property misplaced or lost.

To postpone all of the gain, the cost of

•

an area determined by the President of

Breakage of china, glassware,

the replacement property must be equal

the United States to warrant federal

furniture, and similar items under normal

to or more than the reimbursement you

disaster assistance.

conditions.

received for your property. If the cost of

•

Progressive damage to property

the replacement property is less than the

You can elect to deduct a disaster loss

(buildings, clothes, trees, etc.) caused by

reimbursement received, you must

in the tax year immediately prior to the tax

termites, moths, other insects, or disease.

recognize the gain to the extent the

year in which the disaster occurred as

Cat. No. 12998Z

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4