Reset

Print

Save

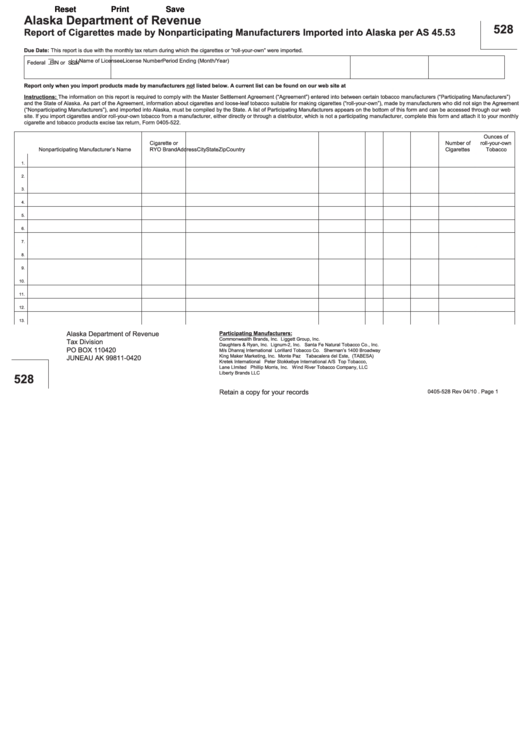

Alaska Department of Revenue

528

Report of Cigarettes made by Nonparticipating Manufacturers Imported into Alaska per AS 45.53

Due Date: This report is due with the monthly tax return during which the cigarettes or “roll-your-own” were imported.

Name of Licensee

License Number

Period Ending (Month/Year)

Federal

EIN or

SSN

Report only when you import products made by manufacturers not listed below. A current list can be found on our web site at

Instructions: The information on this report is required to comply with the Master Settlement Agreement (“Agreement”) entered into between certain tobacco manufacturers (“Participating Manufacturers”)

and the State of Alaska. As part of the Agreement, information about cigarettes and loose-leaf tobacco suitable for making cigarettes (“roll-your-own”), made by manufacturers who did not sign the Agreement

(“Nonparticipating Manufacturers”), and imported into Alaska, must be compiled by the State. A list of Participating Manufacturers appears on the bottom of this form and can be accessed through our web

site. If you import cigarettes and/or roll-your-own tobacco from a manufacturer, either directly or through a distributor, which is not a participating manufacturer, complete this form and attach it to your monthly

cigarette and tobacco products excise tax return, Form 0405-522.

Ounces of

Cigarette or

Number of

roll-your-own

Nonparticipating Manufacturer’s Name

RYO Brand

Address

City

State

Zip

Country

Cigarettes

Tobacco

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

Alaska Department of Revenue

Participating Manufacturers:

Commonwealth Brands, Inc.

Liggett Group, Inc.

R.J. Reynolds Tobacco Co.

Tax Division

Daughters & Ryan, Inc.

Lignum-2, Inc.

Santa Fe Natural Tobacco Co., Inc.

PO BOX 110420

M/s Dhanraj International

Lorillard Tobacco Co.

Sherman’s 1400 Broadway N.Y.C. Ltd.

King Maker Marketing, Inc.

Monte Paz

Tabacalera del Este, S.A. (TABESA)

JUNEAU AK 99811-0420

Kretek International

Peter Stokkebye International A/S

Top Tobacco, L.P.

Lane LImited

Phillip Morris, Inc.

Wind River Tobacco Company, LLC

Liberty Brands LLC

528

Retain a copy for your records

0405-528 Rev 04/10 . Page 1

1

1