Form Ar1020 Bic - Business And Incentive Tax Credits Summary Schedule

ADVERTISEMENT

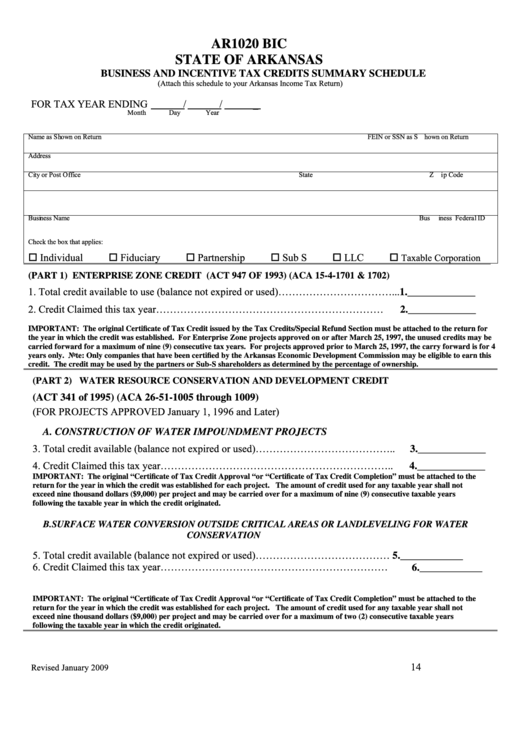

AR1020 BIC

STATE OF ARKANSAS

BUSINESS AND INCENTIVE TAX CREDITS SUMMARY SCHEDULE

(Attach this schedule to your Arkansas Income Tax Return)

FOR TAX YEAR ENDING

/

/

_

Month

Day

Year

Name as Shown on Return

FEIN or SSN as Shown on Return

Address

City or Post Office

State

Zip Code

Business Name

Business Federal ID

Check the box that applies:

Individual

Fiduciary

Partnership

Sub S

LLC

Taxable Corporation

(PART 1) ENTERPRISE ZONE CREDIT (ACT 947 OF 1993) (ACA 15-4-1701 & 1702)

1. Total credit available to use (balance not expired or used)……………………………...

1._____________

2. Credit Claimed this tax year…………………………………………………………......

2._____________

IMPORTANT: The original Certificate of Tax Credit issued by the Tax Credits/Special Refund Section must be attached to the return for

the year in which the credit was established. For Enterprise Zone projects approved on or after March 25, 1997, the unused credits may be

carried forward for a maximum of nine (9) consecutive tax years. For projects approved prior to March 25, 1997, the carry forward is for 4

years only. Note: Only companies that have been certified by the Arkansas Economic Development Commission may be eligible to earn this

credit. The credit may be used by the partners or Sub-S shareholders as determined by the percentage of ownership.

(PART 2) WATER RESOURCE CONSERVATION AND DEVELOPMENT CREDIT

(ACT 341 of 1995) (ACA 26-51-1005 through 1009)

(FOR PROJECTS APPROVED January 1, 1996 and Later)

A. CONSTRUCTION OF WATER IMPOUNDMENT PROJECTS

3. Total credit available (balance not expired or used)…………………………………..

3._____________

4. Credit Claimed this tax year…………………………………………………………..

4._____________

IMPORTANT: The original “Certificate of Tax Credit Approval “or “Certificate of Tax Credit Completion” must be attached to the

return for the year in which the credit was established for each project. The amount of credit used for any taxable year shall not

exceed nine thousand dollars ($9,000) per project and may be carried over for a maximum of nine (9) consecutive taxable years

following the taxable year in which the credit originated.

B. SURFACE WATER CONVERSION OUTSIDE CRITICAL AREAS OR LANDLEVELING FOR WATER

CONSERVATION

5. Total credit available (balance not expired or used)…………………………………....

5.____________

6. Credit Claimed this tax year…………………………………………………………..... 6.____________

IMPORTANT: The original “Certificate of Tax Credit Approval “or “Certificate of Tax Credit Completion” must be attached to the

return for the year in which the credit was established for each project. The amount of credit used for any taxable year shall not

exceed nine thousand dollars ($9,000) per project and may be carried over for a maximum of two (2) consecutive taxable years

following the taxable year in which the credit originated.

14

Revised January 2009

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4