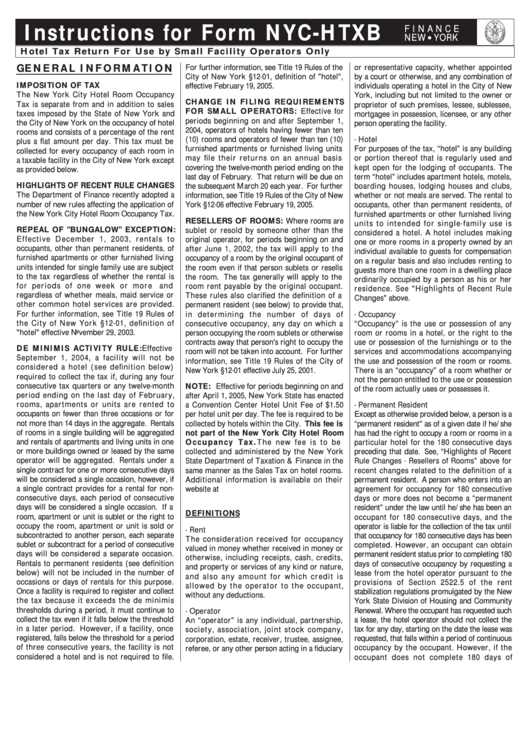

Instructions For Form Nyc-Htxb - Hotel Tax Return For Use By Small Facility Operators Only

ADVERTISEMENT

Instr uctions for For m NYC-HTXB

F I N A N C E

NEW YORK

Hotel Tax Return For Use by Small Facility Operators Only

GE N E R A L IN F O R M A T I O N

For further information, see Title 19 Rules of the

or representative capacity, whether appointed

City of New York §12-01, definition of "hotel",

by a court or otherwise, and any combination of

IMPOSITION OF TAX

effective February 19, 2005.

individuals operating a hotel in the City of New

The New York City Hotel Room Occupancy

York, including but not limited to the owner or

CHANGE IN FILING REQUIREMENTS

Tax is separate from and in addition to sales

proprietor of such premises, lessee, sublessee,

FOR SMALL OPERATORS: Effective for

taxes imposed by the State of New York and

mortgagee in possession, licensee, or any other

periods beginning on and after September 1,

the City of New York on the occupancy of hotel

person operating the facility.

2004, operators of hotels having fewer than ten

rooms and consists of a percentage of the rent

(10) rooms and operators of fewer than ten (10)

- Hotel

plus a flat amount per day. This tax must be

furnished apartments or furnished living units

For purposes of the tax, “hotel” is any building

collected for every occupancy of each room in

may file their returns on an annual basis

or portion thereof that is regularly used and

a taxable facility in the City of New York except

covering the twelve-month period ending on the

kept open for the lodging of occupants. The

as provided below.

last day of February. That return will be due on

term “hotel” includes apartment hotels, motels,

HIGHLIGHTS OF RECENT RULE CHANGES

the subsequent March 20 each year. For further

boarding houses, lodging houses and clubs,

The Department of Finance recently adopted a

information, see Title 19 Rules of the City of New

whether or not meals are served. The rental to

number of new rules affecting the application of

York §12-06 effective February 19, 2005.

occupants, other than permanent residents, of

the New York City Hotel Room Occupancy Tax.

furnished apartments or other furnished living

RESELLERS OF ROOMS: Where rooms are

units to intended for single-family use is

REPEAL OF "BUNGALOW" EXCEPTION:

sublet or resold by someone other than the

considered a hotel. A hotel includes making

Effective December 1, 2003, rentals to

original operator, for periods beginning on and

one or more rooms in a property owned by an

occupants, other than permanent residents, of

after June 1, 2002, the tax will apply to the

individual available to guests for compensation

furnished apartments or other furnished living

occupancy of a room by the original occupant of

on a regular basis and also includes renting to

units intended for single family use are subject

the room even if that person sublets or resells

guests more than one room in a dwelling place

to the tax regardless of whether the rental is

the room. The tax generally will apply to the

ordinarily occupied by a person as his or her

for periods of one week or more

and

room rent payable by the original occupant.

residence. See "Highlights of Recent Rule

regardless of whether meals, maid service or

These rules also clarified the definition of a

Changes" above.

other common hotel services are provided.

permanent resident (see below) to provide that,

For further information, see Title 19 Rules of

in determining the number of days of

- Occupancy

the City of New York §12-01, definition of

consecutive occupancy, any day on which a

“Occupancy” is the use or possession of any

"hotel" effective November 29, 2003.

person occupying the room sublets or otherwise

room or rooms in a hotel, or the right to the

contracts away that person's right to occupy the

use or possession of the furnishings or to the

DE MINIMIS ACTIVITY RULE: Effective

room will not be taken into account. For further

services and accommodations accompanying

September 1, 2004, a facility will not be

information, see Title 19 Rules of the City of

the use and possession of the room or rooms.

considered a hotel (see definition below)

New York §12-01 effective July 25, 2001.

There is an “occupancy” of a room whether or

required to collect the tax if, during any four

not the person entitled to the use or possession

consecutive tax quarters or any twelve-month

NOTE: Effective for periods beginning on and

of the room actually uses or possesses it.

period ending on the last day of February,

after April 1, 2005, New York State has enacted

rooms, apartments or units are rented to

a Convention Center Hotel Unit Fee of $1.50

- Permanent Resident

occupants on fewer than three occasions or for

per hotel unit per day. The fee is required to be

Except as otherwise provided below, a person is a

not more than 14 days in the aggregate. Rentals

collected by hotels within the City. This fee is

“permanent resident” as of a given date if he/she

of rooms in a single building will be aggregated

not part of the New York City Hotel Room

has had the right to occupy a room or rooms in a

and rentals of apartments and living units in one

Occupancy Tax. The new fee is to be

particular hotel for the 180 consecutive days

or more buildings owned or leased by the same

collected and administered by the New York

preceding that date. See, “Highlights of Recent

operator will be aggregated. Rentals under a

State Department of Taxation & Finance in the

Rule Changes - Resellers of Rooms” above for

single contract for one or more consecutive days

same manner as the Sales Tax on hotel rooms.

recent changes related to the definition of a

will be considered a single occasion, however, if

Additional information is available on their

permanent resident. A person who enters into an

a single contract provides for a rental for non-

website at

agreement for occupancy for 180 consecutive

consecutive days, each period of consecutive

days or more does not become a “permanent

days will be considered a single occasion. If a

resident” under the law until he/she has been an

DEFINITIONS

room, apartment or unit is sublet or the right to

occupant for 180 consecutive days, and the

occupy the room, apartment or unit is sold or

operator is liable for the collection of the tax until

- Rent

subcontracted to another person, each separate

that occupancy for 180 consecutive days has been

The consideration received for occupancy

sublet or subcontract for a period of consecutive

completed. However, an occupant can obtain

valued in money whether received in money or

days will be considered a separate occasion.

permanent resident status prior to completing 180

otherwise, including receipts, cash, credits,

Rentals to permanent residents (see definition

days of consecutive occupancy by requesting a

and property or services of any kind or nature,

below) will not be included in the number of

lease from the hotel operator pursuant to the

and also any amount for which credit is

occasions or days of rentals for this purpose.

provisions of Section 2522.5 of the rent

allowed by the operator to the occupant,

Once a facility is required to register and collect

stabilization regulations promulgated by the New

without any deductions.

the tax because it exceeds the de minimis

York State Division of Housing and Community

thresholds during a period, it must continue to

Renewal. Where the occupant has requested such

- Operator

collect the tax even if it falls below the threshold

a lease, the hotel operator should not collect the

An “operator” is any individual, partnership,

in a later period. However, if a facility, once

tax for any day, starting on the date the lease was

society, association, joint stock company,

registered, falls below the threshold for a period

requested, that falls within a period of continuous

corporation, estate, receiver, trustee, assignee,

of three consecutive years, the facility is not

occupancy by the occupant. However, if the

referee, or any other person acting in a fiduciary

considered a hotel and is not required to file.

occupant does not complete 180 days of

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3