BOE-501-CD (BACK) REV. 9 (3-11)

TAX VALUE

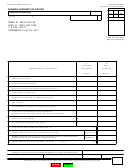

PART 2 - STAMP ACCOUNT FOR CALENDAR MONTH

PRIOR TO DISCOUNT

1a.

1a. Tax value of stamp inventory unaffixed

1. Inventory first of month

(Should agree with Part

1b. Tax value of stamps affixed to packages

1b.

2, line 5 of previous

month's return)

1c. Total (add lines 1a and 1b)

$

1c.

2. Tax value of stamps purchased

2.

$

3. Tax value on tax paid cigarette purchases

$

3.

4. Total tax value to account for (add lines 1c through 3)

4.

$

5a. Tax value of stamp inventory unaffixed

5a.

5. Deduct inventory end

of month (see

5b.

5b. Tax value of stamps affixed to packages

instructions 5 & 7)

5c. Total (add lines 5a and 5b)

5c.

$

6. Tax value of stamps used (subtract line 5c from line 4)

$

6.

7. Deduct unusable stamps for which claim has been filed (see Instructions 5)

7.

$

8. Tax value affixed to packages sold (to Part 1, line 12)

8.

$

FILING REQUIREMENTS

Under section 30182 of the Cigarette and Tobacco Products Tax Law, every cigarette distributor in this state must file a return on or before

the 25th day of the month following the period for which tax is due, with a remittance payable to the State Board of Equalization (BOE). This

return must be filed even if you have no tax liability. A duplicate of the return, together with all supporting records should be retained on the

licensed premise for verification by BOE auditors. BOE-501-CFS, Cigarette Schedule F must be attached.

INSTRUCTIONS

1. Include only federal tax paid cigarettes in this return.

2. The return must cover all cigarette, stamp and sample transactions for an entire calendar month.

3. Sale of cigarettes from one distributor to another distributor is taxable. An appropriate stamp shall be affixed to packages of cigarettes sold

to another distributor.

4. The sale of cigarettes by the original importer of cigarettes manufactured outside the United States to a licensed distributor is

exempt (Part 1, line 8d).

5. Amounts shown in Part 2, line 7, must be in agreement with BOE-1024, Claim for Refund on California Cigarette Stamps, filed for the month

for unusable stamps returned to the BOE. If claim has not been filed for damaged stamps, such stamps should be included in unaffixed

inventory (Part 2, line 5a).

6. Adjustments or corrections to a return for a prior month should be made on an amended return for that month or by letter addressed to the

BOE explaining the adjustment in detail. Do not show such adjustments on this return.

7. Every distributor is required to keep daily records of the number of tax stamps used in their affixing operations. Physical inventories of

unused tax stamps on hand at the end of each month must be taken and all unaffixed and affixed tax stamps on hand must be reported on

Part 2, lines 5a and 5b.

8. Enter the inventory at the end of the month on Part 1, line 6 and the date of the last physical inventory on line 6c.

If you have a cycle count inventory system and perpetual inventory system in place, the monthly statement shall be based on the perpetual

inventory report run on the last business day of the month for which the wholesaler's return is filed. However, at least once every calendar

year, the monthly statement shall be based on a physical inventory of cigarettes on hand on the last business day of the month for which

the wholesaler's report is filed. A "cycle count inventory system" is a system that provides evidence that all cigarettes are counted on a

regular basis, with each item being counted at least once every three-month period. A "perpetual inventory system" is a system in which

inventory records are maintained and updated continuously as items are purchased or sold.

If you do not have a cycle count inventory system and perpetual inventory system in place, the monthly statement shall be based on the

inventory on hand at the end of the month covered by the return. However, at least once every six months, the monthly statement shall be

based on a physical inventory of cigarettes on hand performed within the last five days of the month for which the distributor or

wholesaler's return is filed.

9. If applicable, attach the following forms to the original copy of this return filed with the BOE:

BOE-501-CAS, Schedule A - Distributor's Record of Cigarettes Received

BOE-501-CBS, Schedule B - Sales of Cigarettes by Original Importer

BOE-501-CCS, Schedule C - Out-of-State Sales of Cigarettes Report

BOE-501-CFS, Schedule F - Cigarette Schedule F

If you need additional information, please contact the State Board of Equalization, Special Taxes and Fees, P.O. Box 942879, Sacramento, CA

94279-0088. You may also visit the BOE website at or call the Taxpayer Information Section at 800-400-7115 (TTY: 711);

from the main menu, select the option Special Taxes and Fees.

CLEAR

PRINT

1

1 2

2