Form Dr-166 - Florida Pollutant Tax Application - 2010

ADVERTISEMENT

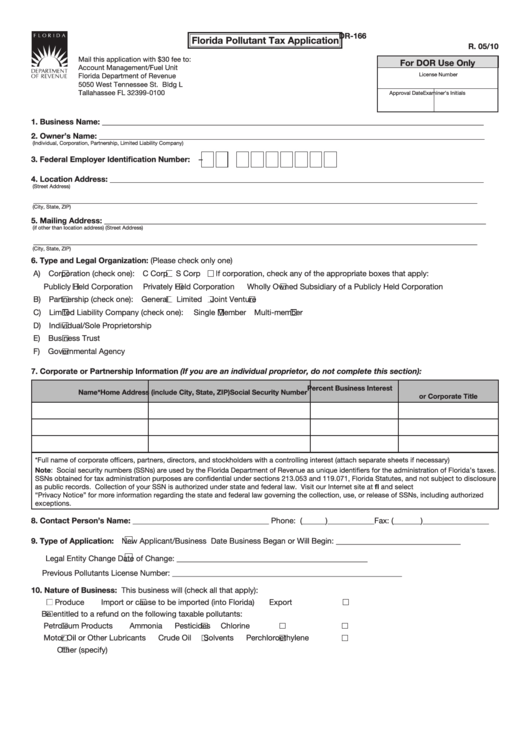

DR-166

Florida Pollutant Tax Application

R. 05/10

Mail this application with $30 fee to:

For DOR Use Only

Account Management/Fuel Unit

License Number

Florida Department of Revenue

5050 West Tennessee St. Bldg L

Tallahassee FL 32399-0100

Approval Date

Examiner’s Initials

1.

Business Name: __________________________________________________________________________________________________

2.

Owner’s Name: ___________________________________________________________________________________________________

(Individual, Corporation, Partnership, Limited Liability Company)

3.

Federal Employer Identification Number:

–

4.

Location Address: ________________________________________________________________________________________________

(Street Address)

__________________________________________________________________________________________________________________

(City, State, ZIP)

5.

Mailing Address: __________________________________________________________________________________________________

(if other than location address)

(Street Address)

__________________________________________________________________________________________________________________

(City, State, ZIP)

6.

Type and Legal Organization: (Please check only one)

A)

Corporation (check one):

C Corp

S Corp

If corporation, check any of the appropriate boxes that apply:

■

■

■

Publicly Held Corporation

Privately Held Corporation

Wholly Owned Subsidiary of a Publicly Held Corporation

■

■

■

B)

Partnership (check one):

General

Limited

Joint Venture

■

■

■

■

C)

Limited Liability Company (check one):

Single Member

Multi-member

■

■

■

D)

Individual/Sole Proprietorship

■

E)

Business Trust

■

F)

Governmental Agency

■

7.

Corporate or Partnership Information (If you are an individual proprietor, do not complete this section):

Percent Business Interest

Name*

Home Address (include City, State, ZIP)

Social Security Number

or Corporate Title

*Full name of corporate officers, partners, directors, and stockholders with a controlling interest (attach separate sheets if necessary)

Note: Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration of Florida’s taxes.

SSNs obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure

as public records. Collection of your SSN is authorized under state and federal law. Visit our Internet site at and select

“Privacy Notice” for more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized

exceptions.

8.

Contact Person’s Name: ___________________________________ Phone: (______)____________Fax: (_______)_________________

■

9.

Type of Application:

New Applicant/Business

Date Business Began or Will Begin: ________________________________

■

Legal Entity Change

Date of Change: _________________________________________________

Previous Pollutants License Number: ___________________________________________________________

10. Nature of Business: This business will (check all that apply):

Produce

Import or cause to be imported (into Florida)

Export

■

■

■

Be entitled to a refund on the following taxable pollutants:

■

Petroleum Products

Ammonia

Pesticides

Chlorine

■

■

■

■

Motor Oil or Other Lubricants

Crude Oil

Solvents

Perchloroethylene

■

■

■

■

Other (specify)

■

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2