Annual Tax And Fees Report Filing Instructions For Domestic And Foreign Health Care Services Organizations, Hospital, Medical, Dental And Optometric Service Corporations And Prepaid Dental Plan Organizations - Arizona Department Of Insurance - 2002

ADVERTISEMENT

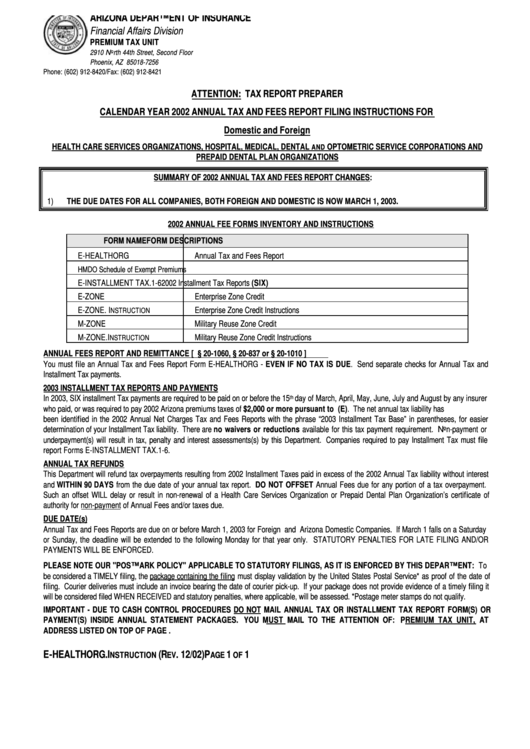

ARIZONA DEPARTMENT OF INSURANCE

Financial Affairs Division

PREMIUM TAX UNIT

2910 North 44th Street, Second Floor

Phoenix, AZ 85018-7256

Phone: (602) 912-8420/Fax: (602) 912-8421

ATTENTION: TAX REPORT PREPARER

CALENDAR YEAR 2002 ANNUAL TAX AND FEES REPORT FILING INSTRUCTIONS FOR

Domestic and Foreign

HEALTH CARE SERVICES ORGANIZATIONS, HOSPITAL, MEDICAL, DENTAL

OPTOMETRIC SERVICE CORPORATIONS AND

AND

PREPAID DENTAL PLAN ORGANIZATIONS

SUMMARY OF 2002 ANNUAL TAX AND FEES REPORT CHANGES:

1)

THE DUE DATES FOR ALL COMPANIES, BOTH FOREIGN AND DOMESTIC IS NOW MARCH 1, 2003.

2002 ANNUAL FEE FORMS INVENTORY AND INSTRUCTIONS

FORM NAME

FORM DESCRIPTIONS

E-HEALTHORG

Annual Tax and Fees Report

E-HEALTHORG.HMDO

HMDO Schedule of Exempt Premiums

E-INSTALLMENT TAX.1-6

2002 Installment Tax Reports (SIX)

E-ZONE

Enterprise Zone Credit

E-ZONE. I

Enterprise Zone Credit Instructions

NSTRUCTION

M-ZONE

Military Reuse Zone Credit

M-ZONE.I

Military Reuse Zone Credit Instructions

NSTRUCTION

ANNUAL FEES REPORT AND REMITTANCE [ A.R.S. § 20-1060, § 20-837 or § 20-1010 ]

You must file an Annual Tax and Fees Report Form E-HEALTHORG - EVEN IF NO TAX IS DUE. Send separate checks for Annual Tax and

Installment Tax payments.

2003 INSTALLMENT TAX REPORTS AND PAYMENTS

In 2003, SIX installment Tax payments are required to be paid on or before the 15

day of March, April, May, June, July and August by any insurer

th

who paid, or was required to pay 2002 Arizona premiums taxes of $2,000 or more pursuant to A.R.S. 20-224(E). The net annual tax liability has

been identified in the 2002 Annual Net Charges Tax and Fees Reports with the phrase “2003 Installment Tax Base” in parentheses, for easier

determination of your Installment Tax liability. There are no waivers or reductions available for this tax payment requirement. Non-payment or

underpayment(s) will result in tax, penalty and interest assessments(s) by this Department. Companies required to pay Installment Tax must file

report Forms E-INSTALLMENT TAX.1-6.

ANNUAL TAX REFUNDS

This Department will refund tax overpayments resulting from 2002 Installment Taxes paid in excess of the 2002 Annual Tax liability without interest

and WITHIN 90 DAYS from the due date of your annual tax report. DO NOT OFFSET Annual Fees due for any portion of a tax overpayment.

Such an offset WILL delay or result in non-renewal of a Health Care Services Organization or Prepaid Dental Plan Organization’s certificate of

authority for non-payment of Annual Fees and/or taxes due.

DUE DATE(s)

Annual Tax and Fees Reports are due on or before March 1, 2003 for Foreign and Arizona Domestic Companies. If March 1 falls on a Saturday

or Sunday, the deadline will be extended to the following Monday for that year only. STATUTORY PENALTIES FOR LATE FILING AND/OR

PAYMENTS WILL BE ENFORCED.

PLEASE NOTE OUR "POSTMARK POLICY" APPLICABLE TO STATUTORY FILINGS, AS IT IS ENFORCED BY THIS DEPARTMENT: To

be considered a TIMELY filing, the package containing the filing must display validation by the United States Postal Service* as proof of the date of

filing. Courier deliveries must include an invoice bearing the date of courier pick-up. If your package does not provide evidence of a timely filing it

will be considered filed WHEN RECEIVED and statutory penalties, where applicable, will be assessed. *Postage meter stamps do not qualify.

IMPORTANT - DUE TO CASH CONTROL PROCEDURES DO NOT MAIL ANNUAL TAX OR INSTALLMENT TAX REPORT FORM(S) OR

PAYMENT(S) INSIDE ANNUAL STATEMENT PACKAGES. YOU MUST MAIL TO THE ATTENTION OF: PREMIUM TAX UNIT, AT

ADDRESS LISTED ON TOP OF PAGE .

E-HEALTHORG.I

(R

. 12/02)

P

1

1

NSTRUCTION

EV

AGE

OF

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1