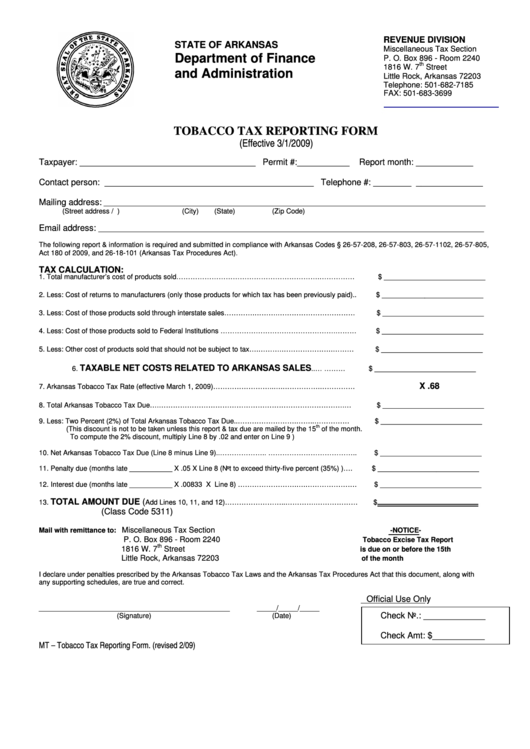

Tobacco Tax Reporting Form

ADVERTISEMENT

REVENUE DIVISION

STATE OF ARKANSAS

Miscellaneous Tax Section

Department of Finance

P. O. Box 896 - Room 2240

th

1816 W. 7

Street

and Administration

Little Rock, Arkansas 72203

Telephone: 501-682-7185

FAX: 501-683-3699

Mary.Roddy@dfa.arkansas.gov

TOBACCO TAX REPORTING FORM

(Effective 3/1/2009)

Taxpayer: _____________________________________

Permit #: ___________

Report month: ____________

Contact person: ____________________________________________ Telephone #: ______________________

Mailing address:

__________________________________________________________________________________________________

(Street address / P.O. Box)

(City)

(State)

(Zip Code)

Email address:

___________________________________________________________________________________________________

The following report & information is required and submitted in compliance with Arkansas Codes § 26-57-208, 26-57-803, 26-57-1102, 26-57-805,

Act 180 of 2009, and 26-18-101 (Arkansas Tax Procedures Act).

TAX CALCULATION:

1. Total manufacturer’s cost of products sold…………………………………………………….……………

$ __________________________

2. Less: Cost of returns to manufacturers (only those products for which tax has been previously paid)..

$ __________________________

3. Less: Cost of those products sold through interstate sales………….……….……………………………

$ __________________________

4. Less: Cost of those products sold to Federal Institutions ………………………………………….………

$ __________________________

5. Less: Other cost of products sold that should not be subject to tax….……….………………….………

$ __________________________

TAXABLE NET COSTS RELATED TO ARKANSAS SALES

6.

..…....………

$ __________________________

X .68

7. Arkansas Tobacco Tax Rate (effective March 1, 2009)……………………..….…………….……………

8. Total Arkansas Tobacco Tax Due….…………………………………………………………………….…

$ __________________________

9. Less: Two Percent (2%) of Total Arkansas Tobacco Tax Due..…………………….……..……………

$ __________________________

th

(This discount is not to be taken unless this report & tax due are mailed by the 15

of the month.

To compute the 2% discount, multiply Line 8 by .02 and enter on Line 9 )

10. Net Arkansas Tobacco Tax Due (Line 8 minus Line 9)..……………….. ………………………………..

$ __________________________

11. Penalty due (months late ___________ X .05 X Line 8 (Not to exceed thirty-five percent (35%) )….

$ __________________________

12. Interest due (months late ___________ X .00833 X Line 8) …………………….….………………….

$ __________________________

TOTAL AMOUNT DUE (

13.

Add Lines 10, 11, and 12)……………………..………….………………

$

(Class Code 5311)

Miscellaneous Tax Section

Mail with remittance to:

-NOTICE-

P. O. Box 896 - Room 2240

Tobacco Excise Tax Report

th

1816 W. 7

Street

is due on or before the 15th

Little Rock, Arkansas 72203

of the month

I declare under penalties prescribed by the Arkansas Tobacco Tax Laws and the Arkansas Tax Procedures Act that this document, along with

any supporting schedules, are true and correct.

Official Use Only

_________________________________________________

_____/_____/_____

Check No.: _____________

(Signature)

(Date)

Check Amt: $___________

MT – Tobacco Tax Reporting Form. (revised 2/09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1