Form It-40rnr - Reciprocal Nonresident Indiana Individual Income Tax Return - 2008

ADVERTISEMENT

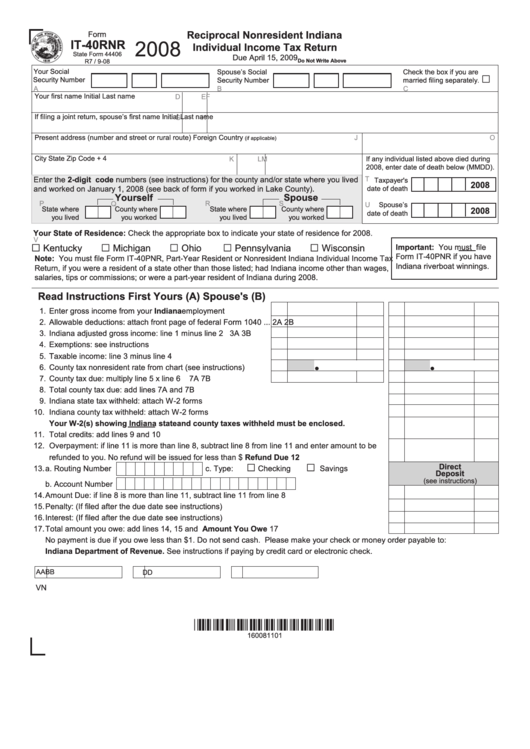

Reciprocal Nonresident Indiana

Form

2008

IT-40RNR

Individual Income Tax Return

State Form 44406

Due April 15, 2009

R7 / 9-08

do Not Write Above

Your Social

Spouse’s Social

Check the box if you are

□

Security Number

Security Number

married filing separately.

A

B

C

Your first name

Initial

Last name

D

E

F

If filing a joint return, spouse’s first name

Initial

Last name

G

H

I

Present address (number and street or rural route)

Foreign Country

J

O

(if applicable)

City

State

Zip Code + 4

K

L

M

If any individual listed above died during

2008, enter date of death below (MMDD).

Enter the 2-digit code numbers (see instructions) for the county and/or state where you lived

T

Taxpayer's

2008

and worked on January 1, 2008 (see back of form if you worked in Lake County).

date of death

Yourself

Spouse

P

R

S

Q

U

Spouse’s

State where

County where

State where

County where

2008

date of death

you lived

you worked

you lived

you worked

Your State of Residence: Check the appropriate box to indicate your state of residence for 2008.

□

V

□

□

□

□

Kentucky

Michigan

Ohio

Pennsylvania

Wisconsin

Important: You must file

Form IT-40PNR if you have

Note: You must file Form IT-40PNR, Part-Year Resident or Nonresident Indiana Individual Income Tax

Indiana riverboat winnings.

Return, if you were a resident of a state other than those listed; had Indiana income other than wages,

salaries, tips or commissions; or were a part-year resident of Indiana during 2008.

Read Instructions First

Yours (A)

Spouse's (B)

1.

Enter gross income from your Indiana employment .................. 1A

1B

2.

Allowable deductions: attach front page of federal Form 1040 ... 2A

2B

3.

Indiana adjusted gross income: line 1 minus line 2 ..................... 3A

3B

4.

Exemptions: see instructions ...................................................... 4A

4B

.

.

5.

Taxable income: line 3 minus line 4 ............................................ 5A

5B

6.

County tax nonresident rate from chart (see instructions)........... 6A

6B

7.

County tax due: multiply line 5 x line 6 ....................................... 7A

7B

8.

Total county tax due: add lines 7A and 7B .........................................................................................

8

9.

Indiana state tax withheld: attach W-2 forms ....................................................................................

9

10.

Indiana county tax withheld: attach W-2 forms ................................................................................... 10

Your W-2(s) showing Indiana state and county taxes withheld must be enclosed.

11.

Total credits: add lines 9 and 10 ........................................................................................................ 11

12.

Overpayment: if line 11 is more than line 8, subtract line 8 from line 11 and enter amount to be

refunded to you. No refund will be issued for less than $1.............................................Refund due 12

□

□

direct

13.

a. Routing Number

c. Type:

Checking

Savings

deposit

(see instructions)

b. Account Number

14.

Amount Due: if line 8 is more than line 11, subtract line 11 from line 8 ............................................... 14

15.

Penalty: (If filed after the due date see instructions) ............................................................................ 15

16.

Interest: (If filed after the due date see instructions) ............................................................................ 16

17.

Total amount you owe: add lines 14, 15 and 16..................................................... Amount You Owe 17

No payment is due if you owe less than $1. Do not send cash. Please make your check or money order payable to:

Indiana department of Revenue. See instructions if paying by credit card or electronic check.

AA

BB

DD

VN

*160081101*

160081101

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2