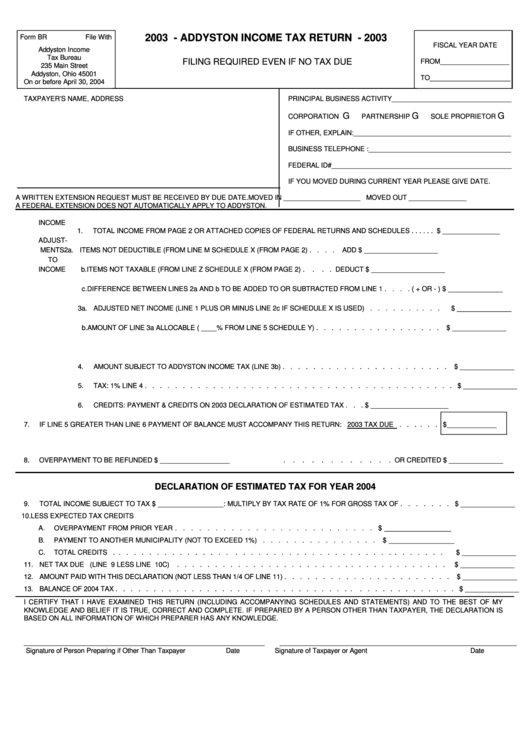

Form Br - Addyston Income Tax Return - 2003

ADVERTISEMENT

2003 - ADDYSTON INCOME TAX RETURN - 2003

Form BR

File With

FISCAL YEAR DATE

Addyston Income

Tax Bureau

FILING REQUIRED EVEN IF NO TAX DUE

FROM__________________

235 Main Street

Addyston, Ohio 45001

TO_____________________

On or before April 30, 2004

TAXPAYER’S NAME, ADDRESS

PRINCIPAL BUSINESS ACTIVITY_______________________________

G

G

G

CORPORATION

PARTNERSHIP

SOLE PROPRIETOR

IF OTHER, EXPLAIN:_________________________________________

BUSINESS TELEPHONE :_____________________________________

FEDERAL ID#_______________________________________________

IF YOU MOVED DURING CURRENT YEAR PLEASE GIVE DATE.

A WRITTEN EXTENSION REQUEST MUST BE RECEIVED BY DUE DATE.

MOVED IN ____________________ MOVED OUT _______________

A FEDERAL EXTENSION DOES NOT AUTOMATICALLY APPLY TO ADDYSTON.

INCOME

1.

TOTAL INCOME FROM PAGE 2 OR ATTACHED COPIES OF FEDERAL RETURNS AND SCHEDULES . . . . . .

$ _______________

ADJUST-

MENTS

2a. ITEMS NOT DEDUCTIBLE (FROM LINE M SCHEDULE X (FROM PAGE 2) . . . .

ADD $ ___________________

TO

INCOME

b. ITEMS NOT TAXABLE (FROM LINE Z SCHEDULE X (FROM PAGE 2) .

.

. . DEDUCT $ ___________________

c. DIFFERENCE BETWEEN LINES 2a AND b TO BE ADDED TO OR SUBTRACTED FROM LINE 1 . . . . ( + OR - ) $ ______________

3a. ADJUSTED NET INCOME (LINE 1 PLUS OR MINUS LINE 2c IF SCHEDULE X IS USED) . . . . . . . . . .

$ ______________

b. AMOUNT OF LINE 3a ALLOCABLE ( ____% FROM LINE 5 SCHEDULE Y) . . . . . . . . . . . . . . . . .

$ ______________

4.

AMOUNT SUBJECT TO ADDYSTON INCOME TAX (LINE 3b) . . . . . . . . . . . . . . . . . . . . . .

$ ______________

5.

TAX: 1% LINE 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

6.

CREDITS: PAYMENT & CREDITS ON 2003 DECLARATION OF ESTIMATED TAX . . . $ ____________________

7.

IF LINE 5 GREATER THAN LINE 6 PAYMENT OF BALANCE MUST ACCOMPANY THIS RETURN: 2003 TAX DUE . . . . . . $_____________

8.

OVERPAYMENT TO BE REFUNDED $ __________________

.

.

.

.

.

.

.

.

.

.

.

. OR CREDITED $ ______________

DECLARATION OF ESTIMATED TAX FOR YEAR 2004

9.

TOTAL INCOME SUBJECT TO TAX $ _________________: MULTIPLY BY TAX RATE OF 1% FOR GROSS TAX OF . . . . . . . $ ______________

10.

LESS EXPECTED TAX CREDITS

A.

OVERPAYMENT FROM PRIOR YEAR . . . . . . . . . . . . . . . . . . . . . . . . . $ _________________

B.

PAYMENT TO ANOTHER MUNICIPALITY (NOT TO EXCEED 1%) . . . . . . . . . . . . . . .

$ _________________

C.

TOTAL CREDITS . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ______________

11. NET TAX DUE (LINE 9 LESS LINE 10C)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ______________

12. AMOUNT PAID WITH THIS DECLARATION (NOT LESS THAN 1/4 OF LINE 11) . . . . . . . . . . . . . . . . . . . . . .

$ ______________

13. BALANCE OF 2004 TAX . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . $ ______________

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THE DECLARATION IS

BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

_______________________________________________________________

______________________________________________________________

Signature of Person Preparing if Other Than Taxpayer

Date

Signature of Taxpayer or Agent

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2