Form Mh-1040es - Declaration Of Estimated Tax Payment Voucher - 2011

ADVERTISEMENT

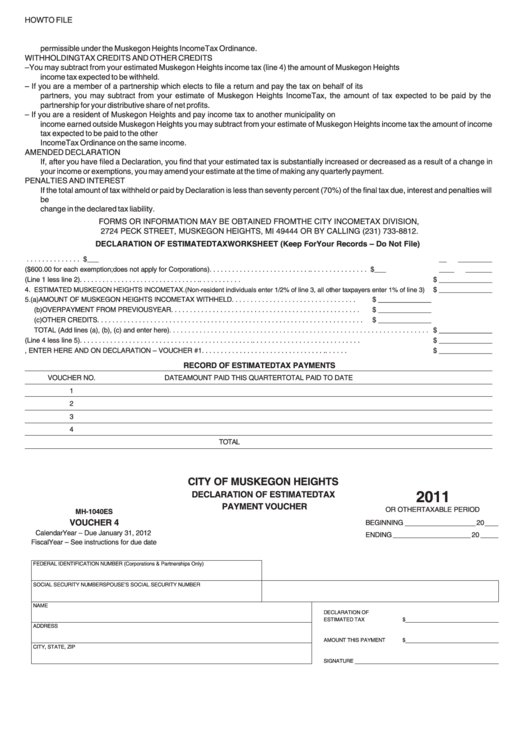

HOW TO FILE

A.

Your annual return for the preceding year may be used as the basis for computing your declaration of estimated tax for the current year.

B.

You may use the same figures used for estimating your federal income tax adjusted to exclude any income or deductions not taxable or

permissible under the Muskegon Heights Income Tax Ordinance.

WITHHOLDING TAX CREDITS AND OTHER CREDITS

A.

Withholding Tax Credit – You may subtract from your estimated Muskegon Heights income tax (line 4) the amount of Muskegon Heights

income tax expected to be withheld.

B.

Income Tax Paid By Partnership – If you are a member of a partnership which elects to file a return and pay the tax on behalf of its

partners, you may subtract from your estimate of Muskegon Heights Income Tax, the amount of tax expected to be paid by the

partnership for your distributive share of net profits.

C. Income Tax Paid To Another Municipality – If you are a resident of Muskegon Heights and pay income tax to another municipality on

income earned outside Muskegon Heights you may subtract from your estimate of Muskegon Heights income tax the amount of income

tax expected to be paid to the other municipality. The credit may not exceed the amount of tax assessable under the Muskegon Heights

Income Tax Ordinance on the same income.

AMENDED DECLARATION

If, after you have filed a Declaration, you find that your estimated tax is substantially increased or decreased as a result of a change in

your income or exemptions, you may amend your estimate at the time of making any quarterly payment.

PENALTIES AND INTEREST

If the total amount of tax withheld or paid by Declaration is less than seventy percent (70%) of the final tax due, interest and penalties will

be charged. The filing of a declaration of estimated tax does not excuse the taxpayer from filing an annual return even though there is no

change in the declared tax liability.

FORMS OR INFORMATION MAY BE OBTAINED FROM THE CITY INCOME TAX DIVISION,

2724 PECK STREET, MUSKEGON HEIGHTS, MI 49444 OR BY CALLING (231) 733-8812.

DECLARATION OF ESTIMATED TAX WORKSHEET (Keep For Your Records – Do Not File)

1. TOTAL MUSKEGON HEIGHTS INCOME EXPECTED IN 2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

__

___

_________

2. EXEMPTIONS ($600.00 for each exemption; does not apply for Corporations) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

____

___

_______

3. ESTIMATED MUSKEGON HEIGHTS TAXABLE INCOME (Line 1 less line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ______________

4.

ESTIMATED MUSKEGON HEIGHTS INCOME TAX

(Non-resident individuals enter 1/2% of line 3, all other taxpayers enter 1% of line 3)

.

$ ______________

5. (a) AMOUNT OF MUSKEGON HEIGHTS INCOME TAX WITHHELD . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ______________

(b) OVERPAYMENT FROM PREVIOUS YEAR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ______________

(c) OTHER CREDITS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ______________

TOTAL (Add lines (a), (b), (c) and enter here) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ______________

6. ESTIMATED TAX (Line 4 less line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ______________

7. AMOUNT TO BE PAID, ENTER HERE AND ON DECLARATION – VOUCHER #1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ______________

RECORD OF ESTIMATED TAX PAYMENTS

VOUCHER NO.

DATE

AMOUNT PAID THIS QUARTER

TOTAL PAID TO DATE

1

2

3

4

TOTAL

CITY OF MUSKEGON HEIGHTS

2011

DECLARATION OF ESTIMATED TAX

PAYMENT VOUCHER

OR OTHER TAXABLE PERIOD

MH-1040ES

VOUCHER 4

BEGINNING

20

Calendar Year – Due January 31, 2012

ENDING

20

Fiscal Year – See instructions for due date

FEDERAL IDENTIFICATION NUMBER (Corporations & Partnerships Only)

SOCIAL SECURITY NUMBER

SPOUSE’S SOCIAL SECURITY NUMBER

NAME

DECLARATION OF

ESTIMATED TAX

$

ADDRESS

AMOUNT THIS PAYMENT

$

CITY, STATE, ZIP

SIGNATURE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2