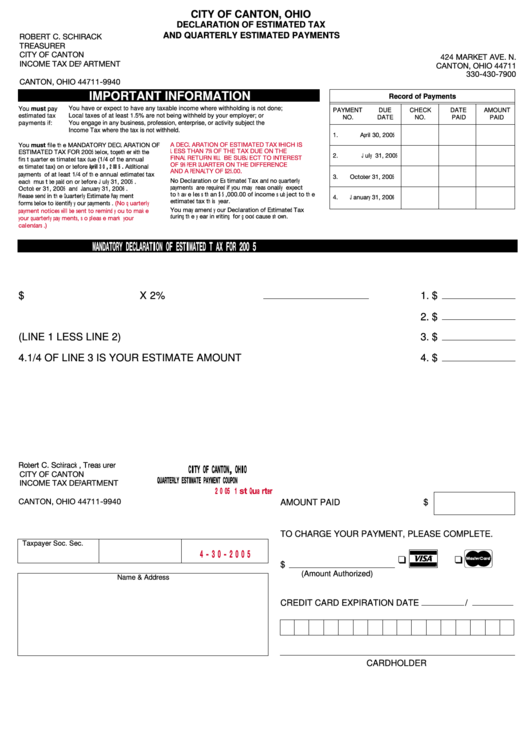

Declaration Of Estimated Tax And Quarterly Estimated Payments - City Of Canton - 2005

ADVERTISEMENT

CITY OF CANTON, OHIO

DECLARATION OF ESTIMATED TAX

AND QUARTERLY ESTIMATED PAYMENTS

ROBERT C. SCHIRACK

TREASURER

CITY OF CANTON

424 MARKET AVE. N.

INCOME TAX DEP ARTMENT

CANTON, OHIO 44711

P .O. BOX 9940

330-430-7900

CANTON, OHIO 44711-9940

IMPORTANT INFORMATION

Record of Payments

You must pay

You have or expect to have any taxable income where withholding is not done;

PAYMENT

DUE

CHECK

DATE

AMOUNT

Local taxes of at least 1.5% are not being withheld by your employer; or

estimated tax

NO.

DATE

NO.

PAID

PAID

You engage in any business, profession, enterprise, or activity subject the

payments if:

Income Tax where the tax is not withheld.

1.

Ap ril 30, 2005

You must file th e MANDATORY DECL ARATION OF

A DECL ARATION OF ESTIMATED TAX W HICH IS

L ESS THAN 75 % OF THE TAX DUE ON THE

ESTIMATED TAX FOR 2005 b elow , tog eth er w ith th e

2.

J uly 31, 2005

FINAL RETURN W IL L BE SUBJ ECT TO INTEREST

firs t q uarter es timated tax d ue (1/4 of th e annual

OF 9% P ER Q UARTER ON THE DIFFERENCE

es timated tax) on or b efore A p r il 3 0 , 2 0 0 5 . Ad d itional

AND A P ENAL TY OF $ 25 .00.

p ay ments of at leas t 1/4 of th e annual es timated tax

3.

Octob er 31, 2005

No Declaration or Es timated Tax and no q uarterly

each mus t b e p aid on or b efore J uly 31, 2005 .

p ay ments are req uired if y ou may reas onab ly exp ect

Octob er 31, 2005 and J anuary 31, 2006 .

to h av e les s th an $ 5 ,000.00 of income s ub ject to th e

P leas e s end in th e Q uarterly Es timate P ay ment

4.

J anuary 31, 2006

es timated tax th is y ear.

forms b elow to id entify y our p ay ments .

(No q uarterly

You may amend y our Declaration of Es timated Tax

p ay ment notices w ill b e s ent to remind y ou to mak e

d uring th e y ear in w riting for g ood caus e s h ow n.

y our q uarterly p ay ments , s o p leas e mark y our

calend ars .)

M A N D A T O R Y D E C L A R A T IO N O F E S T IM A T E D T A X F O R 2 0 0 5

1. TOTAL INCOME SUBJECT TO CANTON TAX $

X 2%

1. $

2. LESS CREDITS

2. $

3. NET TAX DUE (LINE 1 LESS LINE 2)

3. $

4. 1/4 OF LINE 3 IS YOUR ESTIMATE AMOUNT

4. $

Rob ert C. Sch irack , Treas urer

C IT Y O F C A N T O N , O H IO

CITY OF CANTON

Q U A R T E R L Y E S T IM A T E P A Y M E N T C O U P O N

INCOME TAX DEP ARTMENT

2 0 0 5 1 st Q ua r te r

P .O. BOX 9940

$

AMOUNT PAID

CANTON, OHIO 44711-9940

TO CHARGE YOUR PAYMENT, PLEASE COMPLETE.

Taxpayer Soc. Sec. No.

Account Number

Due on or Before

4 - 3 0 - 2 0 0 5

®

K

K

$

(Amount Authorized)

Name & Address

CREDIT CARD EXPIRATION DATE

/

CARDHOLDER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2