Form Sf-1065 - Springfield Income Tax Partnership Return

ADVERTISEMENT

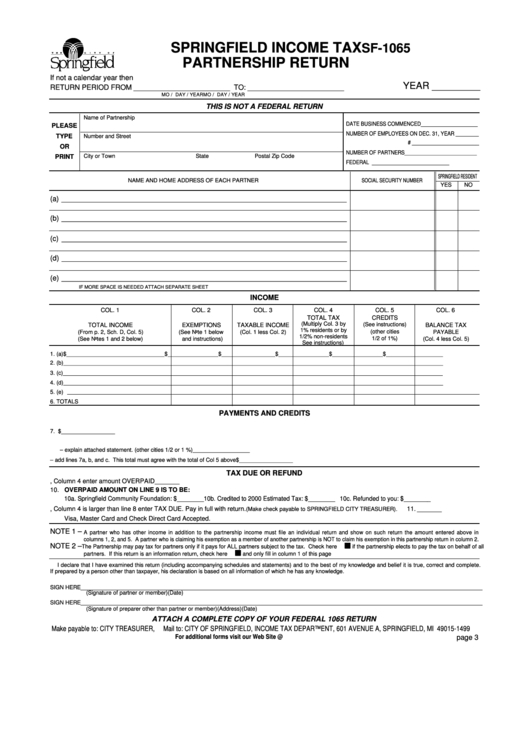

SPRINGFIELD INCOME TAX

SF-1065

PARTNERSHIP RETURN

If not a calendar year then

YEAR _________

RETURN PERIOD FROM ________________________ TO: ________________________

MO / DAY / YEAR

MO / DAY / YEAR

THIS IS NOT A FEDERAL RETURN

Name of Partnership

DATE BUSINESS COMMENCED ______________________

PLEASE

NUMBER OF EMPLOYEES ON DEC. 31, YEAR ___________

TYPE

Number and Street

# __________________________

OR

NUMBER OF PARTNERS ____________________________

City or Town

State

Postal Zip Code

PRINT

FEDERAL I.D. NJMBER ______________________________

SPRINGFIELD RESIDENT

NAME AND HOME ADDRESS OF EACH PARTNER

SOCIAL SECURITY NUMBER

YES

NO

(a) _______________________________________________________________________

(b) _______________________________________________________________________

(c) _______________________________________________________________________

(d) _______________________________________________________________________

(e) _______________________________________________________________________

IF MORE SPACE IS NEEDED ATTACH SEPARATE SHEET

INCOME

COL. 1

COL. 2

COL. 3

COL. 4

COL. 5

COL. 6

TOTAL TAX

CREDITS

(Multiply Col. 3 by

TOTAL INCOME

EXEMPTIONS

TAXABLE INCOME

(See instructions)

BALANCE TAX

1% residents or by

(other cities

(From p. 2, Sch. D, Col. 5)

(See Note 1 below

(Col. 1 less Col. 2)

PAYABLE

1/2% non-residents

1/2 of 1%)

(See Notes 1 and 2 below)

and instructions)

(Col. 4 less Col. 5)

See instructions)

1. (a) $ _______________________________

$ ________________ $_________________ $ ________________ $ ________________ $__________________

2. (b) ________________________________

_________________

__________________

_________________

_________________ ___________________

3. (c) ________________________________

_________________

__________________

_________________

_________________ ___________________

4. (d) ________________________________

_________________

__________________

_________________

_________________ ___________________

5. (e)

6. TOTALS

PAYMENTS AND CREDITS

7. a. Tax paid with tentative return

$ _________________

b. Payments of Declaration of Estimated Springfield Income tax for the filing year

__________________

c. Other credits – explain attached statement. (other cities 1/2 or 1 %)

__________________

8. Total – add lines 7a, b, and c. This total must agree with the total of Col 5 above

$ _________________

TAX DUE OR REFUND

9.

If line 8 is larger than line 6, Column 4 enter amount OVERPAID. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9._______

10. OVERPAID AMOUNT ON LINE 9 IS TO BE:

10a. Springfield Community Foundation: $________ 10b. Credited to 2000 Estimated Tax: $________ 10c. Refunded to you: $________

11. If line 6, Column 4 is larger than line 8 enter TAX DUE. Pay in full with return.

11. _______

(Make check payable to SPRINGFIELD CITY TREASURER).

Visa, Master Card and Check Direct Card Accepted.

NOTE 1 –

A partner who has other income in addition to the partnership income must file an individual return and show on such return the amount entered above in

columns 1, 2, and 5. A partner who is claiming his exemption as a member of another partnership is NOT to claim his exemption in this partnership return in column 2.

NOTE 2 –

The Partnership may pay tax for partners only if it pays for ALL partners subject to the tax. Check here

if the partnership elects to pay the tax on behalf of all

partners. If this return is an information return, check here

and only fill in column 1 of this page

I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true, correct and complete.

If prepared by a person other than taxpayer, his declaration is based on all information of which he has any knowledge.

SIGN HERE _______________________________________________________________________________________________________________________________

(Signature of partner or member)

(Date)

SIGN HERE _______________________________________________________________________________________________________________________________

(Signature of preparer other than partner or member)

(Address)

(Date)

ATTACH A COMPLETE COPY OF YOUR FEDERAL 1065 RETURN

Make payable to: CITY TREASURER,

Mail to: CITY OF SPRINGFIELD, INCOME TAX DEPARTMENT, 601 AVENUE A, SPRINGFIELD, MI 49015-1499

For additional forms visit our Web Site @

page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2