Suspicious Activity Report (Saf-Sf) Instructions Page 2

ADVERTISEMENT

2

27. MATIF-- Marche a Terme International de

6. If more than one su bject is being reported,

Part I

Subject Information

France.

make a copy of page 1 , complete only the subject

28. MGEX-- Minneapolis Grain Exchange

information in Part I, and attach the additional

Note: Enter information about the person(s)

29. NASDAQ--Nasdaq Stock Market

page(s) behind page 1. If more space is needed to

or entity involved that caused this report to

30. NFA--

National Futures

Association

complete any other item(s), identify that item in

be filed, not the victim of the activity .

31. NYBOT-- New York Board of Trade (CSCE,

Part VI by “item number,” and provide the addi-

CTN, FINEX, NYFE)

tional information.

Item 2 -- Multiple Subjects. If there are mul-

32. NYMEX-- New York Mercantile Exchange

tiple subjects involved, check box “2a” and com-

33. NYSE--

New York Stock Exchange

7. Type or complete the report using block writ-

plete a separate Part I for each subject. Check box

34. NQLX--

Nasdaq Liffe Markets

ten letters.

“2b” only if NO critical* subject information is

35. OTC--

Over-the-counter

available. If ANY subject information is available,

36. PCX--

Pacific Exchange

8. Enter all dates in MM/DD/YYYY format

record that information in Part 1, leave box “2b”

37. PHLX--

Philadelphia Stock Exchange

where MM= month, DD= day , and YYYY= year. Pre-

blank, and insert the appropriate special response

38. RE--

Registered Entity

cede any single number with a zero, i.e., 01,02, etc.

“XX” in any critical item for which data is missing.

39. RFA--

Registered Futures Association

40. SEC--

Securities and Exchange

9. List all Telephone numbers with (area code)

Items *3, *4, and 5--Name of Subject . See Gen-

Commission

first and then the seven numbers, using the format

eral Instruction B10. If the subject is an entity ,

41. SRO--

Self-Regulatory Organization

(XXX) XXX-XXXX. List international telephone

enter the legal name in item 3, enter XX in item 4

42. SSN--

social security number

and fax numbers in Part VI.

and leave item 5 blank. If the entity is operated

43. USFE--

U. S . Futures Exchange

under a different trade or business name than its

10. Always enter an individual’s name by en-

legal name, enter the entity’ s legal name in Item 3

tering the last name, first name, and middle initial

(e.g., Smith Enterprises, Inc.) and the name of the

B . How to make a report:

(if known). If a legal entity is listed, enter its name

business in Item 6 ( e.g., Smith’s Tours). If more

in the last name field and XX in the first name

than one Part I is required, make a copy of page 1

1. This form should be e-filed through the

field.

and provide the additional information.

Bank Secr ecy Act E-Filing System. Go to

to r egister.

11. Enter all identifying numbers (alien regis-

Item 6-- Also known as, or doing business as .

This form is also available for download on the

tration, Corporate/Partnership Resolution, CRD,

If a reporting institution has knowledge of a subject’s

Financial Crimes Enforcement Network’ s Web site

CUSIP,

driver ’s license/state ID, EIN, ITIN, For -

®

separate “AKA” and/or entity’ s “DBA” name, en-

at , or may be ordered by calling

eign National ID, ISID,

NFAID, passport, SEC,

®

ter it in Item 6.

the IRS Forms Distribution Center at (800) 829-

and SSN, etc.) starting from left to right. Do not

3676.

include spaces, dashes, or other punctuation. Use

Item 7-- Occupation/type of business . If known,

XX as appropriate to indicate unknown (see B3)

identify the occupation, profession, or business that

If not filed electronically , send each completed

best describes the individual in Part I ( e.g., attor-

suspicious activity report to:

12. Enter all Post Office ZIP codes with at least

ney, car dealer , carpenter , doctor , farmer, plumber ,

the first five numbers (all nine (ZIP + 4)) if known)

truck driver, etc.). Do not use nondescript terms

Detroit Computing Center

and listed from left to right.

such as businessman, merchant, store owner (un-

Attn: SAR-SF

less store’s name is provided). If self employed,

P.O. Box 33980

13. Enter all monetary amounts in U.S.Dollars.

unemployed, or retired are used, add currrent/former

Detroit, MI 48232

Use whole dollar amounts rounded up when neces-

profession if known ( e.g. self-employed building

sary. Use this format: $0,000,000.00. If foreign

contractor, unemployed teacher, retired attorney

2. While all items should be completed fully and

currency is involved, state name of currency and

etc.). If the individual’ s business activities can be

accurately, items marked with an asterisk (*) are

country of origin in Part VI.

described more fully , provide the additional infor -

considered critical and must be completed accord-

mation in Part VI.

ing to the provisions of paragraph 3 below and any

14. Addresses, general . Enter the permanent

special item instructions.

street address, city , two letter state/territory abbre-

viation used by the U.S. Postal Service, and ZIP

Items 8, 9, 10, 1 1, and 12-- *Addr ess. See Gen-

code (ZIP+4 if known) of the individual or entity .

3. If the information for a critical item marked

eral Instructions B12 and B14.

A post office box number sho uld not be used for an

with an asterisk (*) is not known or not applicable,

individual, unless no other address is available. For

Item 13-- E-mail addr ess. Enter the subject’ s E-

enter special response “XX” as appropriate to com-

an individual, also enter any apartment number or

mail address if available.

plete the item. Non-asterisk fields should be left

suite number, road or route number . If a P .O. Box is

blank if the information is unknown or not appli-

used for an entity , enter the street name, suite num-

Item *14-- SSN/ITIN (individual) or EIN (en-

cable. NOTE: The XX response for unknown may

ber, and road or route number . If the address of the

tity). See General Instruction B11 and definitions.

not be used in item 21(suspicious activity “From”

individual or entity is in a foreign country , enter

If the subject named in Items 3 through 5 is a U.S.

date), the check boxes in item 30, and in Parts IV

,

the city , province or state, postal code, and the

Citizen or an alien with a SSN, enter his or her SSN

V or VI.

name of the country (country codes may be found

in Item 14. If that individual is an alien who has an

at /reg_bsaforms.html). Complete

ITIN, enter that number . If the subject is an entity ,

4. Complete each suspicious activity report by

any part of the address that is known, even if the

enter the EIN. If unknown, enter XX in the first

providing as much information as possible on ini-

entire address is not known. If from the United

two spaces.

tial and corrected reports.

States, leave country Item blank.

Item *15-- Account number(s) . See General In-

5. Do not include supporting documentation with

struction B11. Enter up to four affected account

the suspicious activity report filed. Identify and

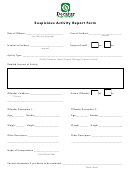

C. Specific Suspicious

Activity Report

numbers in or through which the suspicious activ-

retain a copy of the suspicious activity report and

Preparation Instructions

ity occurred. If no account number is affected or

all supporting documentation ( e.g. transaction

the account number is unknown, enter XX in the

records, new account information, tape recordings,

Item 1-- Type of r eport. Check Box if this report

first account number field. Check the “yes” box to

E-mail messages, correspondence, etc.) or business

is filed to correct a previously filed SAR-SF . To

indicate if the account is closed. If more than four

record equivalent for your files for five (5) years

correct a report, a new SAR-SF must be completed

accounts are affected, provide the additional infor-

from the date of the suspicious activity report.

All

in its entirety . Note corrected items in Section VI

mation in Part VI.

supporting documentation must be made available

(see line “v”).

to appropriate authorities upon request.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3