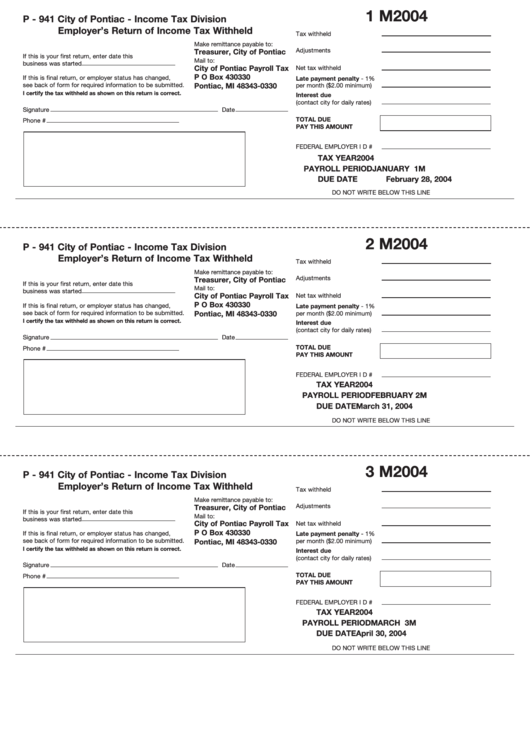

Form P-941 - Employer'S Return Of Income Tax Withheld - City Of Pontiac Income Tax Division - 2004

ADVERTISEMENT

1 M

2004

P - 941 City of Pontiac - Income Tax Division

Employer’s Return of Income Tax Withheld

Tax withheld

Make remittance payable to:

Adjustments

Treasurer, City of Pontiac

If this is your first return, enter date this

Mail to:

business was started

City of Pontiac Payroll Tax

Net tax withheld

P O Box 430330

If this is final return, or employer status has changed,

Late payment penalty - 1%

see back of form for required information to be submitted.

Pontiac, MI 48343-0330

per month ($2.00 minimum)

I certify the tax withheld as shown on this return is correct.

Interest due

(contact city for daily rates)

Signature

Date

TOTAL DUE

Phone #

PAY THIS AMOUNT

FEDERAL EMPLOYER I D #

2004

TAX YEAR

JANUARY 1M

PAYROLL PERIOD

DUE DATE

February 28, 2004

DO NOT WRITE BELOW THIS LINE

2 M

2004

P - 941 City of Pontiac - Income Tax Division

Employer’s Return of Income Tax Withheld

Tax withheld

Make remittance payable to:

Adjustments

Treasurer, City of Pontiac

If this is your first return, enter date this

Mail to:

business was started

City of Pontiac Payroll Tax

Net tax withheld

P O Box 430330

If this is final return, or employer status has changed,

Late payment penalty - 1%

see back of form for required information to be submitted.

Pontiac, MI 48343-0330

per month ($2.00 minimum)

I certify the tax withheld as shown on this return is correct.

Interest due

(contact city for daily rates)

Signature

Date

TOTAL DUE

Phone #

PAY THIS AMOUNT

FEDERAL EMPLOYER I D #

2004

TAX YEAR

FEBRUARY 2M

PAYROLL PERIOD

DUE DATE

March 31, 2004

DO NOT WRITE BELOW THIS LINE

3 M

2004

P - 941 City of Pontiac - Income Tax Division

Employer’s Return of Income Tax Withheld

Tax withheld

Make remittance payable to:

Adjustments

Treasurer, City of Pontiac

If this is your first return, enter date this

Mail to:

business was started

City of Pontiac Payroll Tax

Net tax withheld

P O Box 430330

If this is final return, or employer status has changed,

Late payment penalty - 1%

see back of form for required information to be submitted.

Pontiac, MI 48343-0330

per month ($2.00 minimum)

I certify the tax withheld as shown on this return is correct.

Interest due

(contact city for daily rates)

Signature

Date

TOTAL DUE

Phone #

PAY THIS AMOUNT

FEDERAL EMPLOYER I D #

TAX YEAR

2004

PAYROLL PERIOD

MARCH 3M

DUE DATE

April 30, 2004

DO NOT WRITE BELOW THIS LINE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1