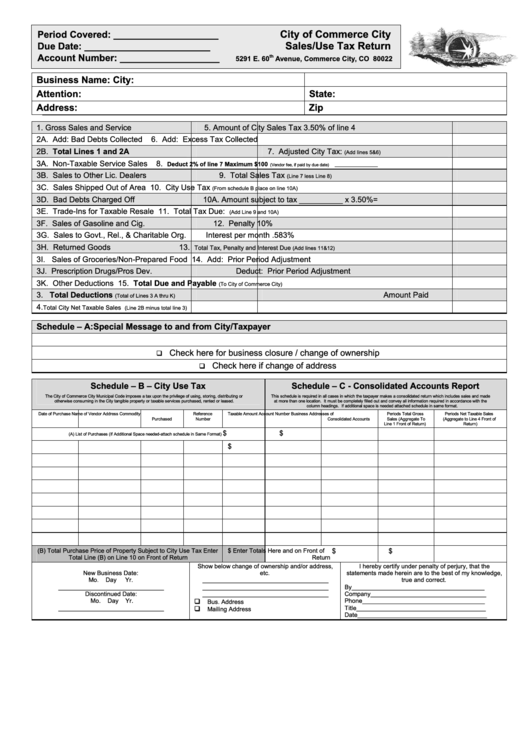

City Of Commerce City Sales/use Tax Return

ADVERTISEMENT

City of Commerce City

Period Covered: ____________________

Sales/Use Tax Return

Due Date: ________________________

Account Number: ___________________

th

5291 E. 60

Avenue, Commerce City, CO 80022

Business Name:

City:

Attention:

State:

Address:

Zip Code:

1.

Gross Sales and Service

5. Amount of City Sales Tax 3.50% of line 4

2A. Add: Bad Debts Collected

6. Add: Excess Tax Collected

2B. Total Lines 1 and 2A

7. Adjusted City Tax:

(Add lines 5&6)

3A. Non-Taxable Service Sales

8.

Deduct 2% of line 7 Maximum $100

(Vendor fee, if paid by due date)

3B. Sales to Other Lic. Dealers

9. Total Sales Tax

(Line 7 less Line 8)

3C. Sales Shipped Out of Area

10. City Use Tax

(From schedule B place on line 10A)

3D. Bad Debts Charged Off

10A. Amount subject to tax __________ x 3.50%=

3E. Trade-Ins for Taxable Resale

11. Total Tax Due:

(Add Line 9 and 10A)

3F. Sales of Gasoline and Cig.

12. Penalty 10%

3G. Sales to Govt., Rel., & Charitable Org.

Interest per month .583%

3H. Returned Goods

13.

Total Tax, Penalty and Interest Due

(Add lines 11&12)

3I. Sales of Groceries/Non-Prepared Food

14. Add: Prior Period Adjustment

3J. Prescription Drugs/Pros Dev.

Deduct: Prior Period Adjustment

3K. Other Deductions

15. Total Due and Payable

(To City of Commerce City)

3. Total Deductions

Amount Paid

(Total of Lines 3 A thru K)

4.

Total City Net Taxable Sales

(Line 2B minus total line 3)

Schedule – A:

Special Message to and from City/Taxpayer

Check here for business closure / change of ownership

Check here if change of address

Schedule – B – City Use Tax

Schedule – C - Consolidated Accounts Report

The City of Commerce City Municipal Code imposes a tax upon the privilege of using, storing, distributing or

This schedule is required in all cases in which the taxpayer makes a consolidated return which includes sales and made

otherwise consuming in the City tangible property or taxable services purchased, rented or leased.

at more than one location. It must be completely filled out and convey all information required in accordance with the

column headings. If additional space is needed attached schedule in same format.

Date of Purchase

Name of Vendor Address

Commodity

Reference

Taxable Amount

Account Number

Business Addresses of

Periods Total Gross

Periods Net Taxable Sales

Purchased

Number

Consolidated Accounts

Sales (Aggregate To

(Aggregate to Line 4 Front of

Line 1 Front of Return)

Return)

$

$

(A) List of Purchases (If Additional Space needed-attach schedule in Same Format)

$

(B) Total Purchase Price of Property Subject to City Use Tax Enter

$

Enter Totals Here and on Front of

$

$

Total Line (B) on Line 10 on Front of Return

Return

Show below change of ownership and/or address,

I hereby certify under penalty of perjury, that the

New Business Date:

etc.

statements made herein are to the best of my knowledge,

Mo.

Day

Yr.

_____________________________________

true and correct.

_______________________________

_____________________________________

By_______________________________________

Discontinued Date:

_____________________________________

Company__________________________________

Mo.

Day

Yr.

Phone____________________________________

Bus. Address

_______________________________

Title______________________________________

Mailing Address

Date______________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1