Instructions For Form 207f-5 - Insurance Premiums Tax Return Nonresident And Foreign Companies Initial Five-Year Return - 2006

ADVERTISEMENT

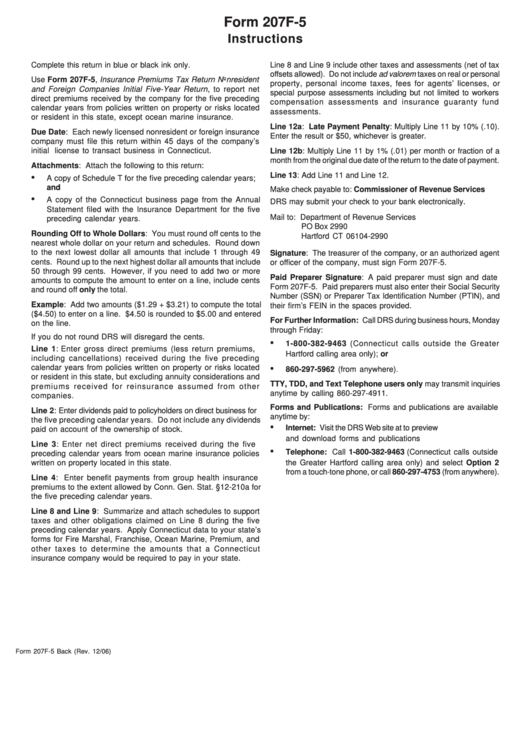

Form 207F-5

Instructions

Complete this return in blue or black ink only.

Line 8 and Line 9 include other taxes and assessments (net of tax

offsets allowed). Do not include ad valorem taxes on real or personal

Use Form 207F-5, Insurance Premiums Tax Return Nonresident

property, personal income taxes, fees for agents’ licenses, or

and Foreign Companies Initial Five-Year Return, to report net

special purpose assessments including but not limited to workers

direct premiums received by the company for the five preceding

compensation assessments and insurance guaranty fund

calendar years from policies written on property or risks located

assessments.

or resident in this state, except ocean marine insurance.

Line 12a: Late Payment Penalty: Multiply Line 11 by 10% (.10).

Due Date: Each newly licensed nonresident or foreign insurance

Enter the result or $50, whichever is greater.

company must file this return within 45 days of the company’s

initial license to transact business in Connecticut.

Line 12b: Multiply Line 11 by 1% (.01) per month or fraction of a

month from the original due date of the return to the date of payment.

Attachments: Attach the following to this return:

Line 13: Add Line 11 and Line 12.

•

A copy of Schedule T for the five preceding calendar years;

and

Make check payable to: Commissioner of Revenue Services

•

A copy of the Connecticut business page from the Annual

DRS may submit your check to your bank electronically.

Statement filed with the Insurance Department for the five

Mail to: Department of Revenue Services

preceding calendar years.

PO Box 2990

Rounding Off to Whole Dollars: You must round off cents to the

Hartford CT 06104-2990

nearest whole dollar on your return and schedules. Round down

to the next lowest dollar all amounts that include 1 through 49

Signature: The treasurer of the company, or an authorized agent

cents. Round up to the next highest dollar all amounts that include

or officer of the company, must sign Form 207F-5.

50 through 99 cents. However, if you need to add two or more

Paid Preparer Signature: A paid preparer must sign and date

amounts to compute the amount to enter on a line, include cents

Form 207F-5. Paid preparers must also enter their Social Security

and round off only the total.

Number (SSN) or Preparer Tax Identification Number (PTIN), and

Example: Add two amounts ($1.29 + $3.21) to compute the total

their firm’s FEIN in the spaces provided.

($4.50) to enter on a line. $4.50 is rounded to $5.00 and entered

For Further Information: Call DRS during business hours, Monday

on the line.

through Friday:

If you do not round DRS will disregard the cents.

•

1-800-382-9463 (Connecticut calls outside the Greater

Line 1: Enter gross direct premiums (less return premiums,

Hartford calling area only); or

including cancellations) received during the five preceding

calendar years from policies written on property or risks located

•

860-297-5962 (from anywhere).

or resident in this state, but excluding annuity considerations and

TTY, TDD, and Text Telephone users only may transmit inquiries

premiums received for reinsurance assumed from other

anytime by calling 860-297-4911.

companies.

Forms and Publications: Forms and publications are available

Line 2: Enter dividends paid to policyholders on direct business for

anytime by:

the five preceding calendar years. Do not include any dividends

•

Internet: Visit the DRS Web site at to preview

paid on account of the ownership of stock.

and download forms and publications

Line 3: Enter net direct premiums received during the five

•

Telephone: Call 1-800-382-9463 (Connecticut calls outside

preceding calendar years from ocean marine insurance policies

written on property located in this state.

the Greater Hartford calling area only) and select Option 2

from a touch-tone phone, or call 860-297-4753 (from anywhere).

Line 4: Enter benefit payments from group health insurance

premiums to the extent allowed by Conn. Gen. Stat. §12-210a for

the five preceding calendar years.

Line 8 and Line 9: Summarize and attach schedules to support

taxes and other obligations claimed on Line 8 during the five

preceding calendar years. Apply Connecticut data to your state’s

forms for Fire Marshal, Franchise, Ocean Marine, Premium, and

other taxes to determine the amounts that a Connecticut

insurance company would be required to pay in your state.

Form 207F-5 Back (Rev. 12/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1