Instructions For Completing Form 11 - Employer'S Municipal Tax Withholding Statement

ADVERTISEMENT

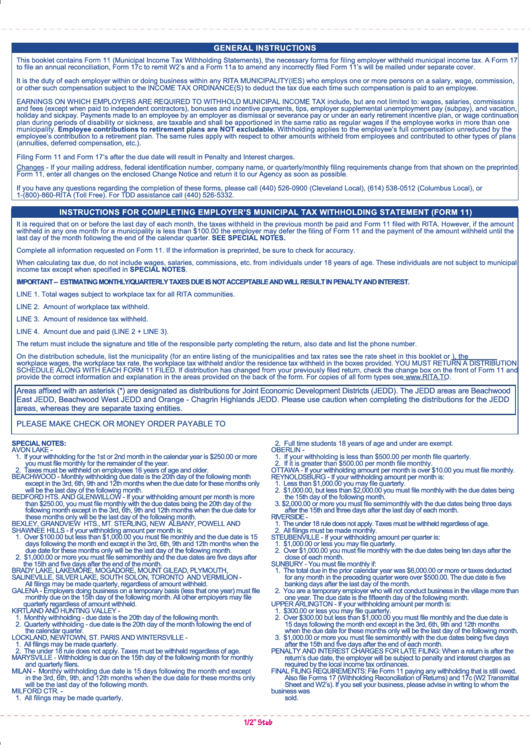

GENERAL INSTRUCTIONS

This booklet contains Form 11 (Municipal Income Tax Withholding Statements), the necessary forms for filing employer withheld municipal income tax. A Form 17

to file an annual reconciliation, Form 17c to remit W2’s and a Form 11a to amend any incorrectly filed Form 11’s will be mailed under separate cover.

It is the duty of each employer within or doing business within any RITA MUNICIPALITY(IES) who employs one or more persons on a salary, wage, commission,

or other such compensation subject to the INCOME TAX ORDINANCE(S) to deduct the tax due each time such compensation is paid to an employee.

EARNINGS ON WHICH EMPLOYERS ARE REQUIRED TO WITHHOLD MUNICIPAL INCOME TAX include, but are not limited to: wages, salaries, commissions

and fees (except when paid to independent contractors), bonuses and incentive payments, tips, employer supplemental unemployment pay (subpay), and vacation,

holiday and sickpay. Payments made to an employee by an employer as dismissal or severance pay or under an early retirement incentive plan, or wage continuation

plan during periods of disability or sickness, are taxable and shall be apportioned in the same ratio as regular wages if the employee works in more than one

municipality. Employee contributions to retirement plans are NOT excludable. Withholding applies to the employee’s full compensation unreduced by the

employee’s contribution to a retirement plan. The same rules apply with respect to other amounts withheld from employees and contributed to other types of plans

(annuities, deferred compensation, etc.).

Filing Form 11 and Form 17’s after the due date will result in Penalty and Interest charges.

Changes - If your mailing address, federal identification number, company name, or quarterly/monthly filing requirements change from that shown on the preprinted

Form 11, enter all changes on the enclosed Change Notice and return it to our Agency as soon as possible.

If you have any questions regarding the completion of these forms, please call (440) 526-0900 (Cleveland Local), (614) 538-0512 (Columbus Local), or

1-(800)-860-RITA (Toll Free). For TDD assistance call (440) 526-5332.

INSTRUCTIONS FOR COMPLETING EMPLOYER’S MUNICIPAL TAX WITHHOLDING STATEMENT (FORM 11)

It is required that on or before the last day of each month, the taxes withheld in the previous month be paid and Form 11 filed with RITA. However, if the amount

withheld in any one month for a municipality is less than $100.00 the employer may defer the filing of Form 11 and the payment of the amount withheld until the

last day of the month following the end of the calendar quarter. SEE SPECIAL NOTES.

Complete all information requested on Form 11. If the information is preprinted, be sure to check for accuracy.

When calculating tax due, do not include wages, salaries, commissions, etc. from individuals under 18 years of age. These individuals are not subject to municipal

income tax except when specified in SPECIAL NOTES.

IMPORTANT – ESTIMATING MONTHLY/QUARTERLY TAXES DUE IS NOT ACCEPTABLE AND WILL RESULT IN PENALTY AND INTEREST.

LINE 1. Total wages subject to workplace tax for all RITA communities.

LINE 2. Amount of workplace tax withheld.

LINE 3. Amount of residence tax withheld.

LINE 4. Amount due and paid (LINE 2 + LINE 3).

The return must include the signature and title of the responsible party completing the return, also date and list the phone number.

On the distribution schedule, list the municipality (for an entire listing of the municipalities and tax rates see the rate sheet in this booklet or ), the

workplace wages, the workplace tax rate, the workplace tax withheld and/or the residence tax withheld in the boxes provided. YOU MUST RETURN A DISTRIBUTION

SCHEDULE ALONG WITH EACH FORM 11 FILED. If distribution has changed from your previously filed return, check the change box on the front of Form 11 and

provide the correct information and explanation in the areas provided on the back of the form. For copies of all form types see .

Areas affixed with an asterisk (*) are designated as distributions for Joint Economic Development Districts (JEDD). The JEDD areas are Beachwood

East JEDD, Beachwood West JEDD and Orange - Chagrin Highlands JEDD. Please use caution when completing the distributions for the JEDD

areas, whereas they are separate taxing entities.

PLEASE MAKE CHECK OR MONEY ORDER PAYABLE TO R.I.T.A.

SPECIAL NOTES:

2. Full time students 18 years of age and under are exempt.

AVON LAKE -

OBERLIN -

1. If your withholding for the 1st or 2nd month in the calendar year is $250.00 or more

1. If your withholding is less than $500.00 per month file quarterly.

you must file monthly for the remainder of the year.

2. If it is greater than $500.00 per month file monthly.

2. Taxes must be withheld on employees 16 years of age and older.

OTTAWA - If your withholding amount per month is over $10.00 you must file monthly.

BEACHWOOD - Monthly withholding due date is the 20th day of the following month

REYNOLDSBURG - If your withholding amount per month is:

except in the 3rd, 6th, 9th and 12th months when the due date for these months only

1. Less than $1,000.00 you may file quarterly.

will be the last day of the following month.

2. $1,000.00, but less than $2,000.00 you must file monthly with the due dates being

BEDFORD HTS. AND GLENWILLOW - If your withholding amount per month is more

the 15th day of the following month.

than $250.00, you must file monthly with the due dates being the 20th day of the

3. $2,000.00 or more you must file semimonthly with the due dates being three days

following month except in the 3rd, 6th, 9th and 12th months when the due date for

after the 15th and three days after the last day of each month.

these months only will be the last day of the following month.

RIVERSIDE -

BEXLEY, GRANDVIEW HTS., MT. STERLING, NEW ALBANY, POWELL AND

1. The under 18 rule does not apply. Taxes must be withheld regardless of age.

SHAWNEE HILLS - if your withholding amount per month is:

2. All filings must be made monthly.

1. Over $100.00 but less than $1,000.00 you must file monthly and the due date is 15

STEUBENVILLE - If your withholding amount per quarter is:

days following the month end except in the 3rd, 6th, 9th and 12th months when the

1. $1,000.00 or less you may file quarterly.

due date for these months only will be the last day of the following month.

2. Over $1,000.00 you must file monthly with the due dates being ten days after the

2. $1,000.00 or more you must file semimonthly and the due dates are five days after

close of each month.

the 15th and five days after the end of the month.

SUNBURY - You must file monthly if:

BRADY LAKE, LAKEMORE, MOGADORE, MOUNT GILEAD, PLYMOUTH,

1. The total due in the prior calendar year was $6,000.00 or more or taxes deducted

SALINEVILLE, SILVER LAKE, SOUTH SOLON, TORONTO AND VERMILION -

for any month in the preceding quarter were over $500.00. The due date is five

All filings may be made quarterly, regardless of amount withheld.

banking days after the last day of the month.

GALENA - Employers doing business on a temporary basis (less that one year) must file

2. You are a temporary employer who will not conduct business in the village more than

monthly due on the 15th day of the following month. All other employers may file

one year. The due date is the fifteenth day of the following month.

quarterly regardless of amount withheld.

UPPER ARLINGTON - If your withholding amount per month is:

KIRTLAND AND HUNTING VALLEY -

1. $300.00 or less you may file quarterly.

1. Monthly withholding - due date is the 20th day of the following month.

2. Over $300.00 but less than $1,000.00 you must file monthly and the due date is

2. Quarterly withholding - due date is the 20th day of the month following the end of

15 days following the month end except in the 3rd, 6th, 9th and 12th months

the calendar quarter.

when the due date for these months only will be the last day of the following month.

LOCKLAND, NEWTOWN, ST. PARIS AND WINTERSVILLE -

3. $1,000.00 or more you must file semimonthly with the due dates being five days

1. All filings may be made quarterly.

after the 15th and five days after the end of each month.

2. The under 18 rule does not apply. Taxes must be withheld regardless of age.

PENALTY AND INTEREST CHARGES FOR LATE FILING: When a return is after the

MARYSVILLE - Withholding is due on the 15th day of the following month for monthly

return’s due date, the employer will be subject to penalty and interest charges as

and quarterly filers.

required by the local income tax ordinances.

MILAN - Monthly withholding due date is 15 days following the month end except

FINAL FILING REQUIREMENTS: File Form 11 paying any withholding that is still owed.

in the 3rd, 6th, 9th, and 12th months when the due date for these months only

Also file Forms 17 (Withholding Reconciliation of Returns) and 17c (W2 Transmittal

will be the last day of the following month.

Sheet and W2’s). If you sell your business, please advise in writing to whom the

MILFORD CTR. -

business was

1. All filings may be made quarterly.

sold.

1/2” Stub

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3