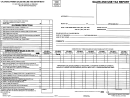

Form 51a129 - Estimated Tax Paid On Monthly Returns - Schedule Of Energy Reported On Monthly Sales And Use Tax Returns

ADVERTISEMENT

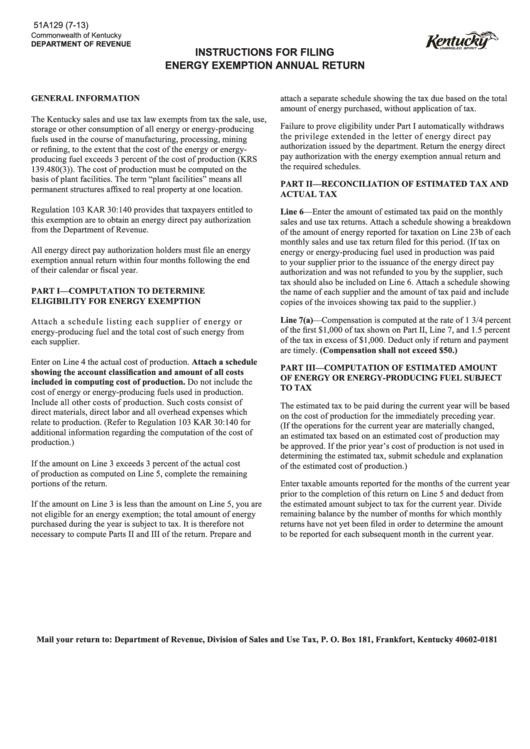

51A129 (7-13)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

INSTRUCTIONS FOR FILING

ENERGY EXEMPTION ANNUAL RETURN

GENERAL INFORMATION

attach a separate schedule showing the tax due based on the total

amount of energy purchased, without application of tax.

The Kentucky sales and use tax law exempts from tax the sale, use,

Failure to prove eligibility under Part I automatically withdraws

storage or other consumption of all energy or energy-producing

the privilege extended in the letter of energy direct pay

fuels used in the course of manufacturing, processing, mining

authorization issued by the department. Return the energy direct

or refining, to the extent that the cost of the energy or energy-

pay authorization with the energy exemption annual return and

producing fuel exceeds 3 percent of the cost of production (KRS

the required schedules.

139.480(3)). The cost of production must be computed on the

basis of plant facilities. The term “plant facilities” means all

PART II—RECONCILIATION OF ESTIMATED TAX AND

permanent structures affixed to real property at one location.

ACTUAL TAX

Regulation 103 KAR 30:140 provides that taxpayers entitled to

Line 6—Enter the amount of estimated tax paid on the monthly

this exemption are to obtain an energy direct pay authorization

sales and use tax returns. Attach a schedule showing a breakdown

from the Department of Revenue.

of the amount of energy reported for taxation on Line 23b of each

monthly sales and use tax return filed for this period. (If tax on

All energy direct pay authorization holders must file an energy

energy or energy-producing fuel used in production was paid

exemption annual return within four months following the end

to your supplier prior to the issuance of the energy direct pay

of their calendar or fiscal year.

authorization and was not refunded to you by the supplier, such

tax should also be included on Line 6. Attach a schedule showing

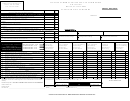

PA R T I — C O M P U T AT I O N T O D E T E R M I N E

the name of each supplier and the amount of tax paid and include

ELIGIBILITY FOR ENERGY EXEMPTION

copies of the invoices showing tax paid to the supplier.)

Line 7(a)—Compensation is computed at the rate of 1 3/4 percent

Attach a schedule listing each supplier of energy or

of the first $1,000 of tax shown on Part II, Line 7, and 1.5 percent

energy-producing fuel and the total cost of such energy from

of the tax in excess of $1,000. Deduct only if return and payment

each supplier.

are timely. (Compensation shall not exceed $50.)

Enter on Line 4 the actual cost of production. Attach a schedule

PART III—COMPUTATION OF ESTIMATED AMOUNT

showing the account classification and amount of all costs

OF ENERGY OR ENERGY-PRODUCING FUEL SUBJECT

included in computing cost of production. Do not include the

TO TAX

cost of energy or energy-producing fuels used in production.

Include all other costs of production. Such costs consist of

The estimated tax to be paid during the current year will be based

direct materials, direct labor and all overhead expenses which

on the cost of production for the immediately preceding year.

relate to production. (Refer to Regulation 103 KAR 30:140 for

(If the operations for the current year are materially changed,

additional information regarding the computation of the cost of

an estimated tax based on an estimated cost of production may

production.)

be approved. If the prior year’s cost of production is not used in

determining the estimated tax, submit schedule and explanation

If the amount on Line 3 exceeds 3 percent of the actual cost

of the estimated cost of production.)

of production as computed on Line 5, complete the remaining

portions of the return.

Enter taxable amounts reported for the months of the current year

prior to the completion of this return on Line 5 and deduct from

the estimated amount subject to tax for the current year. Divide

If the amount on Line 3 is less than the amount on Line 5, you are

not eligible for an energy exemption; the total amount of energy

remaining balance by the number of months for which monthly

returns have not yet been filed in order to determine the amount

purchased during the year is subject to tax. It is therefore not

necessary to compute Parts II and III of the return. Prepare and

to be reported for each subsequent month in the current year.

Mail your return to: Department of Revenue, Division of Sales and Use Tax, P. O. Box 181, Frankfort, Kentucky 40602-0181

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2