Form Cit-A - New Mexico Apportioned Income For Multistate Corporations - 2016

ADVERTISEMENT

*166280200*

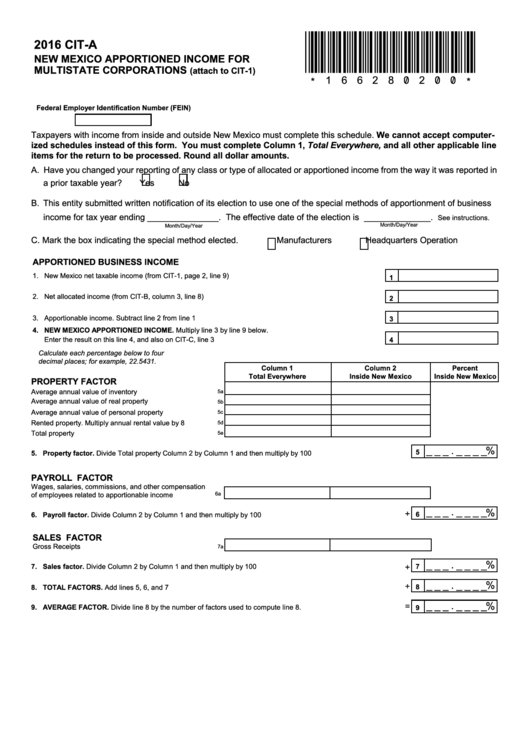

2016 CIT-A

NEW MEXICO APPORTIONED INCOME FOR

MULTISTATE CORPORATIONS

(attach to CIT-1)

Federal Employer Identification Number (FEIN)

Taxpayers with income from inside and outside New Mexico must complete this schedule. We cannot accept computer-

ized schedules instead of this form. You must complete Column 1, Total Everywhere, and all other applicable line

items for the return to be processed. Round all dollar amounts.

A. Have you changed your reporting of any class or type of allocated or apportioned income from the way it was reported in

a prior taxable year?

Yes

No

B. This entity submitted written notification of its election to use one of the special methods of apportionment of business

income for tax year ending _______________. The effective date of the election is ______________.

See instructions.

Month/Day/Year

Month/Day/Year

C. Mark the box indicating the special method elected.

Manufacturers

Headquarters Operation

APPORTIONED BUSINESS INCOME

1. New Mexico net taxable income (from CIT-1, page 2, line 9)................................................................................

1

2. Net allocated income (from CIT-B, column 3, line 8).............................................................................................

2

3. Apportionable income. Subtract line 2 from line 1.................................................................................................

3

4. NEW MEXICO APPORTIONED INCOME. Multiply line 3 by line 9 below.

Enter the result on this line 4, and also on CIT-C, line 3........................................................................................

4

Calculate each percentage below to four

decimal places; for example, 22.5431.

Column 1

Column 2

Percent

Total Everywhere

Inside New Mexico

Inside New Mexico

PROPERTY FACTOR

Average annual value of inventory........................................

5a

Average annual value of real property..................................

5b

Average annual value of personal property..........................

5c

Rented property. Multiply annual rental value by 8...............

5d

Total property .......................................................................

5e

_ _ _ . _ _ _ _

%

5

5. Property factor. Divide Total property Column 2 by Column 1 and then multiply by 100...............................................

PAYROLL FACTOR

Wages, salaries, commissions, and other compensation

of employees related to apportionable income.....................

6a

_ _ _ . _ _ _ _

%

+

6

6. Payroll factor. Divide Column 2 by Column 1 and then multiply by 100........................................................................

SALES FACTOR

Gross Receipts.....................................................................

7a

_ _ _ . _ _ _ _

%

+

7. Sales factor. Divide Column 2 by Column 1 and then multiply by 100...........................................................................

7

_ _ _ . _ _ _ _

%

+

8. TOTAL FACTORS. Add lines 5, 6, and 7.........................................................................................................................

8

_ _ _ . _ _ _ _

%

=

9. AvERAGE FACTOR. Divide line 8 by the number of factors used to compute line 8. ....................................................

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2