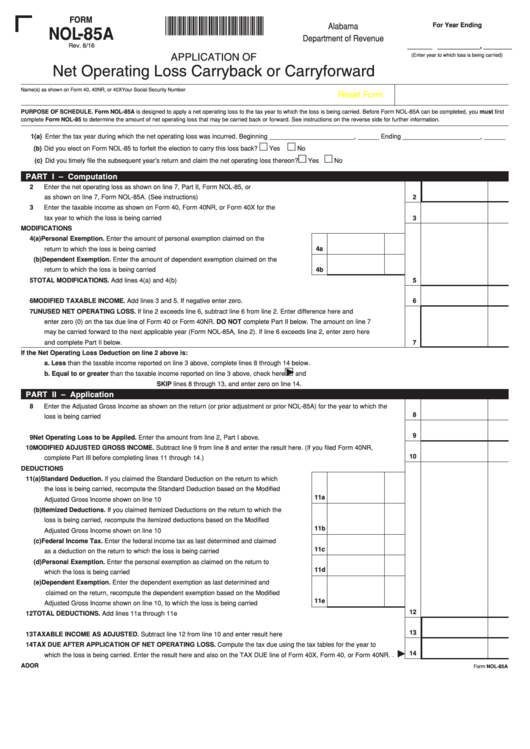

FORM

XX00248A

Alabama

For Year Ending

NOL-85A

Department of Revenue

_______ ____________, ________

Rev. 8/16

(Enter year to which loss is being carried)

APPLICATION OF

Net Operating Loss Carryback or Carryforward

Name(s) as shown on Form 40, 40NR, or 40X

Your Social Security Number

Reset Form

PURPOSE OF SCHEDULE. Form NOL-85A is designed to apply a net operating loss to the tax year to which the loss is being carried. Before Form NOL-85A can be completed, you must first

complete Form NOL-85 to determine the amount of net operating loss that may be carried back or forward. See instructions on the reverse side for further information.

1(a) Enter the tax year during which the net operating loss was incurred. Beginning ________________________, ______ Ending ______________________, ______

(b) Did you elect on Form NOL-85 to forfeit the election to carry this loss back? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

(c) Did you timely file the subsequent year’s return and claim the net operating loss thereon? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

PART I – Computation

2

Enter the net operating loss as shown on line 7, Part II, Form NOL-85, or

as shown on line 7, Form NOL-85A. (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3

Enter the taxable income as shown on Form 40, Form 40NR, or Form 40X for the

tax year to which the loss is being carried . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

MODIFICATIONS

4(a) Personal Exemption. Enter the amount of personal exemption claimed on the

4a

return to which the loss is being carried . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(b) Dependent Exemption. Enter the amount of dependent exemption claimed on the

4b

return to which the loss is being carried . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

TOTAL MODIFICATIONS. Add lines 4(a) and 4(b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6

MODIFIED TAXABLE INCOME. Add lines 3 and 5. If negative enter zero. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7

UNUSED NET OPERATING LOSS. If line 2 exceeds line 6, subtract line 6 from line 2. Enter difference here and

enter zero (0) on the tax due line of Form 40 or Form 40NR. DO NOT complete Part II below. The amount on line 7

may be carried forward to the next applicable year (Form NOL-85A, line 2). If line 6 exceeds line 2, enter zero here

and complete Part II below.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

If the Net Operating Loss Deduction on line 2 above is:

a. Less than the taxable income reported on line 3 above, complete lines 8 through 14 below.

b. Equal to or greater than the taxable income reported on line 3 above, check here . . . . . . . . . . . . . . . . . . . . .

and

SKIP lines 8 through 13, and enter zero on line 14.

PART II – Application

8

Enter the Adjusted Gross Income as shown on the return (or prior adjustment or prior NOL-85A) for the year to which the

8

loss is being carried . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9

Net Operating Loss to be Applied. Enter the amount from line 2, Part I above. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

MODIFIED ADJUSTED GROSS INCOME. Subtract line 9 from line 8 and enter the result here. (If you filed Form 40NR,

10

complete Part III before completing lines 11 through 14.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

DEDUCTIONS

11(a) Standard Deduction. If you claimed the Standard Deduction on the return to which

the loss is being carried, recompute the Standard Deduction based on the Modified

11a

Adjusted Gross Income shown on line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(b) Itemized Deductions. If you claimed Itemized Deductions on the return to which the

loss is being carried, recompute the itemized deductions based on the Modified

11b

Adjusted Gross Income shown on line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(c) Federal Income Tax. Enter the federal income tax as last determined and claimed

11c

as a deduction on the return to which the loss is being carried . . . . . . . . . . . . . . . . . . . . . . . . .

(d) Personal Exemption. Enter the personal exemption as claimed on the return to

11d

which the loss is being carried. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(e) Dependent Exemption. Enter the dependent exemption as last determined and

claimed on the return, recompute the dependent exemption based on the Modified

11e

Adjusted Gross Income shown on line 10, to which the loss is being carried. . . . . . . . . . . . . . .

12

12

TOTAL DEDUCTIONS. Add lines 11a through 11e . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

13

TAXABLE INCOME AS ADJUSTED. Subtract line 12 from line 10 and enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

TAX DUE AFTER APPLICATION OF NET OPERATING LOSS. Compute the tax due using the tax tables for the year to

14

which the loss is being carried. Enter the result here and also on the TAX DUE line of Form 40X, Form 40, or Form 40NR . .

ADOR

Form NOL-85A

1

1 2

2