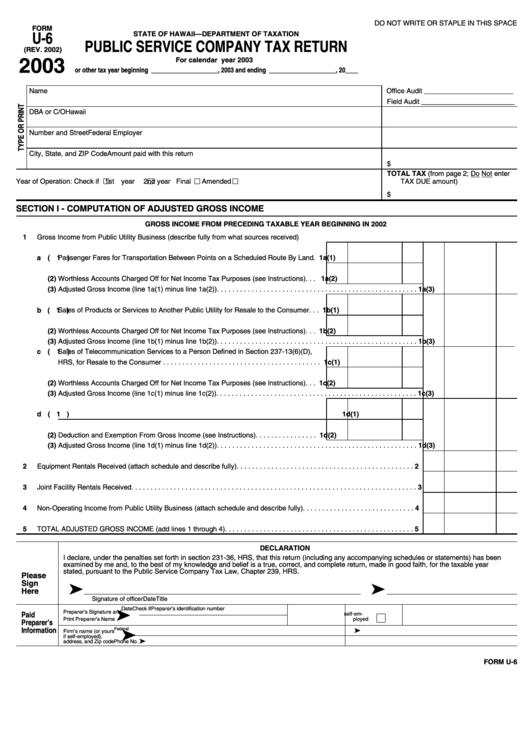

Form U-6 - Public Service Company Tax Return - 2003

ADVERTISEMENT

DO NOT WRITE OR STAPLE IN THIS SPACE

FORM

STATE OF HAWAII—DEPARTMENT OF TAXATION

U-6

PUBLIC SERVICE COMPANY TAX RETURN

(REV. 2002)

For calendar year 2003

2003

or other tax year beginning _____________________, 2003 and ending _____________________, 20____

Name

Office Audit _______________________

Field Audit ________________________

DBA or C/O

Hawaii G.E./Use I.D. No.

Number and Street

Federal Employer I.D. No.

City, State, and ZIP Code

Amount paid with this return

$

TOTAL TAX (from page 2; Do Not enter

Year of Operation: Check if

1st year

2nd year

Final

Amended

TAX DUE amount)

$

SECTION I - COMPUTATION OF ADJUSTED GROSS INCOME

GROSS INCOME FROM PRECEDING TAXABLE YEAR BEGINNING IN 2002

1

Gross Income from Public Utility Business (describe fully from what sources received)

a (1) Passenger Fares for Transportation Between Points on a Scheduled Route By Land .

1a(1)

(2) Worthless Accounts Charged Off for Net Income Tax Purposes (see Instructions) . . .

1a(2)

(3) Adjusted Gross Income (line 1a(1) minus line 1a(2)). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1a(3)

b (1) Sales of Products or Services to Another Public Utility for Resale to the Consumer . . .

1b(1)

(2) Worthless Accounts Charged Off for Net Income Tax Purposes (see Instructions) . . .

1b(2)

(3) Adjusted Gross Income (line 1b(1) minus line 1b(2)). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1b(3)

c (1) Sales of Telecommunication Services to a Person Defined in Section 237-13(6)(D),

HRS, for Resale to the Consumer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1c(1)

(2) Worthless Accounts Charged Off for Net Income Tax Purposes (see Instructions) . . .

1c(2)

(3) Adjusted Gross Income (line 1c(1) minus line 1c(2)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1c(3)

d (1)

1d(1)

(2) Deduction and Exemption From Gross Income (see Instructions) . . . . . . . . . . . . . . . .

1d(2)

(3) Adjusted Gross Income (line 1d(1) minus line 1d(2)). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1d(3)

2

Equipment Rentals Received (attach schedule and describe fully) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3

Joint Facility Rentals Received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Non-Operating Income from Public Utility Business (attach schedule and describe fully) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

TOTAL ADJUSTED GROSS INCOME (add lines 1 through 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

DECLARATION

I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements) has been

examined by me and, to the best of my knowledge and belief is a true, correct, and complete return, made in good faith, for the taxable year

stated, pursuant to the Public Service Company Tax Law, Chapter 239, HRS.

Please

Sign

Here

Signature of officer

Date

Title

➤

Date

Check if

Preparer’s identification number

Preparer’s Signature and

Paid

self-em-

Print Preparer’s Name

ployed

Preparer’s

➤

➤

Information

Federal

Firm’s name (or yours

E.I. No.

if self-employed),

➤

address, and Zip code

Phone No.

FORM U-6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2