Annual Foreign And Domestic Insurance Entities Franchise Tax Report (Legal Reserve Mutual) - Arkansas Secretary Of State - 2010

ADVERTISEMENT

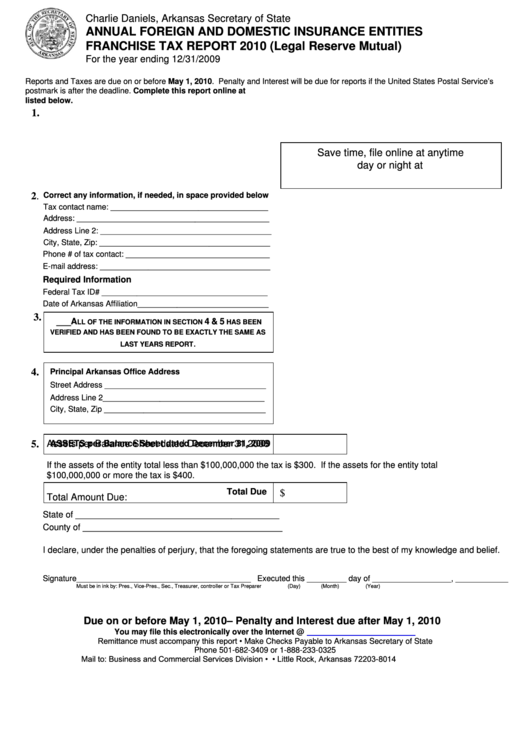

Charlie Daniels, Arkansas Secretary of State

ANNUAL FOREIGN AND DOMESTIC INSURANCE ENTITIES

FRANCHISE TAX REPORT 2010 (Legal Reserve Mutual)

For the year ending 12/31/2009

Reports and Taxes are due on or before May 1, 2010. Penalty and Interest will be due for reports if the United States Postal Service’s

postmark is after the deadline. Complete this report online at or sign in ink and mail to the address

listed below.

1.

Save time, file online at anytime

day or night at

.

Correct any information, if needed, in space provided below

2.

Tax contact name: ____________________________________

Address: ____________________________________________

Address Line 2: _______________________________________

City, State, Zip: _______________________________________

Phone # of tax contact: _________________________________

E-mail address: _______________________________________

Required Information

Federal Tax ID# ______________________________________

Date of Arkansas Affiliation______________________________

3.

___A

4 & 5

LL OF THE INFORMATION IN SECTION

HAS BEEN

VERIFIED AND HAS BEEN FOUND TO BE EXACTLY THE SAME AS

.

LAST YEARS REPORT

Principal Arkansas Office Address

4.

Street Address _____________________________________

Address Line 2_____________________________________

City, State, Zip _____________________________________

Assets per Balance Sheet dated December 31,2008

ASSETS per Balance Sheet dated December 31, 2009

5.

If the assets of the entity total less than $100,000,000 the tax is $300. If the assets for the entity total

$100,000,000 or more the tax is $400.

Total Due

$

Total Amount Due:

State of __________________________________________

County of _________________________________________

I declare, under the penalties of perjury, that the foregoing statements are true to the best of my knowledge and belief.

Signature________________________________________ Executed this _________ day of __________________, ____________

Must be in ink by: Pres., Vice-Pres., Sec., Treasurer, controller or Tax Preparer

(Day)

(Month)

(Year)

Due on or before May 1, 2010 – Penalty and Interest due after May 1, 2010

You may file this electronically over the Internet @

Remittance must accompany this report • Make Checks Payable to Arkansas Secretary of State

Phone 501-682-3409 or 1-888-233-0325

Mail to: Business and Commercial Services Division • P.O. Box 8014 • Little Rock, Arkansas 72203-8014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1