2005 Business License Application Form - The City Of Paducah

ADVERTISEMENT

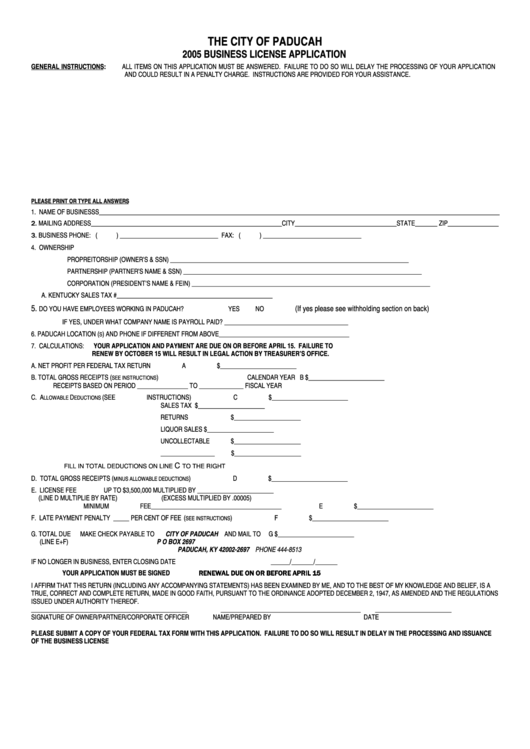

THE CITY OF PADUCAH

2005 BUSINESS LICENSE APPLICATION

GENERAL INSTRUCTIONS:

ALL ITEMS ON THIS APPLICATION MUST BE ANSWERED. FAILURE TO DO SO WILL DELAY THE PROCESSING OF YOUR APPLICATION

AND COULD RESULT IN A PENALTY CHARGE. INSTRUCTIONS ARE PROVIDED FOR YOUR ASSISTANCE.

PLEASE PRINT OR TYPE ALL ANSWERS

1. NAME OF BUSINESSS______________________________________________________________________________________________________________________________

2. MAILING ADDRESS____________________________________________________________CITY________________________________STATE_______ ZIP________________

3. BUSINESS PHONE: (

) _______________________________

FAX: (

) _______________________________

4. OWNERSHIP

PROPREITORSHIP

(OWNER’S & SSN)

___________________________________________________________________________

PARTNERSHIP

(PARTNER’S NAME & SSN)

___________________________________________________________________________

CORPORATION

(PRESIDENT’S NAME & FEIN)

___________________________________________________________________________

A. KENTUCKY SALES TAX #_________________________________________________

5.

(If yes please see withholding section on back)

DO YOU HAVE EMPLOYEES WORKING IN PADUCAH?

YES

NO

IF YES, UNDER WHAT COMPANY NAME IS PAYROLL PAID? _______________________________________

6. PADUCAH LOCATION (

) AND PHONE IF DIFFERENT FROM ABOVE_________________________________________

S

7. CALCULATIONS:

YOUR APPLICATION AND PAYMENT ARE DUE ON OR BEFORE APRIL 15. FAILURE TO

RENEW BY OCTOBER 15 WILL RESULT IN LEGAL ACTION BY TREASURER’S OFFICE.

A. NET PROFIT PER FEDERAL TAX RETURN

A $________________________

B. TOTAL GROSS RECEIPTS (

)

CALENDAR YEAR

B $________________________

SEE INSTRUCTIONS

RECEIPTS BASED ON PERIOD ________________ TO ______________ FISCAL YEAR

C. A

D

(SEE INSTRUCTIONS)

C $________________________

LLOWABLE

EDUCTIONS

SALES TAX

$_____________________

RETURNS

$_____________________

LIQUOR SALES

$_____________________

UNCOLLECTABLE

$_____________________

_________________

$_____________________

C

FILL IN TOTAL DEDUCTIONS ON LINE

TO THE RIGHT

D. TOTAL GROSS RECEIPTS (

)

D $________________________

MINUS ALLOWABLE DEDUCTIONS

E. LICENSE FEE

UP TO $3,500,000 MULTIPLIED BY ________________________

(LINE D MULTIPLIE BY RATE)

(EXCESS MULTIPLIED BY .00005)

MINIMUM FEE_________________________________________

E $________________________

F. LATE PAYMENT PENALTY _____ PER CENT OF FEE (

)

F $________________________

SEE INSTRUCTIONS

G. TOTAL DUE

MAKE CHECK PAYABLE TO

CITY OF PADUCAH

AND MAIL TO

G $________________________

(LINE E+F)

P O BOX 2697

PADUCAH, KY 42002-2697

PHONE 444-8513

IF NO LONGER IN BUSINESS, ENTER CLOSING DATE

______/_______/_______

YOUR APPLICATION MUST BE SIGNED

RENEWAL DUE ON OR BEFORE APRIL 15

I AFFIRM THAT THIS RETURN (INCLUDING ANY ACCOMPANYING STATEMENTS) HAS BEEN EXAMINED BY ME, AND TO THE BEST OF MY KNOWLEDGE AND BELIEF, IS A

TRUE, CORRECT AND COMPLETE RETURN, MADE IN GOOD FAITH, PURSUANT TO THE ORDINANCE ADOPTED DECEMBER 2, 1947, AS AMENDED AND THE REGULATIONS

ISSUED UNDER AUTHORITY THEREOF.

_________________________________________________

____________________________________________

________________________

SIGNATURE OF OWNER/PARTNER/CORPORATE OFFICER

NAME/PREPARED BY

DATE

PLEASE SUBMIT A COPY OF YOUR FEDERAL TAX FORM WITH THIS APPLICATION. FAILURE TO DO SO WILL RESULT IN DELAY IN THE PROCESSING AND ISSUANCE

OF THE BUSINESS LICENSE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1