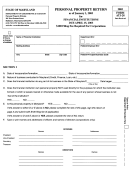

Form At3-28 - Personal Property Return - 2009 Page 2

ADVERTISEMENT

FINANCIAL INSTITUTION PERSONAL PROPERTY RETURN

2009

___________

FORM

AT3-28

Personal property owned by the financial institution and used directly in the business activity of said institution is

exempt. Do not report the exempt property on this return. Any personal property that is leased, loaned or made

available by the institution for the use of a person whose business is not that of the institution is assessable and taxable.

PAGE 2

Tax-Property Article, Section 7-221.

SECTION II

1a.

IMPORTANT:

Show exact location of all assessable personal property owned and leased in the State of

Maryland, including county, city, town, and street address (P.O. boxes are not acceptable).

This assures proper distribution of assessments. If leased property is located in two

or more jurisdictions, provide breakdown by completing additional copies of Section II for

each location.

(County)

Address, Number and Street

Zip Code

(Incorporated Town)

Is the property located inside the limits of an incorporated town?__________

(Yes or No)

1b.

Report all personal property covered in #1a above on a separate schedule and attach to this return.

INSTRUCTIONS

1.

File separate schedule showing names and addresses of lessees, lease number, description of property, installation date and original cost

by year of acquisition for each location. Schedule should group leases by county and town where the property is located. Manufacturer

lessors should submit the retail selling price of the property, not the manufacturing cost. Please submit in an Excel worksheet format on 3.5”

disk if possible. Paper copies listing the above needed information are also acceptable.

2.

Most registered vehicles are exempt, Tax-Property Section 7-230. Motor vehicles with interchangeable registrations and vehicles that are

unregistered are taxable and must be reported.

3.

Rules for 2009 personal property extensions: Internet extension requests are due by April 15th and are free of charge.

Paper extension requests are now due on or before March 15th and require a $20 processing fee for each entity.

4.

The penalty for failure to file this report on or before April 15, 2009, is 1/10 of 1% of the county assessment plus 2% of the initial penalty

amount for each 30 days or part thereof that the return is late. (The initial penalty amount shall not be less than $30 or more than $500.

Tax-Property Article Section 14-704.) In addition, failure to file return may cause forfeiture of the entity’s legal status or its authority to do business

in Maryland. DO NOT PREPAY AN ANTICIPATED PENALTY. If a penalty is imposed, the entity will be billed after the assessment is

calculated.

5.

Mail this form to the State Department of Assessments and Taxation, Personal Property Division, 301 West Preston Street, Baltimore,

Maryland 21201-2395. All legal entities filing this return must include a $300 check payable to the Department of Assessments &

Taxation.

I declare under the penalties of perjury that this return, including any accompanying schedules and statements, has been examined by me and to

the best of my knowledge and belief is a true, correct and complete return.

NAME OF FIRM, OTHER THAN TAXPAYER, PREPARING THIS RETURN

PRINT OR TYPE NAME OF CORPORATE OFFICER OR PRINCIPAL OF ENTITY

TITLE

x

x

SIGNATURE OF PREPARER

DATE

SIGNATURE OF CORPORATE OFFICER OR PRINCIPAL

DATE

(

)

(

)

PREPARER’S PHONE NUMBER

BUSINESS PHONE NUMBER

EMAIL ADDRESS

EMAIL ADDRESS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2