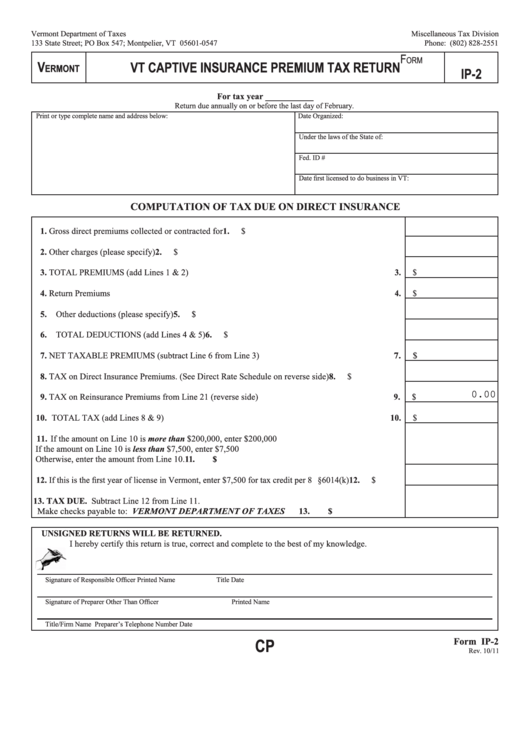

Vermont Department of Taxes

Miscellaneous Tax Division

133 State Street; PO Box 547; Montpelier, VT 05601-0547

Phone: (802) 828-2551

F

orm

V

VT CAPTIVE INSURANCE PREMIUM TAX RETURN

ermont

IP-2

For tax year ___________

Return due annually on or before the last day of February .

Print or type complete name and address below:

Date Organized:

Under the laws of the State of:

Fed . ID #

Date first licensed to do business in VT:

COMPUTATION OF TAX DUE ON DIRECT INSURANCE

1. Gross direct premiums collected or contracted for . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

$

2. Other charges (please specify) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

$

3. TOTAL PREMIUMS (add Lines 1 & 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

$

4. Return Premiums . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

$

5. Other deductions (please specify) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

$

6. TOTAL DEDUCTIONS (add Lines 4 & 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

$

7. NET TAXABLE PREMIUMS (subtract Line 6 from Line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

$

8. TAX on Direct Insurance Premiums . (See Direct Rate Schedule on reverse side) . . . . . . . . . . . . . . . 8.

$

0.00

9. TAX on Reinsurance Premiums from Line 21 (reverse side) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

$

10. TOTAL TAX (add Lines 8 & 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

$

11. If the amount on Line 10 is more than $200,000, enter $200,000

If the amount on Line 10 is less than $7,500, enter $7,500

Otherwise, enter the amount from Line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

$

12. If this is the first year of license in Vermont, enter $7,500 for tax credit per 8 V.S.A. §6014(k) . . . . . 12.

$

13. TAX DUE. Subtract Line 12 from Line 11 .

Make checks payable to: VERMONT DEPARTMENT OF TAXES . . . . . . . . . . . . . . . . . . . . . 13.

$

UNSIGNED RETURNS WILL BE RETURNED.

I hereby certify this return is true, correct and complete to the best of my knowledge.

Signature of Responsible Officer

Printed Name

Title

Date

Signature of Preparer Other Than Officer

Printed Name

Title/Firm Name

Preparer’s Telephone Number

Date

CP

Form IP-2

Rev . 10/11

1

1 2

2