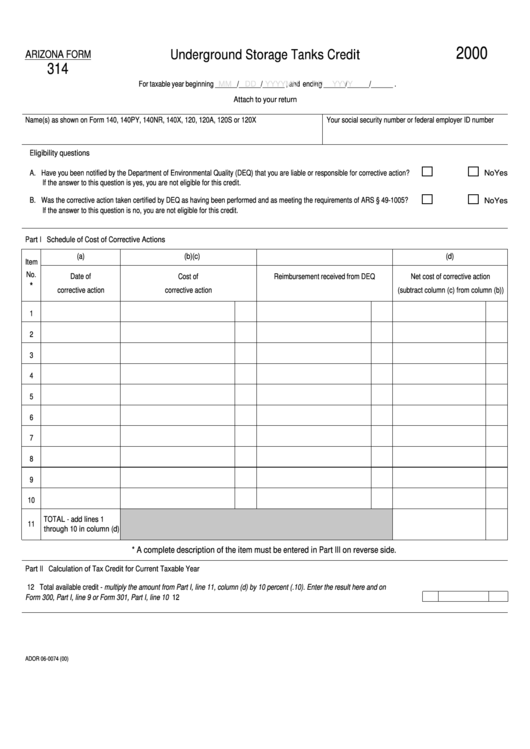

Form 314 - Underground Storage Tanks Credit - 2000

ADVERTISEMENT

2000

Underground Storage Tanks Credit

ARIZONA FORM

314

For taxable year beginning ______/______/______ , and ending ______/______/______ .

MM

DD

YYYY

MM

DD

YYYY

Attach to your return

Name(s) as shown on Form 140, 140PY, 140NR, 140X, 120, 120A, 120S or 120X

Your social security number or federal employer ID number

Eligibility questions

A. Have you been notified by the Department of Environmental Quality (DEQ) that you are liable or responsible for corrective action?

Yes

No

If the answer to this question is yes, you are not eligible for this credit.

B. Was the corrective action taken certified by DEQ as having been performed and as meeting the requirements of ARS § 49-1005?

Yes

No

If the answer to this question is no, you are not eligible for this credit.

Part I Schedule of Cost of Corrective Actions

(a)

(b)

(c)

(d)

Item

No.

Date of

Cost of

Reimbursement received from DEQ

Net cost of corrective action

*

corrective action

corrective action

(subtract column (c) from column (b))

1

2

3

4

5

6

7

8

9

10

TOTAL - add lines 1

11

through 10 in column (d)

* A complete description of the item must be entered in Part III on reverse side.

Part II Calculation of Tax Credit for Current Taxable Year

12 Total available credit - multiply the amount from Part I, line 11, column (d) by 10 percent (.10). Enter the result here and on

Form 300, Part I, line 9 or Form 301, Part I, line 10 ..................................................................................................................................

12

ADOR 06-0074 (00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2